PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550495

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550495

GCC OOH And DOOH - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

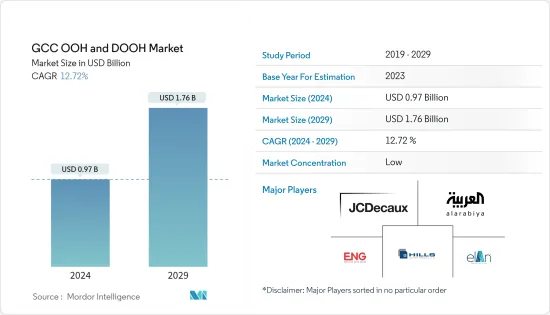

The GCC OOH And DOOH Market size is estimated at USD 0.97 billion in 2024, and is expected to reach USD 1.76 billion by 2029, growing at a CAGR of 12.72% during the forecast period (2024-2029).

Key Highlights

- Digital out-of-home (DOOH) marketing is significantly shaping the Gulf Cooperation Council (GCC) markets, with companies witnessing substantial growth in this sector. Advertisers are flocking to this arena, aiming to amplify brand and product visibility by engaging their audiences in innovative ways. Merely occupying a small screen no longer suffices; the emphasis now lies on broadcasting messages extensively. This approach involves crafting 360-degree ads that resonate with audiences in real-life settings.

- Aligned with Saudi Arabia's 2030 Vision, the marketing landscape in the kingdom stands poised for a transformation. Embracing emerging technologies and transitioning from traditional print billboards to digital ones aligns with environmental concerns and paves the way for a media sector that seamlessly integrates with urban landscapes. This shift not only enhances ecological friendliness but also caters to the evolving aesthetic preferences of the audience.

- Placing ads strategically in high-traffic areas, like busy streets, public transportation hubs, shopping centers, and sports stadiums, ensures brands reach a diverse audience. This broad exposure fosters a sense of ubiquity, enhancing brand recall. Additionally, out-of-home (OOH) advertising presents a unique canvas for creativity and innovation.

- Advertisers leverage visual elements, design, and messaging to create impactful campaigns. With digital tech integration, OOH ads now offer real-time updates and interactive experiences, pushing the boundaries of creativity.

- In May 2023, JCDecaux, a prominent figure in the global outdoor advertising arena, solidified its presence in Kuwait by securing an exclusive advertising deal for Jazeera Airways Terminal 5 (T5). This strategic collaboration seeks to revolutionize advertising at T5, Kuwait's foremost low-cost airline hub, primarily focusing on elevating the passenger journey.

- However, tracking user engagement with digital out-of-home (DooH) advertising is challenging due to the difficulty of accurately measuring DooH impressions. Vendors estimate foot traffic around outdoor ads using smartphone location data, but this method often lacks precision.

GCC OOH and DOOH Market Trends

Ongoing Shift toward Digital Advertising is expected to boost the Market Growth

- The rise of digitalization and the embrace of programmatic technologies have transformed outdoor media, providing advanced targeting and measurement tools that were once out of reach. Digital out-of-home (OOH) advertisements seamlessly integrate into consumers' daily lives, giving brands a distinctive chance to engage with their target demographics subtly.

- The increasing urbanization is leading to a major market's growth. Previously, Out-of-Home (OOH) advertising depended on real estate, requiring marketers to guess where their audience may be. Today, technology provides precise geolocation data. Digital Out-of-Home (DOOH) combines the visibility of traditional OOH with the flexibility, analytics, and ease of digital campaigns. With the right tools and attention to detail, DOOH offers brands a significant opportunity to boost visibility and increase foot traffic.

- Businesses in GCC countries are increasingly turning to digital platforms, acknowledging their central role in the region's advertising landscape. Sectors such as travel, tourism, and hospitality are taking the lead in efforts to rekindle consumer interest in travel. Tourism authorities in GCC countries have taken a bold step by launching a global campaign highlighting the region's diverse tourism attractions.

- Moreover, the government is bolstering the GCC's digital capabilities, with the UAE's Digital Government Strategy 2025 spearheading the swift adoption of digital services in all seven Emirates. This push is a direct response to the heightened emphasis on digital inclusion and the imperative to bolster societal resilience, a lesson underscored by the challenges posed by the COVID-19 pandemic.

Saudi Arabia to Witness Major Growth

- Although alternative media like TV and the Internet are available, outdoor advertising remains crucial for firms and organizations in Saudi Arabia aiming to promote their products. When other channels are not viable, outdoor ads serve as the most effective medium. They provide a comprehensive set of interactive digital solutions and reach a vast audience quickly. Vision 2030 has spurred significant changes globally, and Saudi Arabia, experiencing economic and social growth, has witnessed substantial transformations.

- In October 2023, AlArabia Outdoor Advertising, a prominent OOH firm in Saudi Arabia, secured a significant project. The company will be responsible for setting up, managing, and upkeeping outdoor advertising billboards in Riyadh. The initiative was put forth by Remat Al-Riyadh Development company, aiming to elevate Riyadh into a digital, intelligent, and sustainable metropolis, aspiring to be recognized among the world's top 10 cities.

- Moreover, airports are optimal locations for OOH and DOOH advertising due to the high concentration of travelers. While waiting to board or navigate terminals, passengers are a captive audience receptive to engaging visuals and messaging. According to the General Authority for Statistics (Saudi Arabia), the country has witnessed a significant increase from 37.4 million annual air passengers in 2020 to 111.7 million annual air passengers in 2023.

- According to the World Bank, in 2022, Saudi Arabia saw a notable uptick in its annual urban population growth, rising by 1.4 percentage points, a substantial increase of 1076.92% from 2021. This surge signifies a remarkable shift in the nation's urban population dynamics, thus increasing the demand for the deployment of DOOH in the country.

- Furthermore, Saudi Arabia's robust economy has fostered the growth of the private sector, driven by the entry of new companies and increased competition. Official agencies have also enhanced their communication efforts. Additionally, outdoor spending has risen compared to previous years, thanks to heightened awareness and promotion of new social activities, regional events, and destination tourism.

GCC OOH and DOOH Industry Overview

India out of home (OOH) and Digital-Out-of-Home (DOOH) Market is fragmented. It comprises several extensive outdoor advertising and media companies with operations in multiple markets and the smaller, local companies operating a limited number of structures in one or a few local markets. Some of the major players in the market include JCDecaux.

February 2024: Viola Outdoor, a division of the Abu Dhabi-based media communications group Viola Communications, unveiled D.Toplight, its cutting-edge digital Out of Home (OOH) innovation, at a prominent spot in the heart of the capital. D.Toplight, boasting 3D capabilities, serves as the inaugural installment in the company's envisioned expansive screen network.

January 2024: Media World, a multi-platform media group, collaborated with RSG Group of Companies, sealing a deal valued at over AED 100 million (USD 27.23 million). The agreement focuses on acquiring and managing an outdoor high-resolution digital screen on Dubai's iconic Sheikh Zayed Road. RSG Group will feature this screen on the prestigious Fairmont Dubai Skyline, a luxury five-star hotel and branded residences project.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Competitive Rivalry within the Industry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Ecosystem Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Ongoing Shift Towards Digital Advertising

- 5.1.2 Increasing Use of Recommendation Engines

- 5.2 Market Restraints

- 5.2.1 Operational Challenges Related To Measurement Of Advertising Effectiveness, Cost And Market Fragmentation

- 5.3 Market Opportunities

- 5.4 Industry Regulatory Landscape and Policy Developments

- 5.5 Key Technological Innovations

- 5.5.1 Innovations to assess Audience Measurement and Analytics

- 5.5.2 Indication on Available Units (Spaces) in the Region (Based on Availability)

- 5.5.3 Likeliness of Audience Engagement through Online Channels after being Exposed to OOH Ads (Based on Availability)

- 5.5.4 Use of Digital Signage Screens for Advertisement in the Region

- 5.6 Key Case Studies of OOH and DOOH Advertisement Campaigns in GCC

- 5.7 Overall Positioning of OOH and DOOH Spending amongst other Advertisement Formats in GCC

6 MARKET SEGMENTATION

- 6.1 By Type (Market Size Estimates and Forecasts in USD million, 2022-2029 | Trends and Dynamics | Recent Developments)

- 6.1.1 Static (Traditional) OOH

- 6.1.2 Digital OOH (LED Screens)

- 6.1.2.1 Programmatic OOH

- 6.1.2.2 Others

- 6.2 By Application (Market Size Estimates and Forecasts in USD million, 2022-2029 | Trends and Dynamics | Recent Developments)

- 6.2.1 Billboard

- 6.2.2 Transportation (Transit)

- 6.2.2.1 Airports

- 6.2.2.2 Others (Buses, etc.)

- 6.2.3 Street Furniture

- 6.2.4 Other Place-Based Media

- 6.3 By End-User Industry (Market Size Estimates and Forecasts in USD million, 2022-2029 | Trends and Dynamics | Recent Developments)

- 6.3.1 Automotive

- 6.3.2 Retail and Consumer Goods

- 6.3.3 Healthcare

- 6.3.4 BFSI

- 6.3.5 Other End Users

- 6.4 By Country

- 6.4.1 Saudi Arabia

- 6.4.2 United Arab Emirates

- 6.4.3 Bahrain

- 6.4.4 Kuwait

- 6.4.5 Oman

- 6.4.6 Qatar

7 COMPETITIVE LANDSCAPE (Business Overview | Solution Portfolio | Financials | Business Strategy And Recent Developments)

- 7.1 Company Profiles

- 7.1.1 Al Arabiya

- 7.1.2 JCDecaux SE

- 7.1.3 ELAN Group

- 7.1.4 Emirates Neon Group

- 7.1.5 Hills Advertising L.L.C.

- 7.1.6 Dooha Media

- 7.1.7 BackLite Media LLC

- 7.1.8 Daktronics Inc.

- 7.1.9 Hypermedia FZ-LLC

- 7.1.10 Abu Dhabi Media Network

8 FUTURE OUTLOOK