PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636250

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636250

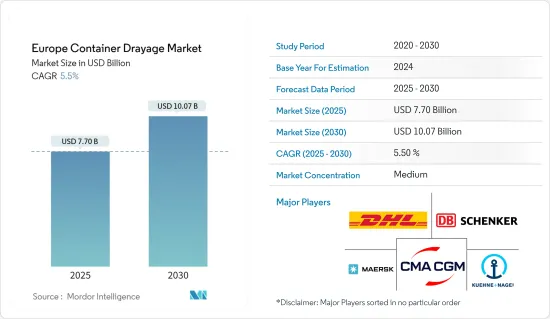

Europe Container Drayage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Europe Container Drayage Market size is estimated at USD 7.70 billion in 2025, and is expected to reach USD 10.07 billion by 2030, at a CAGR of 5.5% during the forecast period (2025-2030).

Key Highlights

- The European container drayage market is driven by trade growth, infrastructure development, technological advancements, and sustainable initiatives.

- The increasing volume of international trade and containerized cargo moving through European ports is a significant driver for the container drayage market. Europe is poised for a robust recovery, with export growth projected to surge by 2.2% in 2024, marking a significant uptick from the 0.4% growth in 2023. Correspondingly, after a dip in 2023, import trade volumes have been forecast to rebound by 1.6% in 2024.

- Challenges, including elevated interest rates, surging inflation, the prolonged conflict in Ukraine, and weakened global demand, weighed heavily on European trade volumes in 2023. However, with a projected easing of interest rates in 2024, economic activity is anticipated to rebound, spurring demand for European exports.

- In 2023, the European cross-border e-commerce market surged, hitting a turnover of EUR 237 billion (USD 256.54 billion), a remarkable 32% leap from 2022. European online retailers have been instrumental in contributing EUR 107 billion (USD 115.82 billion) to this cross-border total. The broader European B2C e-commerce market also flourished, culminating in a turnover of EUR 741 billion (USD 802.09 billion), up by a notable 13%. Cross-border transactions notably comprised 32% of all online sales in Europe.

- Investments in infrastructure, particularly in road networks, ports, and intermodal facilities, are pivotal for ensuring the seamless operation of container drayage services, thereby driving the market forward.

Europe Container Drayage Market Trends

Demand for Containers Driven by Cross-border E-commerce

In 2023, the European cross-border e-commerce market witnessed a significant surge, reaching a turnover of EUR 237 billion (USD 256.54 billion), marking a notable 32% leap over 2022. European online retailers played a pivotal role, contributing EUR 107 billion (USD 115.82 billion) to this cross-border total. The broader European B2C e-commerce market also thrived, achieving a turnover of EUR 741 billion (USD 802.09 billion), reflecting a substantial 13% increase. Notably, cross-border transactions accounted for 32% of all online sales in Europe.

German online retailers led the way, achieving a substantial 28% increase in cross-border sales, totaling EUR 43 billion (USD 46.54 billion). In contrast, the United Kingdom experienced a slight dip of 1.8%, with cross-border sales amounting to EUR 27.5 billion (USD 29.77 billion), down from EUR 28 billion (USD 30.31 billion) in 2022.

French online stores saw a notable 30% surge, reaching EUR 32 billion (USD 34.64 billion) in cross-border sales. Additionally, Spanish platforms witnessed a significant 50% rise, reaching EUR 18 billion (USD 19.48 billion), while Dutch platforms also experienced a substantial uptick, hitting EUR 7 billion (USD 7.58 billion), marking a 45% increase.

In 2023, clothing and footwear emerged as the dominant product category in European cross-border e-commerce. A significant 60% of respondents surveyed extensively revealed a strong preference for purchasing items from this category through international online platforms. In contrast, consumer electronics secured the second spot, with only 27% of respondents opting to procure these goods from overseas.

Italy Emerging as a Lucrative Hub for Container Drayage Services

Italian ports boast a unique dual function within the nation's port ecosystem. While, like in most countries, they primarily facilitate import and export activities, Italian ports distinguish themselves by assuming a pivotal role as key hubs in southern Europe.

Geographically, Italy's peninsula not only bridges Europe with the eastern Maghreb but also serves as a prominent gateway to the heart of the Mediterranean. Notably, the primary maritime route in the Mediterranean, linking the Suez Canal's exit with the Strait of Gibraltar, runs near Italy's coast.

Furthermore, Italian ports have cultivated strong ties with Central European landlocked nations like Hungary, Austria, and Switzerland. Among these connections, Trieste emerges as the premier port, serving as the gateway to Austria and Hungary.

Italy boasts 20 ports spread across its mainland peninsula and the islands of Sardinia and Sicily. In 2023, the primary ports collectively managed 11.03 million TEUs, marking a 6.3% dip over 2022. However, this figure still surpassed the volumes seen in both 2020 and 2021. Notably, this decline mirrors a broader European trend, with nearly all major container ports facing setbacks in 2023.

In 2023, Italy managed nearly double the container traffic of France, handling around 5 million TEUs. Surprisingly, despite having a similar number of ports, Italy outpaced France. Notably, three Italian ports - Gioia Tauro, Genoa, and La Spezia - joined the exclusive 'millionaire club.' While Gioia Tauro thrives as a primary hub, Genoa and La Spezia primarily serve as crucial links to the hinterland.

Gioia Tauro, in particular, shone in 2023, boasting a 5% growth in its traffic. The port's authority attributed this surge to the significant presence of MSC at the terminal. Originally developed by Contship, the terminal at Gioia Tauro saw a transition, with Maersk acquiring a stake before it eventually became a pivotal hub for the MSC group, a move that solidified the Swiss company's foothold in the Mediterranean.

Europe Container Drayage Industry Overview

The European container drayage market is dominated by some key players. It boasts a diverse mix, ranging from major global logistics firms to regional players and a host of small to medium-sized enterprises. Noteworthy names include DHL, DB Schenker, and Kuehne + Nagel, alongside industry behemoths like CMA CGM and Maersk Line.

Key trends in the European container drayage market encompass a shift toward digital operations, a growing focus on eco-friendly practices, the integration of IoT and telematics for real-time monitoring, and a rising preference for intermodal transportation solutions. These trends are significantly altering the market's landscape.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Increasing International Trade Driving the Market

- 4.2.1.2 Increasing Importance of Environmental Sustainability Driving the Market

- 4.2.2 Restraints

- 4.2.2.1 Regulatory Factors Affecting the Market

- 4.2.2.2 Infrastructure Challenges Affecting the Market

- 4.2.3 Opportunities

- 4.2.3.1 Technological Advancements Driving the Market

- 4.2.1 Drivers

- 4.3 Value Chain/Supply Chain Analysis

- 4.4 Government Regulations, Trade Agreements, and Initiatives

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of Geopolitics and the COVID-19 Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By Mode of Transport

- 5.1.1 Rail

- 5.1.2 Road

- 5.1.3 Other Modes of Transport

- 5.2 By Country

- 5.2.1 Germany

- 5.2.2 France

- 5.2.3 United Kingdom

- 5.2.4 Spain

- 5.2.5 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 DHL

- 6.2.2 DB Schenker

- 6.2.3 Kuehne + Nagel

- 6.2.4 CMA CGM

- 6.2.5 Maersk Line

- 6.2.6 Hapag-Lloyd

- 6.2.7 MSC (Mediterranean Shipping Company)

- 6.2.8 COSCO Shipping

- 6.2.9 Evergreen Marine

- 6.2.10 Yang Ming*

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 GDP Distribution, by Activity and Region

- 8.2 Insights into Capital Flows