PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521505

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521505

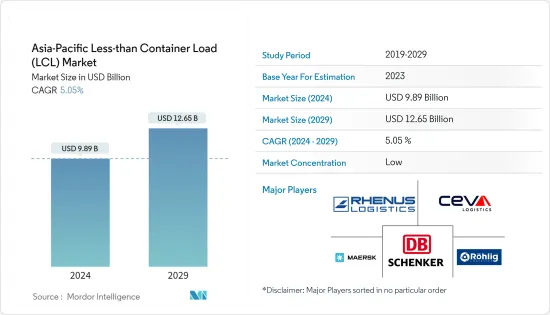

Asia-Pacific Less-than Container Load (LCL) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Asia-Pacific Less-than Container Load Market size is estimated at USD 9.89 billion in 2024, and is expected to reach USD 12.65 billion by 2029, growing at a CAGR of 5.05% during the forecast period (2024-2029).

The market is driven by the increasing sea freight in the region. Furthermore, the market is driven by the decreasing rates due to uncertainties in the market.

According to Dimerco, intra-Asian ocean freight rates are "sliding," although the market is holding up better than long-haul shipments. The Taiwanese forwarder stated in its September 2022 Asia-Pacific freight report that demand for maritime freight was deteriorating globally owing to the economic crisis and inflation, with macro data not indicating a speedy reversal. Overall, ocean loading factors ex-Asia for long-haul shipments decreased by 94%, according to Dimerco. In the coming weeks, the percentage could fall to 92% or such. Low demand has resulted in falling maritime freight charges. Intra-Asian rates from Southeast and Northeast Asia are also falling but remain reasonably constant when compared to rates into and out of China. Indeed, the South-East Asia Freight Index decreased by 2.5% in September 2022, while the Shanghai Containerised Freight Index sank by 10.4%.

Because of the increased trade among RECP countries, as well as the raw material transport required for the manufacturing move from China into Southeast Asian countries, cargo traffic within this region is still highly active. According to Maersk's most recent Asia-Pacific report, intra-Asian and intra-African trades were the only ones to have container volumes rise by 3.7% between May and July 2022. Changes in the macroeconomic climate are hastening market normalization and allowing ports to decongest, putting pressure on the value proposition supplied by carriers. Maersk claimed that overall demand for Asia-Pacific-Indian Subcontinent maritime freight was dropping due to the economic environment in destination regions and that automotive volume has been impacted by Pakistan's economic condition and also flooding.

Global shipping is confronting several challenges. While container rates are falling significantly, contract rates are approaching spot rates. This tendency is visible in other places, such as China and Southeast Asia, where, despite the drop in container rates, demand for shipping remains weak due to global inflation and constrained demand, resulting in a large drop in freight prices. Container costs have declined dramatically in key Asian ports such as Ningbo, Shanghai, and Singapore in the last year, indicating that the current situation may stay shortly. Container trends are an important indicator of economic success and global trade, and the market picture now appears grim. Container pricing and leasing rates are falling as the global shipping industry is witnessing a freefall in container rates.

After the Chinese New Year, container volumes and rates remain low, indicating a shift in the shipping business. An overstock of containers had resulted in carriers wishing to sell their inventory by October 2022. Spot rates, contract rates, and container prices have all plummeted dramatically as a result of global inflation and limited demand, with one key Asia-US route suffering an 80% decline in freight pricing. Furthermore, container prices remained low, with Asia-US West Coast rates 11% lower in January 2023 than in January 2020 and Asia-US East Coast rates 84% lower in January 2023 than in January 2022. Consumer demand in North Europe, in addition to Asia-US transportation routes, is unlikely to improve very soon.

Asia-Pacific Less-than Container Load (LCL) Market Trends

Increase in sea freight in the region driving the market

- The current global shipping industry position is complicated, as container rates are declining significantly, with contract rates approaching spot rates. This tendency is visible in other places, such as China and Southeast Asia, where, despite the drop in container rates, demand for shipping remains weak due to global inflation and constrained demand, resulting in a large drop in freight prices. The shipping sector's long-term prospects remain uncertain, as poor consumer demand in North Europe and gradual market recovery in China indicate that the industry will likely continue to struggle. Container rates in key Asian ports such as Ningbo, Shanghai, and Singapore have declined dramatically in the last year, indicating that the current situation may persist in the foreseeable future.

- Container trends are an important indicator of economic success and global trade, and the market picture now appears grim. Container pricing and leasing rates are falling, and the global shipping sector is experiencing a container rate freefall. Blank sailings have not been able to keep prices from falling, and the industry's mid-term view indicates a downturn in container activity on the Asia-EU and Asia-America trade lanes. Contract prices, on the other hand, are closer to spot rates, indicating a lack of demand for long-term commitments due to market uncertainty.

- Intra-Asian trade is exhibiting some resiliency, with comparatively higher container demand. Nonetheless, the mid-term prognosis did not anticipate demand returning to the high levels seen in 2020 and 2021, except for a possible inventory replenishment cycle, which was expected to generate some demand for containers. Falling container rates and rising availability in certain parts of the world indicate poor demand and slower economic growth. In summary, the global shipping sector is in a difficult condition, with container prices falling, demand weakening, and trade routes shifting. While the shipping industry may recover in the future, the current picture is bleak.

Increase in intra-continental trade driving the market

- Policymakers in Asia are correct to be concerned about the potential reconfiguration of global supply chains, given the consequences for the development of their export-oriented and open economies. While there is justification for focusing on prospective alterations on the supply side of the global and regional economic systems, equally drastic shifts on the demand side merit equal attention. There is expanding significance of final demand originating in emerging Asia and drawing policy implications for the region's future trade integration. Trade has been a primary driver of East Asian development, with Korea and Japan achieving high-income status through export-driven development plans.

- Initially, rapid intra-industry trade drove much of East Asia's intra-regional trade integration, which mirrored the development of cross-border global value chains with higher vertical specialization and geographical dispersion of production processes across the region. This resulted in a dramatic increase in intermediate product trade among emerging Asian economies, but the EU, Japan, and the United States remained the primary export customers for finished goods. Consider semiconductors and other computer parts traded from high-wage economies such as Japan, Korea, and Taiwan, China for final assembly to lower-wage economies such as Malaysia and China, and more recently Vietnam, with final products such as TV sets, computers, and cell phones shipped to consumers in the United States, Europe, and Japan.

Asia-Pacific Less-than Container Load (LCL) Industry Overview

The Asia-Pacific less-than container load (LCL) Market is highly fragmented with a lot of local, regional, and global players. Some of the major players include RHENUS LOGISTICS, CEVA Logistics, Rohlig Logistics GmbH & Co. KG., A.P. Moller-Maersk, DB Schenker, and many more. Singapore, Vietnam, and Thailand are highly competitive markets, with the presence of a large number of international players. Companies are constantly under pressure to minimize costs and optimize operational efficiency. In the wake of investment shifts and diversification of global supply chains, international investors are increasingly interested in mergers and acquisitions in the APAC logistics market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Method

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Market Overview

- 4.3 Market Dynamics

- 4.3.1 Drivers

- 4.3.2 Restraints

- 4.3.3 Opportunities

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of COVID-19 on the market

5 MARKET SEGMENTATION

- 5.1 By Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 By End User

- 5.2.1 Manufacturing

- 5.2.2 Retail (Includes E-commerce)

- 5.2.3 Healthcare and Pharmaceuticals

- 5.2.4 Agriculture

- 5.2.5 Other End Users

- 5.3 By Country

- 5.3.1 Australia

- 5.3.2 China

- 5.3.3 India

- 5.3.4 Indonesia

- 5.3.5 Japan

- 5.3.6 Malaysia

- 5.3.7 Thailand

- 5.3.8 Vietnam

- 5.3.9 Other Asia-Pacific Countries

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 RHENUS LOGISTICS

- 6.2.2 CEVA Logistics

- 6.2.3 Rohlig Logistics GmbH & Co. KG.

- 6.2.4 A.P. Moller - Maersk

- 6.2.5 DB Schenker

- 6.2.6 Hapag-Lloyd

- 6.2.7 Kuehne+Nagel

- 6.2.8 TVS Supply Chain Solutions (TVS SCS)

- 6.2.9 DHL

- 6.2.10 ZIM Integrated Shipping Services Ltd

- 6.2.11 GEODIS

- 6.2.12 Gulf Agency Company*

7 FUTURE OF THE MARKET

8 APPENDIX