PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636242

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636242

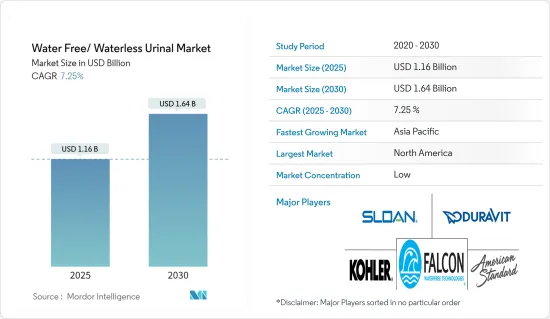

Water Free/ Waterless Urinal - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Water Free/ Waterless Urinal Market size is estimated at USD 1.16 billion in 2025, and is expected to reach USD 1.64 billion by 2030, at a CAGR of 7.25% during the forecast period (2025-2030).

The water-free/waterless urinal market is poised for substantial growth, driven by mounting environmental concerns, strict water conservation mandates, and technological advancements. Businesses and institutions worldwide are increasingly favoring eco-friendly solutions, especially in regions facing water scarcity. Waterless urinals are gaining traction as both cost-effective and environmentally responsible alternatives to traditional flush systems, underscoring sustainability across various sectors.

Rising awareness of water scarcity, bolstered by government programs and a growing emphasis on sustainable construction, has fueled the steady expansion of the water-free urinals market. Yet, the adoption and growth of water-free urinals vary significantly from one nation to another. Market dynamics are shaped by factors like cultural norms, building codes, and infrastructure development.

This market's growth mirrors a global commitment to curbing water usage and embracing sustainability. Given the ongoing technological innovations in waterless urinals, the market is poised to play a pivotal role in worldwide water conservation efforts in the years ahead.

Water Free/ Waterless Urinal Market Trends

The Rise of Waterless Urinals in the Residential Segment

The residential real estate industry has shown steady growth globally, paralleled by a notable trend toward sustainable building practices such as the adoption of waterless urinals. This shift is governed by increasing environmental concerns and a preference for eco-friendly solutions among homeowners. Residential property values have risen substantially, reflecting a growing awareness of the benefits of water conservation. As more homeowners prioritize sustainability, the demand for waterless urinals is expected to increase. These urinals are valued for their cost-effectiveness and positive environmental impact, making them popular choices in new residential constructions and renovations worldwide. Their integration supports efforts toward sustainable living and resource conservation in residential developments across various regions.

As homeowners prioritize eco-friendly solutions, these urinals offer significant benefits, including reduced water usage annually. Their integration into new and renovated homes supports green building certifications like LEED, enhancing property value and appeal. With advancements in odor control and maintenance efficiency, waterless urinals are becoming preferred choices in residential developments worldwide, contributing to sustainable living and environmental stewardship.

Waterless Urinals are Gaining Prominence in North America

In North America, the water-free and waterless urinals market stands out prominently, with a high level of adoption and acceptance.

Commercial buildings, educational institutions, government facilities, and upscale residential developments across the United States and Canada have increasingly integrated waterless urinals into their facilities. These urinals are favored for their efficiency in reducing water consumption, operational cost savings, and minimal maintenance requirements compared to traditional flush systems.

Waterless urinals are pivotal in North America's sustainable building revolution, saving water annually compared to traditional flush urinals. Their adoption is driven by stringent water conservation regulations, especially in states like California, and their economic benefits include lower maintenance costs and LEED certification advantages. Innovations by manufacturers like Falcon Waterfree Technologies and Sloan Valve enhance usability and environmental impact. Educational campaigns further promote acceptance in government buildings, educational institutions, and corporate offices, highlighting North America's leadership in integrating water-saving technologies into mainstream construction practices.

Moreover, North American manufacturers and suppliers offer a wide range of waterless urinal models that cater to different architectural styles and user preferences. These varieties, along with supportive government policies and incentives for sustainable practices, may further propel the market growth.

Water Free/ Waterless Urinal Industry Overview

The water-free/ waterless urinal market is fragmented, with prominent players such as Falcon Waterfree Technologies, Sloan Valve Company, Duravit AG, Kohler Co., and American Standard Brands. Falcon Waterfree Technologies leads the waterless urinal market with innovative sustainability solutions. Sloan Valve Company offers robust quality and performance, while Duravit AG focuses on luxury design. Kohler Co. and American Standard Brands provide broad product ranges, highlighting intense competition and diverse consumer choices in this evolving market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Focus on Reducing Water Consumption and Promoting Eco-friendly Building Practices

- 4.2.2 Continuous Innovation in Urinal Designs and Materials, Enhancing Efficiency and User Experience.

- 4.3 Market Restraints/ Challenges

- 4.3.1 Higher Upfront Investment Compared to Traditional Urinals, Which Can Deter Budget-Constrained Buyers.

- 4.3.2 Retrofitting Existing Plumbing Systems to Accommodate Waterless Urinals Pose Logistical And Compatibility Challenges.

- 4.4 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 4.4.1 Opportunities for Continuous Improvement in Urinal Designs, Materials, And Odor Control Technologies To Enhance Performance And User Experience.

- 4.5 Insights on Technological Innovations in the Market

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/ Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights on Various Regulatory Trends Shaping the Market

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Technology Type

- 5.1.1 Liquid Sealant Cartridges

- 5.1.2 Membrane Traps

- 5.1.3 Biological Blocks

- 5.1.4 Mechanical Balls

- 5.2 By Application

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.3 By Distribution Channel

- 5.3.1 Online

- 5.3.2 Offline

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Falcon Waterfree Technologies

- 6.2.2 Sloan Valve Company

- 6.2.3 Duravit AG

- 6.2.4 Kohler Co.

- 6.2.5 American Standard Brands

- 6.2.6 Zurn Industries LLC

- 6.2.7 URIMAT Schweiz AG

- 6.2.8 Villeroy & Boch AG

- 6.2.9 EKAM Eco Solutions

- 6.2.10 Waterless Co.*

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 DISCLAIMER AND ABOUT US