Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636258

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636258

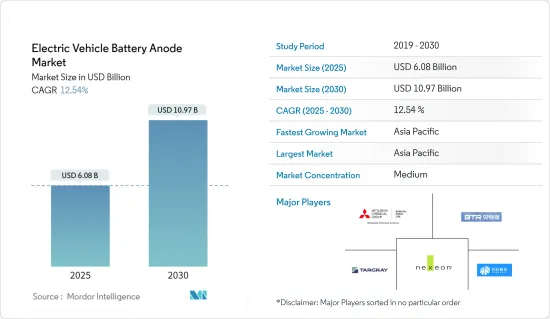

Electric Vehicle Battery Anode - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 124 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

The Electric Vehicle Battery Anode Market size is estimated at USD 6.08 billion in 2025, and is expected to reach USD 10.97 billion by 2030, at a CAGR of 12.54% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the increasing demand for electric vehicles and supportive government initiatives are expected to drive the market during the forecast period.

- On the other hand, technical challenges associated with anode materials like graphite are expected to hinder the market growth during the forecast period.

- However, technological innovations and the development of sustainable materials are expected to provide significant opportunities for the market in the coming years.

- Asia-Pacific is estimated to dominate the market due to the increasing adoption rate of electric vehicles across the various countries in the region.

Electric Vehicle Battery Anode Market Trends

The Lithium-Ion Batteries Segment to Dominate the Market

- The lithium-ion batteries segment plays a crucial role in the performance and efficiency of electric vehicles. As the demand for electric vehicles continues to surge, the need for high-performance lithium-ion batteries has become more pronounced. Lithium-ion batteries, known for their high energy density, long cycle life, and relatively low self-discharge rates, are essential components in the EV ecosystem, particularly in their anode design.

- One significant trend impacting the lithium-ion batteries segment is the declining price of lithium-ion batteries, which has made electric vehicles more accessible to a broader range of consumers. As of 2023, the average price of lithium-ion batteries dropped to around USD 139 per kWh, representing a decrease of over 82% since 2013.

- This ongoing decline in costs is projected to continue, with estimates suggesting prices could fall below USD 113/kWh by 2025 and reach USD 80/kWh by 2030. The reduction in battery prices makes EVs more affordable and encourages manufacturers to invest in advanced anode materials and technologies that enhance battery performance.

- Anodes in lithium-ion batteries are primarily made from graphite, favored for its excellent conductivity and ability to intercalate lithium ions. However, there is ongoing research into alternative materials, such as silicon and silicon-based composites, which can significantly enhance energy storage capacity. The push toward these new materials is partly driven by the need for higher performance and efficiency in EV batteries, as manufacturers seek to increase driving range and reduce charging times for consumers.

- The governments of the major developing countries globally have been supporting the increasing adoption of electric vehicles and making the country self-reliant for battery manufacturing, further creating the demand for batteries and battery anodes.

- For example, the Indian government aims to transition two and three-wheelers to 100% electric vehicles and achieve 30% e-mobility in total automotive sales by 2030.

- As more consumers and governments push for cleaner transportation, the production of EVs is rapidly increasing. This surge in production directly boosts the demand for EV batteries and, consequently, their components, including anodes.

- Moreover, several countries encouraged domestic and international companies to invest in electric vehicle battery production. For instance, in May 2023, Northvolt, a Swedish battery manufacturer, announced plans to invest several billion euros in building an electric-vehicle battery cell plant in Germany. The company plans to invest approximately USD 8.8 billion in the plant, with the German government providing around half a billion euros in subsidies.

- Overall, the lithium-ion battery segment of the electric vehicle battery anode market is evolving rapidly, driven by technological advancements, declining battery prices, and a growing emphasis on sustainability.

Asia-Pacific is Expected to Dominate the Market

- The Asia-Pacific electric vehicle (EV) battery anode market is witnessing significant growth, primarily driven by China's dominant position in the EV industry. China leads in electric vehicle production and sales and plays a pivotal role in the battery anode supply chain. With global electric vehicle sales skyrocketing from 1.06 million in 2019 to approximately 8.1 million in 2023, a staggering increase of over 650%, the demand for efficient and high-capacity battery anodes has never been more pronounced.

- China's aggressive expansion of battery anode production capacity is particularly noteworthy. Several provinces are setting ambitious targets to enhance their output significantly. Several provinces have announced ambitious plans to increase their production. For instance, Guizhou province aims to build 800,000 tons per year (t/yr) of battery anode and feedstock materials capacity by 2025. Similarly, Jiangsu HSC New Energy Materials is set to complete a 200,000 t/yr anode material production facility by 2025.

- China leads the world in electric vehicle production and sales, contributing to a substantial demand for battery electrolytes. According to the International Energy Agency, global electric vehicle sales grew from 1,060,000 in 2019 to 8,100,000 in 2023, representing an increase of more than 650%. The country's strong government support, including subsidies and incentives for EV adoption, accelerates this trend.

- Moreover, companies are at the forefront of battery material innovation. For instance, in October 2023, Epsilon Advanced Materials (EAM), India's leading battery materials company, announced plans to construct a USD 650 million graphite anode manufacturing facility in Brunswick County, North Carolina. This facility marks the first and largest investment by an Indian company in the US electric vehicle (EV) battery market. It is projected to support the production of 1.1 million electric vehicles by 2030. Construction is set to begin in 2024, with manufacturing expected to start in 2026 and full operational capacity reached by 2031. Once fully operational, the facility will utilize green technologies to produce high-capacity anode materials, with an annual production capacity of 50,000 tons of graphite anode.

- Hence, owing to the above factors, the market is expected to create demand in Asia-Pacific.

Electric Vehicle Battery Anode Industry Overview

The electric vehicle battery anode market is semi-consolidated. Some of the major players (not in particular order) include Mitsubishi Chemical Group, BTR New Material Group Co. Ltd, Shanshan Co., Targray Industries Inc., and Nexeon Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003539

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Demand of Electric Vehicles

- 4.5.1.2 Supportive Government Initiatives

- 4.5.2 Restraints

- 4.5.2.1 Technical Challenges like Degradation

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Batteries

- 5.1.2 Lead-acid Batteries

- 5.1.3 Other Battery Types

- 5.2 Battery Material Type

- 5.2.1 Graphite

- 5.2.2 Silicon

- 5.2.3 Other Battery Material Types

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Russia

- 5.3.2.7 Turkey

- 5.3.2.8 NORDIC

- 5.3.2.9 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Malaysia

- 5.3.3.6 Vietnam

- 5.3.3.7 Thailand

- 5.3.3.8 Indonesia

- 5.3.3.9 Rest of Asia Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Egypt

- 5.3.5.5 Qatar

- 5.3.5.6 Nigeria

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Mitsubishi Chemical Group

- 6.3.2 BTR New Material Group Co. Ltd

- 6.3.3 Shanshan Co.

- 6.3.4 NEI Corporation

- 6.3.5 Sionic Energy

- 6.3.6 Targray Industries Inc.

- 6.3.7 Nexeon Ltd

- 6.3.8 LG Chem Ltd

- 6.3.9 Tokai Carbon Co. Ltd

- 6.3.10 Nippon Carbon Co. Ltd

- 6.4 Market Ranking/Share Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Sustainable Materials

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.