PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550526

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550526

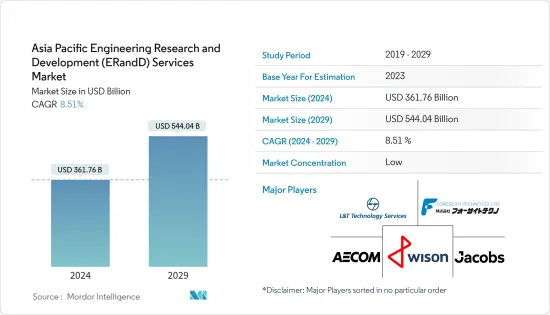

Asia-Pacific Engineering Research And Development (ER&D) Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Asia Pacific Engineering Research And Development Services Market size is estimated at USD 361.76 billion in 2024, and is expected to reach USD 544.04 billion by 2029, growing at a CAGR of 8.51% during the forecast period (2024-2029).

Key Highlights

- The Asia-Pacific engineering research and development (R&D) services sector is experiencing significant growth, propelled by technological advancements, investments, and a dynamic industrial landscape. The region boasts diverse industries that are pouring significant resources into engineering R&D.

- There has been a rapid expansion, driven by technological progress and surging consumer demand, and is growing in the automotive, aerospace, electronics, telecommunications, and healthcare sectors. The automotive sector prioritizes electric vehicles (EVs), autonomous driving technologies, and advanced driver assistance systems (ADAS). Meanwhile, the aerospace industry is advocating for more efficient and sustainable aircraft designs. Such demands underscore the necessity for specialized R&D services to foster innovation and uphold competitiveness.

- Many Asian countries are witnessing a surge in new Engineering R&D facilities. For instance, in June 2024, Toyota Motor Corporation announced that the company opened its research and development facility. The facility launched by the company would provide various services that would help drive vehicle development as Toyota strives to build ever-better cars.

- In Asia-Pacific, governments are rolling out policies and programs to bolster engineering R&D activities. These measures encompass tax incentives for R&D expenditures, grants for research projects, and initiatives aimed at nurturing innovation and entrepreneurship. For example, Japan's Society 5.0 initiative seeks to merge cyberspace with the physical realm, crafting a super-smart society and propelling R&D in fields like robotics and data analytics. In parallel, South Korea's Creative Economy strategy promotes innovation and technological advancement.

Asia-Pacific Engineering Research And Development (ER&D) Services Market Trends

Growing Advancement in Technologies in Asia Pacific

- Technological innovation propels the expanding engineering R&D market in Asia-Pacific. Emerging technologies such as artificial intelligence (AI), machine learning, big data analytics, blockchain, and the Internet of Things (IoT) are transforming traditional engineering methods. Companies are increasing R&D investments to leverage these technologies, innovate products, and streamline operations. For instance, AI and machine learning enhance predictive maintenance, optimize supply chains, and improve product design and development.

- Technology-driven industries are significantly driving the increase in engineering R&D activities. In the APAC region, sectors such as automotive, aerospace, electronics, telecommunications, and healthcare are rapidly expanding and transforming. For instance, the automotive sector is focusing on electric vehicles (EVs) and autonomous driving technologies. Meanwhile, the electronics industry is advancing in 5G and semiconductor technologies. These sectors require substantial R&D investments to remain competitive and address technological challenges.

- With the growing advancement of technology, there has been a rising demand for AI in various countries in Asia-Pacific. According to Salesforce's report, in 2023, Singapore led the Asia-Pacific region with an AI readiness index score of 70.1 out of 100. The Philippines trailed significantly, registering a score of just 35.7 on the same index. Such growing AI readiness governments, private enterprises, and venture capitalists are increasingly funding R&D initiatives to foster innovation and support technological advancements.

- Asia-Pacific's engineering R&D landscape is set for a bright future. With the relentless evolution of technology and industries' swift adaptation, the demand for R&D services is rising. Advance technologies like quantum computing, biotechnology, and advanced manufacturing are not just trends but catalysts for innovation, paving the way for fresh R&D endeavors. Bolstered by its technological expertise, robust investment landscape, and talented workforce, the APAC region stands poised to strengthen its position as a dominant player in the global engineering R&D arena.

Rising Demand of Engineering Research and Development Services in India

- Technological advancements, rising investments, and a stronger focus on innovation are driving significant growth in the demand for engineering research and development (R&D) services in India. The country has emerged as a hub for technological innovation, particularly in fields such as artificial intelligence (AI), machine learning, robotics, and the Internet of Things (IoT). These technological advancements necessitate extensive R&D efforts to develop new solutions, enhance existing technologies, and address complex engineering challenges. Companies are investing in R&D to remain competitive and leverage these technologies to improve their products and services.

- The Government of India and the private sector have started prioritizing R&D to drive economic growth and innovation. The government has also taken various Initiatives, such as the Make in India campaign and the Atmanirbhar Bharat, to boost domestic manufacturing and innovation capabilities. Additionally, there has been a rise in venture capital and private equity investments in Indian startups and technology companies, further fueling the demand for R&D services.

- Further, various sectors are increasing their R&D spending. For instance, the Indian automotive sector has experienced substantial growth over the years. According to a report by SIAM India, after a decline in two-wheeler sales in 2021, the market rebounded in 2023, reaching approximately 19.5 million units by the end of the fiscal year. India's increasing demand for two-wheelers has driven the need for advanced engineering research and development services, further fueling market growth.

- India has emerged as a dominant force in the global outsourcing of engineering R&D services. Numerous multinational corporations are forging partnerships with Indian firms, capitalizing on their expertise and cost benefits. Such collaborations enable these companies to tap into premium R&D services while streamlining their operational expenses. Indian firms are stepping up their participation in worldwide research collaborations, bolstering their capabilities and standing globally.

- The growing demand for engineering research and development services in India reflects the country's dynamic and evolving technological landscape. With increasing investments, a rich talent pool, and supportive government policies, India is well-positioned to continue its growth as a global leader in engineering R&D. As industries across various sectors seek innovative solutions and technological advancements, the role of R&D services will remain crucial in driving progress and maintaining competitiveness in the global market.

Asia-Pacific Engineering Research And Development (ER&D) Services Industry Overview

The Asia-Pacific engineering research and development (ER&D) services market is fragmented due to the presence of several players. Several key players in the Asia-Pacific engineering research and development (ER&D) services market are constantly making efforts to bring advancements. A few prominent companies enter collaborations and expand their footprints in the region to strengthen their positions. Wison Engineering Ltd, Foresight Techno Co. Ltd, Tata Technologies, and Infosys are the major players in the market.

In July 2024, ZEISS inaugurated a new R&D and manufacturing center in Suzhou Industrial Park. Covering 13,000 sq. m, this marked the group's first independent land acquisition for a project in China. With this move, ZEISS solidifyied its position as a key R&D and manufacturing hub in China, focusing on industrial quality solutions, research and surgical microscopes, and ophthalmic equipment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Regulatory Landscape and Policy Developments

- 4.4 Assessment of Impact of Macroeconomic Trends

- 4.5 Industry Ecosystem Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Advancement in Technologies

- 5.1.2 Increasing Demand for Innovative Products and Solutions

- 5.2 Market Restraints

- 5.2.1 Lack of Skilled Professionals

- 5.3 Key Base Indicator Analysis

- 5.3.1 Current Available Talent Pool of Engineers

- 5.3.2 Talent Upskill Initiatives (Government and Industry Collaborations)

6 MARKET SEGMENTATION

- 6.1 By Service Provider Type (Market Size Estimates and Forecasts, Associated Trends)

- 6.1.1 Global Capability Centers (GCCs)

- 6.1.2 Engineering Service Providers (ESPs)

- 6.2 By Industry Vertical (Market Size Estimates and Forecasts, Associated Trends)

- 6.2.1 Automotive

- 6.2.2 Industrial

- 6.2.3 Aerospace and Defence

- 6.2.4 Consumer Electronics

- 6.2.5 Semiconductor

- 6.2.6 BFSI

- 6.2.7 Other Industry Verticals (includes Retail, Healthcare, and IT and Telecom)

- 6.3 By Service Line (Market Size Estimates and Forecasts, Associated Trends)

- 6.3.1 Mechanical and Electrical Engineering Services

- 6.3.2 Embedded Engineering Services

- 6.3.3 Software Engineering Services

- 6.4 By Country (Market Size Estimates and Forecasts, Associated Trends)

- 6.4.1 China

- 6.4.2 Japan

- 6.4.3 India

- 6.4.4 South Korea

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Wison Engineering Ltd

- 7.1.2 Foresight Techno Co. Ltd

- 7.1.3 L&T Technology Services

- 7.1.4 Tata Technologies

- 7.1.5 Quest Global Services Pte. Ltd

- 7.1.6 AECOM Engineering company

- 7.1.7 Global Logic

- 7.1.8 Jacobs Engineering Group Inc.

- 7.1.9 Fluor Corporation

- 7.1.10 Infosys

- 7.1.11 Tech Mahindra

- 7.1.12 Wipro

- 7.1.13 Capgemini

- 7.1.14 Accenture

- 7.1.15 DXC Technology

8 VENDOR POSITIONING ANALYSIS OF ENGINEERING SERVICE PROVIDERS

9 FUTURE OUTLOOK OF THE MARKET