Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1630424

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1630424

South America Compressor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 110 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

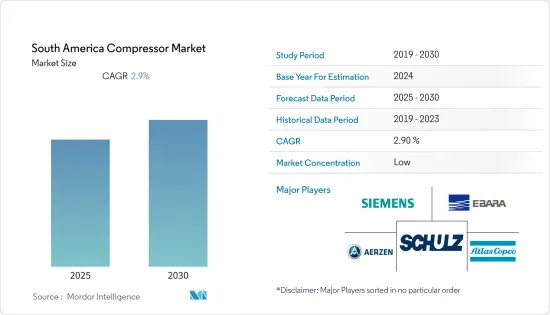

The South America Compressor Market is expected to register a CAGR of 2.9% during the forecast period.

The market was negatively impacted by the outbreak of COVID-19 due to regional lockdowns and a slowdown in end-user industries. Currently, the market has reached pre-pandemic levels.

Key Highlights

- Factor such as increasing demand for compressors from fertilizers and petrochemical plants to process and pressurize multiple gases is likely going to drive the SAmericanerica compressor market.

- However, increasing the installation of renewable energy sources to provide power that does not use compressors is expected to restrain the South American compressor market.

- New technologies in compressors have more efficiency than the present ones and are expected to create several opportunities for the South American compressor market in the future.

- Due to its highest gas production in the region, Argentina is expected to be the fastest-growing country in the SAmericanerica compressor market.

South America Compressor Market Trends

Oil and Gas Industry Segment Expected to Dominate the Market

- Compressors are mechanical devices that increase the pressure of a gas by reducing its volume. They are widely used throughout the oil and gas industry. The upstream, midstream, and downstream sectors of the oil and gas business require compression for numerous applications, such as transmission, storage, gas gathering, gas lift, gas injection, flash gas compression, and refrigeration.

- Moreover, discoveries of gas reservoirs in the region are likely going to use the compressor as an integral part of the gas transportation infrastructure. Hence, the expanding gas pipeline networks are expected to be one of the most significant drivers for the growth of the market studied during the forecast period.

- In 2021, the total electricity generated in South America, approximately 20.4%, was from natural gas in the region. As the energy generation source, natural gas comes second after hydropower in the region, which is 2021 accounted for approximately 660.1 TWh of the energy in the area.

- The 1430-km long proposed Brazil-Argentina pipeline will allow production from the Vaca Muerte shale to connect to Neuquen province in Brazil. Negotiations over the project started in August 2021, and the estimated cost of the project is USD 4.9 billion.

- Gasoducto del Noreste (GNEA) is another major upcoming gas pipeline in Argentina. GNEA is a pipeline (1,500km long) that is being constructed to transport gas from Bolivia to different areas in Argentina. The government is also focusing on the development of the gas transportation infrastructure in the country, along with the development of this GNEA project.

- Hence, owing to the above points, the oil and gas industry segment is likely going to dominate the South American compressor market during the forecast period.

Argentina Expected to be the Fastest Growing Market

- Argentina, due to the constant increase in energy demand and an increasing number of commercial and industrial operations, the country is likely to be the fastest-growing market for compressors in South America. Moreover, the growth in the share of natural gas in power generation in the country is likely to drive the compressor market.

- The production of shale gas in the country will increase by about 90% in 2021. This is expected to provide new avenues for the companies engaged in the compressor business.

- In 2021, the production of gas in Argentina was 38.6 billion cubic meters (bcm), which was higher than the production in 2020, 38.3 bcm. The increasing usage of gas in the country to generate electricity is likely to drive the compressor market in various sectors such as power generation, refineries, etc.

- GasoductodelNoreste (GNEA) is another major upcoming gas pipeline in Argentina. GNEA is a pipeline (1,500km long) that is being constructed to transport gas from Bolivia to different areas in Argentina. The government is also focusing on the development of the gas transportation infrastructure in the country, along with the development of this GNEA project.

- Hence, owing to the above points, Argentina is expected to be the fastest-growing market for compressors in South America during the forecast period.

South America Compressor Industry Overview

The South America compressor market is moderately fragmented. Some of the key players in this market (in no particular order) include Atlas Copco AB, Siemens AG, Schulz S.A., Ebara Corporation, and Aerzener Maschinenfabrik GmbH.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 71347

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Positive Diplacement

- 5.1.2 Dynamic

- 5.2 End User

- 5.2.1 Oil and Gas Industry

- 5.2.2 Power Sector

- 5.2.3 Manufacturing Sector

- 5.2.4 Chemicals and Petrochemical Industry

- 5.2.5 Other End Users

- 5.3 Geography

- 5.3.1 Brazil

- 5.3.2 Argentina

- 5.3.3 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 Siemens AG

- 6.3.2 Baker Hughes Co

- 6.3.3 Trane Technologies PLC

- 6.3.4 Atlas Copco AB

- 6.3.5 Schulz S.A.

- 6.3.6 General Electric Company

- 6.3.7 Ebara Corporation

- 6.3.8 Aerzener Maschinenfabrik GmbH

- 6.3.9 ELGI Equipments Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.