Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1626885

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1626885

Oil Refining - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 125 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

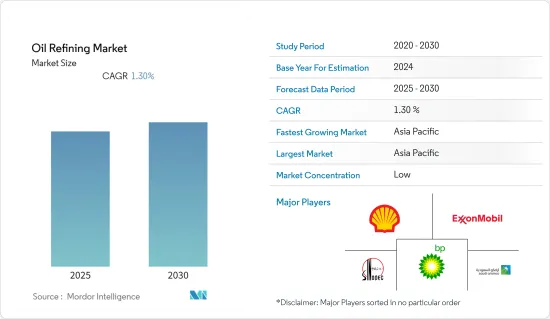

The Oil Refining Market is expected to register a CAGR of 1.3% during the forecast period.

Key Highlights

- Over the medium term, expanding downstream infrastructure worldwide to meet the increasing demand for refined petroleum products is expected to drive the market during the forecast period.

- On the other hand, the environmental concerns and regulations regarding oil and its products are expected to hinder the market's growth during the forecasted period.

- Nevertheless, many refineries worldwide are aging and require upgrades to improve efficiency, increase capacity, and comply with environmental regulations. Upgrading existing facilities presents opportunities for market studies during the forecasted period.

- Asia-Pacific is expected to remain the major player in the oil refining market. Owing to the upcoming major refinery projects in China and India.

Oil Refining Market Trends

Increasing Global Demand For Refined Petroleum Products To Drive The Market

- The growing consumption of petroleum products, such as gasoline, diesel, jet fuel, and lubricants, is driving the demand for oil refining. Rising population, urbanization, and industrialization contribute to this increased demand.

- The world's population continues to expand, particularly in developing countries. As more people migrate to urban areas, there is a higher demand for transportation fuels, such as gasoline and diesel, to meet the needs of increased vehicular traffic.

- Moreover, economic development and industrialization lead to increased energy consumption. As economies grow, there is a rise in manufacturing activities, infrastructure development, and commercial sectors, all of which require a steady supply of refined petroleum products.

- Additionally, the transportation sector heavily relies on refined petroleum products for various modes of transportation, including cars, trucks, airplanes, ships, and trains. The expanding global transportation network and the increasing mobility needs contribute to the growing demand for refined products.

- According to the International Organization of Motor Vehicle Manufacturers, global vehicle production increased by more than 6% between 2021 and 2022. This growth in vehicle production is expected to increase fuel demand during the forecasted period.

- Furthermore, various countries are investing in expanding their refining capacities to meet the growing demand for petroleum products. Capacity expansions help to bridge the supply-demand gap and ensure energy security.

- For instance, in November 2022, the Nigerian government stated that Petrol Integrated International (GII) had purchased 800 hectares of property in the state for its proposed oil refinery. This added to the growing number of refineries popping up to end Nigeria's decades-long paradoxical condition of being both a large producer of crude oil and a major importer of refined petroleum products.

- Therefore, as mentioned above, the increasing demand for petroleum products is expected to drive the market.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region is home to a significant portion of the world's population, including rapidly developing countries like China and India. These countries' increasing population and urbanization drive the demand for refined petroleum products, including transportation fuels and petrochemical feedstocks.

- Moreover, the Asia-Pacific region has been experiencing robust economic growth over the past few decades. This economic expansion leads to increased industrial activities, infrastructure development, and commercial sectors, which require a substantial supply of refined petroleum products.

- Furthermore, as incomes rise and the middle class expands in countries like China and India, there is a growing demand for automobiles and increased mobility. This trend leads to higher vehicle ownership rates, driving the need for gasoline and diesel fuels, resulting in increased oil refining activities.

- For instance, according to the International Organization of Motor Vehicle Manufacturers, vehicle sales in the Asia-Pacific region increased by more than 4% between 2021 and 2022, signifying the increasing vehicle sales, which drives the demand for petroleum products in the region.

- The Asia-Pacific region has witnessed significant growth in the petrochemical industry, which relies on refined petroleum products as feedstocks. The rising demand for petrochemical products, such as plastics, polymers, and chemicals, supports the region's need for increased oil refining capacity.

- For instance, in August 2022, PetroVietnam, a state-owned Vietnam Oil and Gas Group subsidiary, revealed plans to construct an oil refinery with a crude oil processing capacity of 24 to 26 Mt/year in Ba Ria, Vung Tau province, southern Vietnam. The building process was to be divided into two stages. The first and second phases are anticipated to cost USD 13.5 billion and USD 5 billion, respectively.

- Due to these factors, the Asia-Pacific region is expected to continue being the largest market for the oil refining industry, with significant investments and capacity expansions taking place to cater to the growing demand for refined petroleum products.

Oil Refining Industry Overview

The oil refining market is moderately consolidated. Some of the major players operating in the market (in no particular order) include Exxon Mobil Corporation, Shell PLC, Sinopec Corp., BP PLC, and Saudi Arabian Oil Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 48420

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Refining Capacity and Forecast in million barrels per day (mbpd), till 2028

- 4.3 Refining Throughput in barrels per day, till 2022

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Increasing Global Demand For Refined Petroleum Products

- 4.6.1.2 Economic Growth And Industrialization

- 4.6.2 Restraints

- 4.6.2.1 Environmental Concerns And Regulations

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION - BY GEOGRAPHY Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)}

- 5.1 North America

- 5.1.1 United States

- 5.1.2 Canada

- 5.1.3 Rest of North America

- 5.2 Asia-Pacific

- 5.2.1 China

- 5.2.2 India

- 5.2.3 South Korea

- 5.2.4 Japan

- 5.2.5 Rest of Asia-Pacific

- 5.3 Europe

- 5.3.1 Russia

- 5.3.2 Germany

- 5.3.3 Italy

- 5.3.4 Spain

- 5.3.5 Rest of Europe

- 5.4 South America

- 5.4.1 Brazil

- 5.4.2 Venezuela

- 5.4.3 Argentina

- 5.4.4 Rest of South America

- 5.5 Middle-East and Africa

- 5.5.1 Saudi Arabia

- 5.5.2 Iran

- 5.5.3 Nigeria

- 5.5.4 Kuwait

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Exxon Mobil Corporation

- 6.3.2 Shell PLC

- 6.3.3 Sinopec Corp.

- 6.3.4 BP PLC

- 6.3.5 Saudi Arabian Oil Co.

- 6.3.6 Valero Energy Corporation

- 6.3.7 Petroleos de Venezuela SA

- 6.3.8 China National Petroleum Corporation

- 6.3.9 Chevron Corporation

- 6.3.10 Rosneft PAO

- 6.3.11 TotalEnergies SE

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Upgrading Existing Refineries

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.