Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644324

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644324

Asia-Pacific Compressor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 100 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

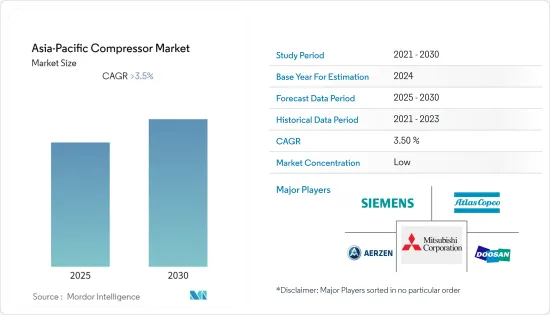

The Asia-Pacific Compressor Market is expected to register a CAGR of greater than 3.5% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. However, the market has znow reached pre-pandemic levels.

Key Highlights

- Over the long term, factors such as increasing demand for compressors from the refineries and steel manufacturing plants used for gas transportation and energy generation plants are likely to drive the Asia-Pacific compressor market.

- On the other hand, increasing the installation of renewable energy sources to provide power that does not use compressors is expected to restrain the Asia-Pacific compressor market.

- Nevertheless, countries in the Asia-Pacific have acknowledged the environmental pollution due to the usage of coal. Hence, nations have increased the use of gas-fired plants for a cleaner form of energy. Such implementation by different countries is expected to create several future opportunities for the Asia-Pacific compressor market.

- Due to its dominance in the region's steel, chemical, power, and other manufacturing industries, China is expected to dominate the Asia-Pacific compressor market.

APAC Compressor Market Trends

Oil and Gas Industry Segment Expected to Dominate the Market

- Compressors are mechanical devices that increase the pressure of a gas by reducing its volume. They are widely used throughout the oil and gas industry. The oil and gas business's upstream, midstream, and downstream sectors require compression for numerous applications, such as transmission, storage, gas gathering, gas lift, gas injection, flash gas compression, and refrigeration.

- Moreover, compressors are also an integral part of the gas transportation infrastructure. Hence, the expanding gas pipeline networks are expected to be one of the most significant drivers for the market's growth during the forecast period.

- In 2021, the total refining capacity of crude oil in the region was 36,478 thousand barrels per day (TBPD), which was higher than the region's capacity in 2019, 35,527 TBPD. The rapid growth in the refining capacity within the nations is likely to use compressors for the transportation of gas, which is expected to create a positive impact on the compressor market in the region.

- In August 2022, Indian Oil Corporation Limited announced its plans to implement the Panipat refinery expansion (P-25) project to enhance refining capacity from 15 MMTPA to 25 MMTPA (million metric tonnes per annum) to meet the growth in demand for petroleum products.

- Moreover, in December 2022, State-owned Gail India and Japanese transport firm Mitsui OSK Lines, through its wholly-owned subsidiary, signed a time charter contract for a new-build liquefied natural gas (LNG) carrier and for joint ownership of an existing LNG carrier. The vessel will be built by South Korean shipbuilder Daewoo Shipbuilding & Marine Engineering with a charter period from 2023.

- Hence, owing to the above points, the oil and gas industry is likely going to be the fastest-growing and largest segment in the Asia-Pacific compressor market during the forecast period.

China Expected to Dominate the Market

- China, due to its rapid increase in energy demand and industrialization, is likely to be the largest market for compressor in Asia-Pacific. Moreover, China has been instrumental in driving the manufacturing sector globally. The country is the global leader in the steel, chemical, power, and cement industries and is among the top players in the petrochemical and refining industries.

- The country's increasing refinery facility capacity due to the increasing consumption of oil and gas refined products in the country is likely to drive the compressor market during the forecast period.

- The country had the largest steel manufacturing capacity additions in the world during the past two decades. This trend resulted in excessive production capacity, which uses an extensive number of compressors and is likely going to drive the market in the country.

- In 2021, gas consumption in China was 378.7 billion cubic meters (bcm), which was higher than its consumption in 2020, 336.6 bcm. Due to increasing environmental concerns, the country has targeted more gas for energy generation than coal. The above expansion in coal power plants has been slowed down, and there is a rapid increase in gas usage in energy generation.

- In December 2022, The Saudi Arabian Oil Company, one of the leading integrated energy and chemicals companies, China Petroleum and Chemical Corporation and SABIC, announced the exploring collaboration across refining and petrochemical projects in China and Saudi Arabia. Additionally, Aramco and Sinopec, have signed heads of agreement for a greenfield project in Gulei, Fujian Province, which plans to include a 320,000 barrels-per-day refinery and 1.5 million tons-per-year petrochemical cracker complex. It is expected to commence operations by the end of 2025.

- Hence, owing to the above points, China is expected to dominate the Asia-Pacific compressor market during the forecast period.

APAC Compressor Industry Overview

The Asia-Pacific compressor market is fragmented. Some of the key players in this market (in no particular order) include Atlas Copco AB, Siemens AG, Mitsubishi Heavy Industries Ltd, Doosan Co. Ltd, and Aerzener Maschinenfabrik GmbH.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 71069

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Force Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Positive Diplacement

- 5.1.2 Dynamic

- 5.2 End User

- 5.2.1 Oil and Gas Industry

- 5.2.2 Power Sector

- 5.2.3 Manufacturing Sector

- 5.2.4 Chemicals and Petrochemical Industry

- 5.2.5 Other End Users

- 5.3 Geography

- 5.3.1 India

- 5.3.2 China

- 5.3.3 Japan

- 5.3.4 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 Baker Hughes Co

- 6.3.2 Trane Technologies PLC

- 6.3.3 Atlas Copco AB

- 6.3.4 Ariel Corporation

- 6.3.5 General Electric Company

- 6.3.6 Mitsubishi Heavy Industries Ltd

- 6.3.7 Aerzener Maschinenfabrik GmbH

- 6.3.8 Doosan Co Ltd

- 6.3.9 Seimens AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.