Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636563

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636563

Europe Electric Vehicle (EV) Charging Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 130 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

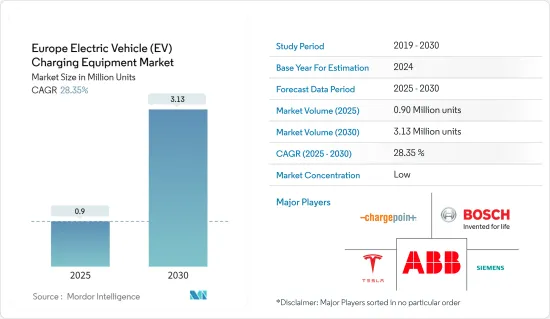

The Europe Electric Vehicle Charging Equipment Market size is estimated at 0.90 million units in 2025, and is expected to reach 3.13 million units by 2030, at a CAGR of 28.35% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the growing adoption of electric vehicles and the efforts to enhance EV charging infrastructure supported by government initiatives are expected to drive the EV charging equipment market during the forecast period.

- Conversely, the market's growth during the forecast period may be stunted by the high installation and maintenance costs tied to setting up charging stations.

- However, the burgeoning European markets' demand for a comprehensive EV charging network, coupled with technological strides in EV charging equipment, presents substantial opportunities for the Europe EV charging equipment market during the forecast period.

- Germany, with its proactive initiatives promoting electric vehicle adoption, is poised for notable growth in the European landscape.

Europe Electric Vehicle (EV) Charging Equipment Market Trends

Battery Electric Vehicles Segment to Dominate the Market

- Battery electric vehicles (BEVs), commonly known as electric vehicles, utilize a sizable traction battery pack to power their electric motors. To recharge, these vehicles connect to electric vehicle supply equipment (EVSE).

- BEVs, being entirely electric, typically lack an internal combustion engine (ICE), fuel tank, or exhaust pipe. They derive their energy from a grid-recharged battery pack. As zero-emission vehicles, BEVs do not produce the harmful tailpipe emissions associated with traditional gasoline-powered cars, thus mitigating air pollution.

- Europe's automotive industry is undergoing a significant shift, with battery electric vehicles (BEVs) gaining traction and popularity. Driven by technological advancements, governmental backing, and heightened environmental awareness, BEVs are emerging as a viable solution to combat climate change and lessen dependence on fossil fuels.

- Data from the International Energy Agency (IEA) reveals that BEV sales in the European Union reached approximately 1.6 million units in 2023, marking a 33% increase from 1.2 million units in 2022. Furthermore, the total BEV stock in the EU has climbed to around 4.6 million units. As BEV sales surge, the demand for charging infrastructure in Europe intensifies.

- Moreover, several European governments are strategizing to amplify EV adoption in the upcoming years. For instance, in May 2024, the French government set an ambitious target for its automakers: to produce two million electric or hybrid vehicles by the decade's end. As part of a new medium-term agreement with the government, the industry aims for an interim target of 800,000 electric vehicle sales by 2027, a significant jump from 200,000 in 2022. Additionally, carmakers are setting their sights on boosting electric light utility vehicle sales to 100,000 annually, up from 16,500 in 2022. Such ambitious goals are poised to drive a substantial demand for EV charging equipment in the region.

- According to the European Automobile Manufacturers' Association (ACEA), the EU saw the installation of only about 150,000 public charging points in 2023 (averaging less than 3,000 weekly), bringing the total to over 630,000. In contrast, the European Commission aims for a target of around 3.5 million charging points by 2030. Achieving this would necessitate an installation rate of approximately 410,000 public charging points annually (or nearly 8,000 weekly), nearly three times the current rate.

- Conversely, ACEA projects a need for 8.8 million charging points by 2030. Meeting this demand would require an annual installation of 1.2 million chargers (or over 22,000 weekly), which is eight times the current rate. Such ambitious targets underscore the growing BEV market in Europe and the corresponding surge in demand for EV charging equipment.

- In recent years, several prominent Chinese automakers have expressed interest in establishing manufacturing and assembly plants in Europe, aiming to boost sales of competitively priced vehicles and challenge their European counterparts. For instance, in April 2024, Chery Auto, China's leading automaker by export volume, announced a joint venture with Spain's EV Motors to inaugurate its inaugural European manufacturing facility in Catalonia, with production slated to commence later in 2024. Furthermore, discussions are underway for potential car factories in Britain this decade.

- In 2023, BYD, the world's foremost EV manufacturer, declared plans for its maiden European production base in Hungary, set to commence operations in three years. This facility will cater to the European market, producing both battery EVs and plug-in hybrids. Such developments are anticipated to bolster the BEV manufacturing sector, subsequently amplifying the demand for a robust EV charging infrastructure.

- Given these dynamics, the BEV segment is poised to lead the European EV charging equipment market in the coming years.

Germany to Witness a Significant Growth

- Germany has been rapidly expanding its electric vehicle (EV) equipment and infrastructure, mirroring the nation's increasing embrace of the EV industry. According to the International Energy Agency (IEA), by the close of 2023, Germany boasted approximately 108,000 publicly available EV charging points. This tally comprised around 21,000 fast chargers and 87,000 slow chargers. Notably, in 2023, Germany added over 16,000 public slow charging points and 6,000 public fast charging points.

- The German government has ambitious plans, targeting the installation of 1 million public charging points nationwide by the end of 2030. Yet, as of late 2023, only about 11% of this target has been met. To bridge this gap, a substantial increase in public EV charging points is anticipated in the coming years, signaling a burgeoning market for EV charging equipment.

- The government is actively approving EV charging installations in diverse locales, from public spaces to residential and commercial properties. This initiative has spurred demand for EV charging equipment, catering to the rising number of electric vehicles on the roads. Expanding the EV charging infrastructure is pivotal for Germany, as it aims to alleviate range anxiety and enhance accessibility, thereby encouraging more consumers to transition to electric vehicles.

- In February 2024, Fastned, a prominent European EV charging firm, received approval to establish 34 fast-charging sites along Germany's highways. This initiative, part of the "Deutschlandnetz" tender, underscores Germany's commitment to bolstering its EV charging infrastructure. Fastned's move is a stride towards its ambitious goal of 1,000 fast charging stations across Europe by 2030.

- Companies in Germany are increasingly setting up their own EV charging hubs, a strategy to bolster the nation's EV infrastructure and cater to the surging demand for charging equipment. These hubs not only promote EV adoption but also play a role in curbing carbon emissions and championing sustainable transport solutions.

- In November 2023, Mercedes-Benz inaugurated its inaugural proprietary charging hub in Mannheim, Germany. This venture aligns with the company's global ambition of establishing over 2,000 charging stations by decade's end, featuring upwards of 10,000 fast-charging points.

- Germany is also pushing for EV chargers at gas stations, reinforcing its commitment to sustainable transport. This mandate not only promotes clean energy vehicles but also addresses broader climate change challenges.

- In September 2023, German Chancellor Olaf Scholz announced a forthcoming law stipulating that 80% of all service stations must offer fast-charging options, with a minimum capacity of 150 kilowatts.

- Given these developments, the EV charging equipment market in Germany is poised for significant growth, buoyed by rising EV adoption, robust investments, and supportive government policies and targets.

Europe Electric Vehicle (EV) Charging Equipment Industry Overview

The Europe electric vehicle (EV) charging equipment market is semi-fragmented. Some of the key players in the market (not in any particular order) include ABB Ltd, Robert Bosch GmbH, ChargePoint Inc., Siemens AG, and Tesla Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50004069

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in Units, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Adoption of Electric Vehicles and Related Investments

- 4.5.1.2 Efforts to Boost EV Charging Infrastructure Supported by Government Initiatives

- 4.5.2 Restraints

- 4.5.2.1 High Installation Costs Associated With Setting Up Charging Stations And Maintenance Costs

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Vehicle Type

- 5.1.1 Battery Electric Vehicle (BEV)

- 5.1.2 Plug-in Hybrid Electric Vehicle (PHEV)

- 5.1.3 Hybrid Electric Vehicle (HEV)

- 5.2 Application

- 5.2.1 Home Charging

- 5.2.2 Workplace Charging

- 5.2.3 Public Charging

- 5.3 Charging Type

- 5.3.1 AC Charging (Level 1 and Level 2)

- 5.3.2 DC Charging

- 5.4 Geography

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 Nordic

- 5.4.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 ABB Ltd

- 6.3.2 Robert Bosch GmbH

- 6.3.3 Delta Electronics Inc.

- 6.3.4 Siemens AG

- 6.3.5 Tesla Inc.

- 6.3.6 ChargePoint Inc.

- 6.3.7 Enphase Energy, Inc.

- 6.3.8 Powercharge

- 6.3.9 Ampure

- 6.3.10 Exicom Tele-Systems Ltd

- 6.3.11 Schneider Electric SE

- 6.3.12 Eaton Corporation

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technology Advancement in the EV Charging Equipment

- 7.2 Need for a Robust EV Charging Network in the Emerging European Markets

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.