Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636251

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636251

India SLI Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 100 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

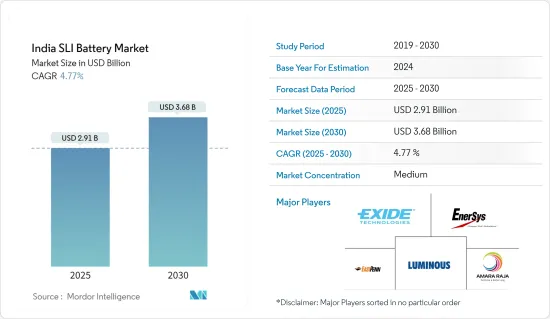

The India SLI Battery Market size is estimated at USD 2.91 billion in 2025, and is expected to reach USD 3.68 billion by 2030, at a CAGR of 4.77% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, growing demand for SLI batteries from industrial and agricultural applications and increasing adoption of motor vehicles are expected to drive the demand for SLI batteries during the forecast period.

- On the other hand, the increasing penetration of alternative battery chemistries restrains the growth of the Indian SLI battery market.

- Nevertheless, increased focus on battery recycling and expansion in emerging markets for both new vehicles and after-market replacements are expected to create significant opportunities for SLI battery market players in the near future.

India SLI Battery Market Trends

The Increasing Adoption of Motor Vehicles Drives the Market

- The increasing adoption of motor vehicles in India drives the growth of the market. The increasing adoption of motor vehicles is leading to increased demand for reliable and efficient automotive batteries.

- Robust automotive production and sales bolster the demand for SLI batteries in Asia. China and India are significant automotive markets, and SLI batteries are used in new vehicles and after-market replacements. The sales of electric vehicles rose significantly over the study period.

- According to the International Energy Agency, in 2023, the total number of EVs sold in India was 82,000, an increase of 70.8% compared to 2022. Sales are expected to rise exponentially in the coming years as numerous projects are initiated, which will raise the demand for SLI batteries during the forecast period.

- In order to achieve sustainable transportation, the country is actively promoting the use of electric vehicles (EVs). The country is embracing the electric revolution as the world transitions toward a greener future by encouraging the use of these vehicles.

- For instance, in February 2024, the JSW group announced the establishment of an electric vehicle (EV) venture in Odisha, including producing electric commercial vehicles (CVs) and passenger cars. The company invested INR 40,000 crore (USD 4.78 billion), spread over the next few years, targeting the production of 100,000 vehicles annually. Such investments are likely to raise the production of motor vehicles and raise the demand for SLI batteries in the coming years.

- As of 2023, companies were making advancements in battery technology, such as VRLA batteries, which became more popular due to their maintenance-free nature and improved performance. These batteries are gradually replacing traditional flooded lead-acid batteries in many applications; this factor is expected to create more opportunities for motor vehicles during the forecast period.

- Such projects and investments are likely to increase motor vehicle production across the region and raise the demand for SLI batteries during the forecast period.

The Automotive End-user Segment is Expected to Grow

- The automotive industry in India is expanding, with increasing demand for both passenger and commercial vehicles. This growth drives the need for reliable SLI batteries. The sales of automobiles have been rising significantly over the last few years.

- For instance, according to the Society of Indian Automobile Manufacturers (SIAM), domestic automobile sales in India in 2023 were 23.85 million units, an increase of 12.5% compared to 2022. The sale of automobiles is expected to rise significantly in the coming years as the government announces numerous initiatives and programs to raise vehicle production across the region.

- The Indian government has been proactive in promoting electric vehicles (EVs) through various initiatives to reduce pollution, decrease dependence on fossil fuels, and foster sustainable development. The Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme provides financial incentives for EV purchase and infrastructure development. These initiatives significantly impact the demand for SLI batteries across the region.

- For instance, as of 2023, the Indian government set a target for EV sales, accounting for 30% of private cars, 70% of commercial vehicles, and 80% of two- and three-wheelers by 2030. Further, the government also offered subsidy incentives from INR 10,000 per kWh (USD 120) to INR 15,000 per kWh (USD 180). Such initiatives and targets are likely to accelerate the production of EVs across the country and raise the demand for SLI batteries in the forecast period.

- Advancements in battery technology for automobiles may eventually replace the need for SLI batteries, even in auxiliary functions, as integrated battery management systems become more common. The leading companies are investing heavily in R&D to improve the performance, lifespan, and environmental impact of SLI batteries.

- For instance, in December 2023, KPIT Technologies unveiled sodium-ion battery technology developed in-house by researchers at the city-based company over the previous eight years. The overall cost of the advanced battery is likely to decrease by 30% compared to the existing alternatives. Such advancements are likely to raise the demand for advanced technology and increase the demand for SLI batteries during the forecast period.

India SLI Battery Industry Overview

The Indian SLI battery market is semi-fragmented. Some key players (not in particular order) include Exide Technologies, EnerSys, East Penn Manufacturing Co., Luminous Power Technologies Pvt. Ltd, and Amara Raja Batteries Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003530

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Motor Vehicles

- 4.5.1.2 Growing Demand for SLI Batteries from Industrial and Agricultural Applications

- 4.5.2 Restraints

- 4.5.2.1 Increasing Penetration of Alternative Battery Chemistries

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Pestle Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Flooded Battery

- 5.1.2 VRLA Battery

- 5.1.3 EBF Battery

- 5.2 End-User

- 5.2.1 Automotive

- 5.2.2 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted & SWOT Analysis for Leading Players

- 6.3 Company Profiles

- 6.3.1 Amara Raja Batteries Ltd

- 6.3.2 Exide Technologies

- 6.3.3 Luminous Power Technologies Pvt. Ltd.

- 6.3.4 EnerSys

- 6.3.5 HBL Power Systems Ltd.

- 6.3.6 East Penn Manufacturing Company

- 6.3.7 TATA AutoComp GY Batteries Pvt. Ltd.

- 6.3.8 Southern Batteries Pvt. Ltd.

- 6.3.9 SAFT Groupe SA

- 6.3.10 Jayachandran Industries (P) Ltd

- 6.4 List of Other Prominent Companies (Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increased Focus on Battery Recycling

- 7.2 Expansion in Emerging Markets for Both New Vehicles and After-Market Replacements

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.