PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550245

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550245

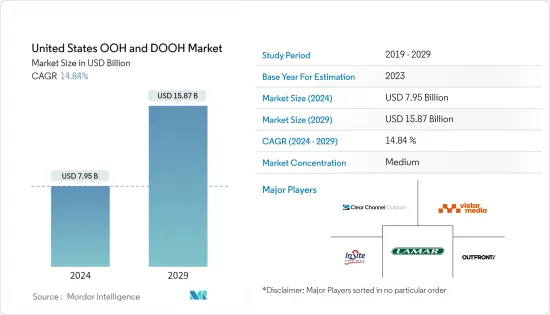

United States OOH And DOOH - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The United States OOH And DOOH Market size is estimated at USD 7.95 billion in 2024, and is expected to reach USD 15.87 billion by 2029, growing at a CAGR of 14.84% during the forecast period (2024-2029).

In the United States, the OOH and DOOH market is witnessing robust growth, fuelled by technological advancements that include dynamic digital billboards and interactive displays, which not only boost engagement but also draw in a larger pool of advertisers.

Key Highlights

- Digital out-of-home (DOOH) enables local retailers to quickly customize their displays and messages, ensuring information is delivered to consumers more efficiently and with greater impact. Unlike traditional advertising, DOOH is not only more nimble but also easier to manage. These digital displays provide real-time product updates, interactive content, and visually engaging images and videos.

- With urban populations expanding and consumer preferences favoring digital media in the United States, OOH and DOOH platforms stand out for their unmatched visibility and impact, propelling market growth. Moreover, smart city initiatives leverage a range of digital displays to enhance urban operations, each presenting revenue potential via advertisements. Ranging from compact interactive kiosks to expansive digital billboards, these setups boast strong computing capabilities, quality graphics, and reliable connectivity. Beyond their visual impact, they furnish crucial analytics, empowering data-driven decisions.

- In February 2024, Intersection, a company specializing in experience-driven out-of-home media and technology, unveiled a strategic collaboration with TikTok and LinkNYC, the premier digital network in New York City. TikTok's 'Out of Phone' campaign marks a significant pivot in digital advertising, bridging the gap between TikTok's online content and the physical realm, notably through partnerships with Intersection and LinkNYC. Through this collaboration, Intersection extends TikTok's Out of Phone initiative to the streets of NYC. Leveraging the vast LinkNYC network, creators can showcase their digital creations on interactive displays throughout the city.

- In November 2023, Displayce, a demand-side platform focused on programmatic digital out-of-home (DOOH) advertising, and Place Exchange, a supply-side platform (SSP) for programmatic OOH media, unveiled an integration. This move aims to broaden the DOOH supply reach in the United States and Latin America, offering enhanced marketing avenues for Displayce's clientele.

- However, adapting to evolving consumer behavior poses a major challenge for DOOH advertisers. They struggle with effectively engaging their target audiences and encounter difficulties in precisely tracking and evaluating campaign performance. This encompasses attributing ROI to specific DOOH campaigns and assessing their impact on consumer behavior.

United States OOH And DOOH Market Trends

Ongoing Shift Toward Digital Advertising Aided by Increased Spending on Smart City Projects

- The United States' increasing focus on smart city initiatives is propelling growth in the OOH and DOOH advertising markets. These initiatives are bolstering the advertising landscape by introducing advanced infrastructure, such as digital screens and interactive kiosks. Moreover, with the advent of IoT and 5G, connectivity has been significantly enhanced, enabling advertisers to deliver real-time, data-driven campaigns that are not only more relevant but also highly engaging.

- Smart city advancements not only boost foot traffic but also enhance the visibility of advertisements. Moreover, as smart cities prioritize sustainability, they unite with the trend toward digital advertising, lessening the dependence on printed materials and resonating with environmentally conscious consumers. This synergy significantly bolsters the efficacy and outreach of both OOH and DOOH campaigns.

- In October 2023, the New York City Office of Technology and Innovation (OTI) introduced the new Smart City Testbed Program, which would include government collaboration with outside organizations to roll out eight pilot technology projects.

- Moreover, the rising digital advertising is augmenting the growth of the OOH and DOOH markets in the United States by leveraging technology to create more dynamic and engaging ad experiences. Digital billboards and screens, with their real-time content updates and interactive features, captivate audiences, driving higher engagement. Advanced data analytics further refine ad targeting, elevating relevance and impact. Digital formats' flexibility enables platforms to display multiple ads simultaneously, optimizing ad space. This digital advertising innovation enhances the appeal of OOH and DOOH to advertisers, fuelling market growth.

- As per the Outdoor Advertising Association of America, in 2023, the United States spent over USD 6.33 billion on billboard advertising, representing over 70% of the country's total out-of-home (OOH) ad expenditure. Transit and place-based advertising each saw expenditures of approximately USD 1.4 billion and USD 568 million.

- In February 2024, Gannett Co. Inc., a media and marketing solutions company focusing on digital platforms and subscriptions, partnered with the USA TODAY Network. This collaboration marks a significant milestone as they are now the official content partner for the Big Ten Conference, the United States' oldest Division I collegiate athletic conference. As a crucial part of the agreement, syndicated content from across USA TODAY Network's local network of more than 200 publications would be featured on BigTen.org. Notable contributors include The Columbus Dispatch, The Des Moines Register, Detroit Free Press, and The Indianapolis Star.

Billboard Application Segment to Hold Significant Market Share

- Digital billboards are gaining popularity on US streets, offering an effective platform for international product, service, and goods promotion. These billboards are ubiquitous, found not only on highways but also on main streets. Their appeal lies in the ability to swiftly update information on roadside billboards, shopping centers, or even sports stadiums. As per the Outdoor Advertising Association of America, in 2023, the United States witnessed a surge of over 40% in the count of digital billboards, reaching around 16.6 thousand.

- The surge in digital billboard adoption is propelling the growth of the out-of-home (OOH) and digital out-of-home (DOOH) markets in the United States. These billboards provide dynamic, real-time content, enhancing engagement with their vivid displays. Advertisers leverage this by swiftly updating messages, incorporating motion graphics, and customizing ads based on real-time data, including local events and time of day. Digital billboards, with their flexibility, not only enhance campaign effectiveness and reach but also offer valuable analytics, enabling advertisers to build more precise and efficient strategies.

- In November 2023, Clear Channel Outdoor Americas (CCOA) and the United Service Organizations (USO) are collaborating on a nationwide digital out-of-home (DOOH) media campaign. The campaign aims to encourage public support for US military personnel and their families. The prime aim is to boost awareness and encourage civilians to stand in solidarity with veterans.

- In April 2024, Vistar Media, a global provider of technology solutions for out-of-home (OOH) media, revealed that Lamar Advertising Company, a player in the global outdoor advertising landscape, chose Vistar's Cortex, a content management software (CMS), to drive its extensive network of digital out-of-home (DOOH) billboards spanning the United States.

- In 2023, Lamar selected Vistar to manage its Denver Transit DOOH network, solidifying a partnership. Lamar, known for its extensive US digital billboard network, provides advertisers access to nearly 5,000 displays, generating over 5 billion weekly impressions. Lamar successfully implemented Vistar's Cortex software suite across its entire DOOH network in under six weeks, achieving zero downtime. This swift and seamless transition highlights the tailored efficacy of Vistar's Cortex, specifically designed to meet the unique requirements of DOOH networks.

United States OOH And DOOH Industry Overview

The US OOH and DOOH market is moderately competitive due to the presence of significant players like Outfront Media, Lamar Advertising Company, and Vistar Media. Market players are enhancing their portfolios and seeking enduring competitive advantages through strategic partnerships and product launches.

- March 2024: OUTFRONT Media, a US out-of-home media (OOH) company, bolstered its transit advertising by expanding its programmatic capabilities. The company is rapidly implementing its programmatic rollout in New York City's MTA system. This initiative will encompass almost all the MTA's subway stations, potentially engaging over four million daily commuters and tourists. Additionally, it would extend to commuter rail stations in the surrounding areas.

- January 2024: Assembly, a global media agency, unveiled its retail media innovation, ShopConnect. This planning tool uniquely blends programmatic buying with digital out-of-home (DOOH), enabling real-time consumer experiences with effectiveness and relevance. In collaboration with Talon, an independent OOH media agency, and Place Exchange, a programmatic SSP, the tool was built to link Assembly's media activation prowess with DOOH inventory seamlessly. This inventory spans locations both inside and outside, strategically positioned near retailers throughout the United States.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Competitive Rivalry within the Industry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Ecosystem Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Ongoing Shift Toward Digital Advertising Aided by Increased Spending on Smart City Projects

- 5.1.2 Increase in Air Traffic Owing to Growth in Tourism Industry has Aided the Spending on Airport Advertisement in the United States

- 5.2 Market Restraints

- 5.2.1 Operational Challenges Related to Measurement of Advertising Effectiveness, Cost, and Market Fragmentation

- 5.3 Market Opportunities

- 5.4 Industry Regulatory Landscape and Policy Developments

- 5.5 Key Technological Innovations

- 5.5.1 Innovations to assess Audience Measurement and Analytics

- 5.5.2 Indication on Available Units (Spaces) in the Region (Based on Availability)

- 5.5.3 Likeliness of Audience Engagement through Online Channels after being Exposed to OOH Ads (Based on Availability)

- 5.5.4 Use of Digital Signage Screens for Advertisement in the Region

- 5.6 Key Case Studies of OOH and DOOH Advertisement Campaigns in the Country

- 5.7 Overall Positioning of OOH and DOOH Spending Among Other Advertisement Formats in the Country

6 MARKET SEGMENTATION

- 6.1 By Type (Market Size Estimates and Forecasts in USD million, 2022-2029 | Trends and Dynamics | Recent Developments)

- 6.1.1 Static (Traditional) OOH

- 6.1.2 Digital OOH (LED Screens)

- 6.1.2.1 Programmatic OOH

- 6.1.2.2 Other Types

- 6.2 By Application (Market Size Estimates and Forecasts in USD million, 2022-2029 | Trends and Dynamics | Recent Developments)

- 6.2.1 Billboard

- 6.2.2 Transportation (Transit)

- 6.2.2.1 Airports

- 6.2.2.2 Other Applications (Buses, etc.)

- 6.2.3 Street Furniture

- 6.2.4 Other Place-based Media

- 6.3 By End-user Industry (Market Size Estimates and Forecasts in USD million, 2022-2029 | Trends and Dynamics | Recent Developments)

- 6.3.1 Automotive

- 6.3.2 Retail and Consumer Goods

- 6.3.3 Healthcare

- 6.3.4 BFSI

- 6.3.5 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Clear Channel Outdoor

- 7.1.2 Outfront Media

- 7.1.3 Vistar Media

- 7.1.4 Lamar Advertising Company

- 7.1.5 InSite Street Media

- 7.1.6 J C Decaux

- 7.1.7 Ad Focus Inc.

- 7.1.8 Daktronics

- 7.1.9 Intersection

- 7.1.10 JCDecaux

8 FUTURE OUTLOOK