Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636173

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636173

SLI Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 130 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

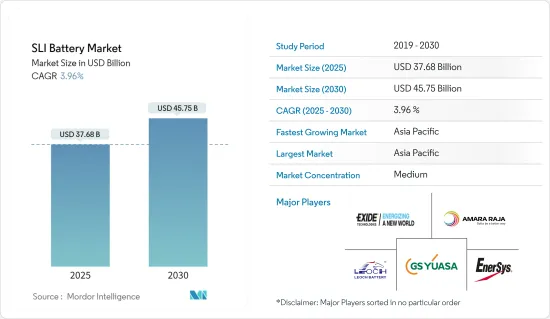

The SLI Battery Market size is estimated at USD 37.68 billion in 2025, and is expected to reach USD 45.75 billion by 2030, at a CAGR of 3.96% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the increasing adoption of motor vehicles and the growing demand for SLI batteries from industrial and agricultural applications are expected to drive the SLI batteries market during the forecast period.

- On the other hand, the increasing penetration of alternative battery chemistries and the stringent government regulations are expected to hinder the market's growth during the forecast period.

- Nevertheless, the increased focus on battery recycling and the expansion in emerging markets for both new vehicles and after-market replacements will likely create opportunities for the SLI battery market.

SLI Battery Market Trends

Automotive Segment to Witness Significant Growth

- The market for starting, lighting, and Ignition (SLI) batteries in the automotive segment is expected to witness notable growth, driven by the expanding automotive industry and the continuous need for reliable power sources. SLI batteries are essential components in motor vehicles, providing the necessary power to start the engine, run electrical systems, and ensure proper ignition.

- As the global vehicle fleet continues to grow, the demand for SLI batteries remains robust. For example, as per the International Organization of Motor Vehicle Manufacturers(OICA), the total global motor vehicle sales stood at around 92.724 million in 2023, recording over 11.89% growth compared to the previous years in 2022.

- Of the total global motor vehicle sales in 2023, the total passenger vehicles and commercial vehicle sales stood at over 65.272 million and 27.452 million, respectively. Such trends are expected to continue over the short term and create a substantial demand for the SLI battery during the forecast period. In addition, advancements in SLI battery technology, such as enhanced flooded batteries (EFB) and absorbent glass mat (AGM) batteries, are providing improved performance and durability, further propelling market growth.

- Despite the positive outlook, the SLI battery market will gradually start facing challenges from the growing popularity of electric vehicles (EVs) and the shift toward more sustainable energy solutions. EVs typically use lithium-ion batteries, which may reduce the demand for traditional SLI batteries in the long term.

- Nevertheless, several nations continue to experience a stable adoption of petrol and diesel vehicles over the short term in the coming years. For example, in September 2023, the United Kingdom's Prime Minister confirmed the planned ban was being pushed back five years from 2030 to 2035. Before the United Kingdom announced a shift in policy, the government had planned to ban the sale of new, pure petrol and diesel vehicles by 2030. Now, the plan is for the ban to begin in 2035.

- According to the government, under the ban, only electric battery-powered cars and zero-emission vehicles will be able to be bought new from 2035. However, most people will not be impacted by the ban, as most drivers buy vehicles secondhand. Only sales of new petrol and diesel models would be affected, not the existing ones. Moreover, the delay in the ban brings the United Kingdom into line with the European Union, which is also banning sales of new petrol and diesel cars by 2035.

- Overall, the SLI battery market is expected to maintain a growth trajectory, albeit at a moderate pace. Continued investments in automotive infrastructure, coupled with technological advancements in battery design and manufacturing, is expected to play a crucial role in market growth. In addition, the development of eco-friendly SLI batteries and recycling initiatives will align with global sustainability goals, ensuring the market's relevance in the evolving automotive landscape.

Asia-Pacific Region is Expected to Dominate the Market

- The Asia-Pacific region is expected to witness significant growth in the SLI (Starting, Lighting, and Ignition) battery market. This is likely to be driven by a combination of factors, including rapid urbanization, increasing vehicle production, and growing consumer demand for automobiles. Countries such as China, India, Japan, and South Korea are major contributors to this growth due to their large automotive markets and significant investments in automotive manufacturing infrastructure.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), the total number of motor vehicles produced in China stood at around 30.161 million in 2023, Japan produced over 8.99 million, South Korea produced 4.243 million, and India produced over 5.85 million. This makes the region one of the significant markets for SLI batteries worldwide. Moreover, the replacement market for SLI batteries is also substantial due to the high number of vehicles on the road.

- Recently, some of the major automobile manufacturers have also planned to develop and expand automobile manufacturing facilities in the region, where the vehicles are fuelled by petrol and diesel. For example, in November 2023, Toyota, one of the largest Japanese automakers, signed a Memorandum of Understanding (MoU) with the government of Karnataka to set up a third manufacturing plant in India, which would increase its production capacity by 1 lakh units per annum. The upcoming plant will also be situated in Bidadi, near Bangalore, near the existing two, and is expected to attract an investment of around INR 3,300 crores.

- Toyota's existing plants at Bidadi have a combined output of about 4 lakh units per annum, and this new plant operational by 2026 is planned to add about 30% to Toyota's production capacity. This announcement comes on the back of the brand, which has been completing 25 years in India. According to the company, the new plant will be the primary production base for an upcoming three-row SUV. Toyota is planned to produce 60,000 units annually, with a launch likely by 2026. Such developments in automobile manufacturing are expected to boost the adoption of SLI batteries in the coming years.

- Furthermore, some of the leading SLI battery players, such as GS Yuasa Corporation, announced that their India-based company Tata AutoComp GY Batteries Private Ltd (TGY), an equity-method affiliate of subsidiary GS Yuasa International Ltd (GS Yuasa), aims to double its annual production capacity for motorcycle lead-acid batteries to 8.4 million units. TGY, which was established in October 2005, is aiming to boost its market share in India, Asia's largest motorcycle-producing country.

- TGY launched production in a newly added wing at its plant in 2021 and began full-fledged mass production with the addition of a new production line in 2022. With this, TGY aims to continue expanding production capacity and establish a production system capable of producing 8.4 million lead-acid motorcycle batteries per year, double its pre-expansion capacity of 4.2 million units. The plant expansion is expected to enable the company to expand the range of battery models it manufactures. In addition, TGY is expected to strengthen its production of automotive lead-acid batteries, with a focus on high-performance lead-acid batteries for environment-friendly vehicles, such as start & stop vehicles, demand for which is expected to continue growing in the coming years.

- Therefore, owing to the abovementioned factors, the Asia-Pacific region is anticipated to witness notable growth for the SLI battery market during the forecast period.

SLI Battery Industry Overview

The SLI battery market is semi-fragmented. Some of the key players in the market (not in any particular order) include GS Yuasa International Ltd, Exide Technologies, Amara Raja Energy & Mobility Limited, EnerSys, and Leoch International Technology Limited Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50002581

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Motor Vehicles

- 4.5.1.2 Growing Demand for SLI Batteries from Industrial and Agricultural Applications

- 4.5.2 Restraints

- 4.5.2.1 Increasing Penetration of Alternative Battery Chemistries

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Flooded Battery

- 5.1.2 VRLA Battery

- 5.1.3 EBF Battery

- 5.2 End-User

- 5.2.1 Automotive

- 5.2.2 Others

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Nordic

- 5.3.2.7 Russia

- 5.3.2.8 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Thailand

- 5.3.3.6 Malaysia

- 5.3.3.7 Indonesia

- 5.3.3.8 Vietnam

- 5.3.3.9 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 United Arab Emirates

- 5.3.4.3 South Africa

- 5.3.4.4 Egypt

- 5.3.4.5 Nigeria

- 5.3.4.6 Qatar

- 5.3.4.7 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Chile

- 5.3.5.4 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted & SWOT Analysis for Leading Players

- 6.3 Company Profiles

- 6.3.1 GS Yuasa International Ltd.

- 6.3.2 Exide Technologies

- 6.3.3 Amara Raja Energy & Mobility Limited

- 6.3.4 EnerSys

- 6.3.5 Leoch International Technology Limited? Inc.

- 6.3.6 East Penn Manufacturing Company

- 6.3.7 C&D Technologies Inc.?

- 6.3.8 Clarios International Inc.?

- 6.3.9 Trojan Battery Company

- 6.3.10 Crown Battery Manufacturing Company

- 6.4 List of Other Prominent Companies (Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increased Focus on Battery Recycling

- 7.2 Expansion in Emerging Markets for Both New Vehicles and After-Market Replacements

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.