Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636564

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636564

Western Europe Electric Vehicle (EV) Charging Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 130 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

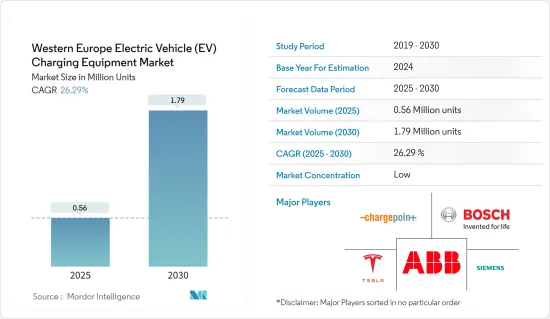

The Western Europe Electric Vehicle Charging Equipment Market size is estimated at 0.56 million units in 2025, and is expected to reach 1.79 million units by 2030, at a CAGR of 26.29% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the growing adoption of electric vehicles and the efforts to expand the EV charging networks are expected to drive the EV charging equipment market during the forecast period.

- On the other hand, high installation costs associated with setting up charging stations and maintenance costs are expected to hinder the market's growth during the forecast period.

- Nevertheless, the technological advancements in EV charging Equipment are expected to provide significant opportunities for the Western Europe EV charging equipment market during the forecast period.

- Germany is expected to be a significant country in the region due to its various initiatives for the adoption of electric vehicles.

Western Europe Electric Vehicle (EV) Charging Equipment Market Trends

Public EV Charging Segment to Dominate the Market

- Driven by increasing EV adoption, government incentives, and a commitment to sustainable transportation, the public electric vehicle (EV) charging segment is poised for substantial growth, leading the Western Europe EV charging equipment market during the forecast period.

- In recent years, Western European nations have rapidly expanded their public EV charging networks. For instance, the International Energy Agency (IEA) reported that in 2023, major West European nations like Germany and France boasted around 108,000 and 110,000 public EV charging points, respectively. In contrast, countries like the Netherlands, Switzerland, and Austria had approximately 145,800, 15,800, and 17,500 public EV charging points. With these nations setting ambitious carbon emission reduction targets, the infrastructure supporting EVs, especially public charging stations, is set to be a focal point of development.

- As Western European nations ramp up their public EV charging points, the demand for electric vehicle charging equipment has surged. This expansion is vital for supporting the global shift towards sustainable transportation. Electric vehicle charging equipment includes various technologies and devices that facilitate EV charging.

- In March 2024, Kempower, a leading fast charging technology provider, installed its inaugural public charging systems in Kleve, Germany. Operated by Kuster Energy, the system boasts a capacity of up to 400 kW, featuring four Kempower Satellites with a single connection cable, allowing for swift EV charging. This uptick in public charging infrastructure underscores Germany's dedication to promoting EVs and curbing carbon emissions.

- Moreover, several countries in the region are actively setting targets to deploy electric vehicle (EV) charging stations as part of their efforts to promote the adoption of electric vehicles and reduce greenhouse gas emissions. The deployment of EV charging infrastructure is crucial for addressing range anxiety among EV drivers and encouraging more people to switch to electric vehicles.

- For instance, in April 2024, a unit of France's national development bank announced it had teamed up with an operator of electric vehicle rechargers to finance the deployment of about 10,000 points at enterprises switching their fleets of vehicles. Moreover, Bump aspires to become the leader in corporate charging stations and those deployed by retail chains for use by their clients by installing 25,000 by 2030. This initiative is part of France's efforts to promote the adoption of electric vehicles and reduce carbon emissions in line with global sustainability goals.

- In early 2024, the French government allocated funding for 10,000 electric vehicle chargers. Additionally, EDF, France's state-owned electricity company, partnered with Morrison, an infrastructure firm, to build 8,000 rapid charging stations in public parking lots by 2030. Such initiatives are expected to drive a significant demand for EV charging equipment in the coming years.

- In Germany, the government is facilitating the installation of EV charging sites in various locations, including public spaces. This initiative has spurred a heightened demand for EV charging equipment, essential for the growing electric vehicle population. Addressing range anxiety and ensuring accessibility to charging stations are pivotal for encouraging more consumers in Germany to transition to electric vehicles.

- For instance, in February 2024, Fastned, a prominent European EV charging company, received approval to establish 34 fast-charging sites along Germany's highways. This initiative aligns with the "Deutschlandnetz" tender, a strategic move to bolster Germany's EV charging infrastructure. Fastned's expansion is a significant stride towards its ambitious goal of 1,000 fast charging stations across Europe by 2030.

- Given these developments, the public EV charging segment is set to lead the Western Europe EV charging equipment market in the coming years.

Germany is Expected to Dominate the Market

- Germany has been rapidly expanding its electric vehicle (EV) infrastructure, mirroring the nation's increasing embrace of the EV industry. According to the International Energy Agency (IEA), by the close of 2023, Germany boasted approximately 108,000 publicly available EV charging points. This tally comprised around 21,000 fast chargers and 87,000 slow chargers. Notably, in 2023, Germany added over 16,000 public slow charging points and 6,000 public fast charging points.

- The German government has ambitious plans, targeting the installation of 1 million public charging points nationwide by the end of 2030. Yet, as of late 2023, only about 11% of this target has been met. To bridge this gap, a significant surge in public EV charging points is anticipated in the coming years, signaling a burgeoning market for EV charging equipment.

- The government is actively approving EV charging installations in diverse locations, from public spaces to residential and commercial properties. This initiative has spurred demand for EV charging equipment, catering to the rising number of electric vehicles on the roads. Strengthening the EV charging infrastructure is pivotal for Germany, as it aims to alleviate range anxiety and enhance accessibility, thereby encouraging more consumers to transition to electric vehicles.

- In February 2024, Fastned, a prominent European EV charging firm, received approval to establish 34 fast-charging sites along Germany's highways. This initiative, part of the "Deutschlandnetz" tender, underscores Germany's commitment to bolstering its EV charging infrastructure. Fastned's move is a stride towards its broader ambition of rolling out 1,000 fast charging stations across Europe by 2030.

- Companies in Germany are increasingly setting up their own EV charging hubs, a strategic endeavor to bolster the nation's EV infrastructure and cater to the surging demand for charging equipment. These hubs not only facilitate EV adoption but also play a role in curbing carbon emissions and championing sustainable transport solutions.

- In November 2023, Mercedes-Benz inaugurated its inaugural proprietary charging hub in Mannheim, Germany. This venture aligns with the automaker's global ambition of establishing over 2,000 charging stations by decade's end, featuring upwards of 10,000 fast-charging points.

- Germany is pushing for EV chargers at gas stations, underscoring its commitment to sustainable transport. This mandate not only promotes clean energy vehicles but also addresses pressing climate concerns.

- In September 2023, German Chancellor Olaf Scholz announced a forthcoming law stipulating that 80% of service stations must offer fast-charging options, with a minimum capacity of 150 kilowatts.

- Given these trends, the EV charging equipment market in Germany is poised for substantial growth, aligning with the nation's escalating EV adoption, investments, and supportive government policies.

Western Europe Electric Vehicle (EV) Charging Equipment Industry Overview

The Western Europe electric vehicle (EV) charging equipment market is semi-fragmented. Some of the key players in the market (not in any particular order) include ABB Ltd, Robert Bosch GmbH, ChargePoint Inc., Siemens AG, and Tesla Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50004070

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in Units, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Adoption of Electric Vehicles

- 4.5.1.2 Efforts to Expand EV Charging Networks

- 4.5.2 Restraints

- 4.5.2.1 High Installation Costs Associated With Setting Up Charging Stations And Maintenance Costs

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Vehicle Type

- 5.1.1 Battery Electric Vehicle (BEV)

- 5.1.2 Plug-in Hybrid Electric Vehicle (PHEV)

- 5.1.3 Hybrid Electric Vehicle (HEV)

- 5.2 Application

- 5.2.1 Home Charging

- 5.2.2 Workplace Charging

- 5.2.3 Public Charging

- 5.3 Charging Type

- 5.3.1 AC Charging (Level 1 and Level 2)

- 5.3.2 DC Charging

- 5.4 Geography

- 5.4.1 Germany

- 5.4.2 France

- 5.4.3 Netherlands

- 5.4.4 Switzerland

- 5.4.5 Rest of Western Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 ABB Ltd

- 6.3.2 Robert Bosch GmbH

- 6.3.3 Delta Electronics Inc.

- 6.3.4 Siemens AG

- 6.3.5 Tesla Inc.

- 6.3.6 ChargePoint Inc.

- 6.3.7 Enphase Energy, Inc.

- 6.3.8 Powercharge

- 6.3.9 Ampure

- 6.3.10 Exicom Tele-Systems Ltd

- 6.3.11 Schneider Electric SE

- 6.3.12 Eaton Corporation

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technology Advancement in the EV Charging Equipment

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.