PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684834

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684834

Oil Refining Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

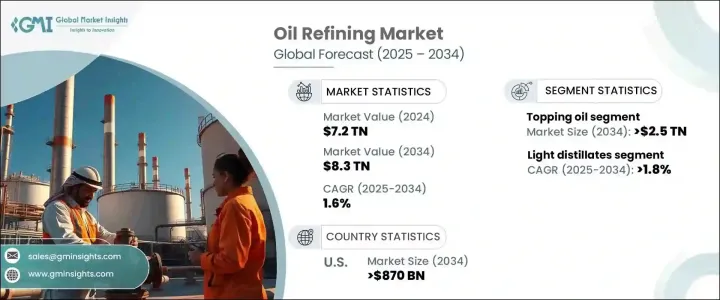

The Global Oil Refining Market reached USD 7.2 trillion in 2024 and is expected to grow at a CAGR of 1.6% between 2025 and 2034. Rapid industrialization, economic expansion, and the rising global population are fueling the demand for refined petroleum products. Developing economies, particularly in Asia and Africa, are witnessing increasing energy consumption as urbanization accelerates and living standards rise. The aviation and transportation industries are key drivers of this growth, requiring a steady supply of refined fuels to support expanding global mobility.

At the same time, stricter environmental regulations are reshaping refining operations, pushing companies to invest in cleaner technologies and sustainable practices. The industry is balancing the need for fuel security with the transition to lower-carbon solutions, making refinery modernization a top priority. Governments worldwide are incentivizing investments in refining infrastructure to reduce import dependency and boost self-sufficiency in energy production. Advanced refining processes, including hydrocracking and catalytic reforming, are enhancing efficiency and maximizing yield from crude oil, supporting steady market expansion. The ongoing exploration of new oil reserves and the adoption of digital technologies in refinery management further strengthen the sector's outlook. With continued advancements in refining capabilities and sustained demand for fuel and petrochemical products, the global oil refining market is poised for long-term growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.2 Trillion |

| Forecast Value | $8.3 Trillion |

| CAGR | 1.6% |

The topping oil segment is projected to generate USD 2.5 trillion by 2034, driven by its efficiency in breaking down large hydrocarbon molecules into high-value refined products. As industries increase their reliance on petrochemical feedstocks for manufacturing and energy production, demand for topping oil continues to rise. Enhanced refining techniques that improve yield efficiency are becoming industry standards, helping refiners maximize output and profitability. The segment's role in supplying crucial fuels for industrial operations further solidifies its importance in meeting global energy demands.

The light distillates segment is expected to grow at a CAGR of 1.8% through 2034, supported by rising disposable incomes and expanding middle-class populations worldwide. The widespread use of gasoline, naphtha, and other refined petroleum products across multiple sectors-including manufacturing, transportation, and residential heating-is driving demand. Infrastructure expansion, particularly in developing economies, is increasing the need for high-quality refined fuels. With industrialization gaining momentum, the segment is positioned for steady growth, reinforcing its critical role in the oil refining landscape.

The U.S. oil refining market is projected to generate USD 870 billion by 2034, bolstered by strong demand for domestically produced oil products. As the country seeks to reduce reliance on foreign oil, policies favoring refinery expansions and technological advancements are accelerating industry growth. Investments in digital refinery management, automation, and process optimization are improving efficiency, making U.S. refineries more competitive on the global stage. Additionally, government initiatives to explore untapped oil reserves and increase refining capacity are ensuring a stable and resilient supply chain. With ongoing advancements and a commitment to energy independence, the U.S. remains a dominant force in the global oil refining market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Complexity Level, 2021 – 2034 (USD Billion, Million Barrels Per Day)

- 5.1 Key trends

- 5.2 Topping

- 5.3 Conversion

- 5.4 Deep conversion

Chapter 6 Market Size and Forecast, By Product, 2021 – 2034 (USD Billion, Million Barrels Per Day)

- 6.1 Key trends

- 6.2 Light distillates

- 6.3 Middle distillates

- 6.4 Fuel oil

- 6.5 Others

Chapter 7 Market Size and Forecast, By Fuel, 2021 – 2034 (USD Billion, Million Barrels Per Day)

- 7.1 Key trends

- 7.2 Gasoline

- 7.3 Gasoil

- 7.4 Kerosene

- 7.5 LPG

- 7.6 Others

Chapter 8 Market Size and Forecast, By Application, 2021 – 2034 (USD Billion, Million Barrels Per Day)

- 8.1 Key trends

- 8.2 Road transport

- 8.3 Aviation

- 8.4 Marine bunker

- 8.5 Petrochemical

- 8.6 Other industry

- 8.7 Residential/Commercial/Agriculture

- 8.8 Electricity generation

- 8.9 Rail & domestic

Chapter 9 Market Size and Forecast, By Region, 2021 – 2034 (USD Billion, Million Barrels Per Day)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 Italy

- 9.3.4 Netherlands

- 9.3.5 Russia

- 9.3.6 Spain

- 9.3.7 UK

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 South Korea

- 9.4.3 India

- 9.4.4 Singapore

- 9.4.5 Indonesia

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 Kuwait

- 9.5.4 Egypt

- 9.5.5 South Africa

- 9.5.6 Nigeria

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

Chapter 10 Company Profiles

- 10.1 ADNOC

- 10.2 Bharat Petroleum

- 10.3 BP

- 10.4 Chevron

- 10.5 CNPC

- 10.6 ExxonMobil

- 10.7 Fluor

- 10.8 Hindustan Petroleum

- 10.9 Indian Oil

- 10.10 Kuwait Petroleum

- 10.11 Marathon Petroleum

- 10.12 PBF Energy

- 10.13 Phillips 66

- 10.14 Reliance Industries

- 10.15 S-Oil

- 10.16 Saudi Aramco

- 10.17 Shell

- 10.18 Valero