PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911832

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911832

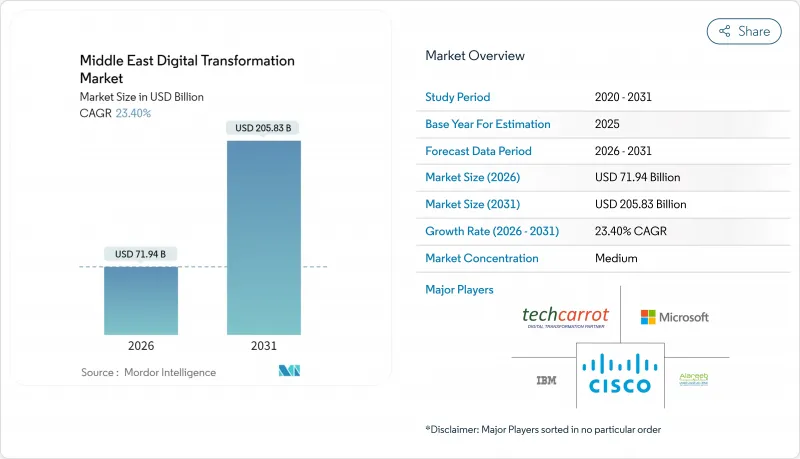

Middle East Digital Transformation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Middle East Digital Transformation Market was valued at USD 58.30 billion in 2025 and estimated to grow from USD 71.94 billion in 2026 to reach USD 205.83 billion by 2031, at a CAGR of 23.4% during the forecast period (2026-2031).

This swift rise mirrors the region's policy-driven pivot from oil dependence toward technology-anchored value creation. Sovereign wealth funds have already committed more than USD 100 billion to artificial-intelligence infrastructure, including NEOM's net-zero data factories, while hyperscale cloud regions now dot every Gulf state . Government mega-initiatives treat digital transformation as economic insurance, compelling public agencies and state-owned enterprises to allocate up to 40% of their annual technology budgets to AI, 5G, and cloud programs. Competitive dynamics remain collaborative as international hyperscalers form joint ventures with local champions instead of entering head-to-head battles, and sector opportunities broaden as 5G densification underpins IoT scale-up across smart-city and industrial projects.

Middle East Digital Transformation Market Trends and Insights

Government mega-initiatives accelerating ICT and AI spend

Public-sector programs redefine the Middle East digital transformation market by anchoring technology budgets to national diversification strategies. Saudi Vision 2030, the UAE National AI Strategy 2031, Qatar National Vision 2030, and Kuwait's forthcoming AI Roadmap earmark multibillion-dollar outlays for hyperscale infrastructure, public-service digitization, and nationwide upskilling. These commitments insulate spending from oil-price cycles and guarantee multi-year project pipelines, prompting international cloud providers and device OEMs to localize manufacturing, R&D, and customer-success teams. As a result, public procurement alone already accounts for nearly one-third of annual regional outlays, funneling steady demand into private-sector ecosystems.

Hyperscale cloud-region rollouts cutting transformation costs

Microsoft, Amazon Web Services, Google Cloud, Oracle, and Tencent have all switched on in-country availability zones, driving enterprise operating-cost reductions of 25-35% compared with hybrid on-premises estates. Microsoft's USD 1.5 billion collaboration with Abu Dhabi-based G42 is rolling out sovereign Azure regions that comply with Gulf privacy laws while supporting global workloads. New zones slash latency for mobile apps, reduce compliance overhead, and enable Arabic-language AI models to run at scale, accelerating cloud-first adoption across banking, retail, and public safety.

Chronic shortage of senior digital talent and AI specialists

Eighty-plus percent of Gulf employers report immediate hiring gaps in cloud architecture, data science, and cyber-operations roles. Wage inflation regularly tops 20% for senior DevSecOps engineers, elongating project timelines and inflating total-cost-of-ownership models. Governments respond with accelerated STEM curricula, golden-visa schemes for tech workers, and vendor-led certification drives, such as Oracle's plan to upskill 350,000 regional professionals by 2028 . Automation tools, low-code platforms, and generative-AI copilots partially offset shortages, yet complex integration work still relies on scarce specialist talent.

Other drivers and restraints analyzed in the detailed report include:

- 5G and fiber network densification enabling IoT scale-up

- Sovereign-wealth and private-capital surge into AI infrastructure

- Heightened cybersecurity and data-sovereignty compliance risks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud and edge platforms anchor 22.45% of 2025 revenue, underscoring their role as the indispensable substrate for every other capability in the Middle East digital transformation market. Adoption of GPU-rich instances and serverless runtimes is now mainstream, and sovereign clouds ensure compliance for public-sector and regulated workloads. Artificial-intelligence applications, from large language models to computer-vision inspection, are on track for a 26.55% CAGR, pulling through demand for high-performance networking and open-source MLOps stacks. As AI matures, digital-twin pilots in oil-gas refineries, industrial-robotics retrofits in logistics hubs, and blockchain-based trade-finance pilots widen the solution mix. Extended-reality training simulators gain traction in aviation and healthcare, where immersive modules cut certification time by up to 40%. IoT sensor grids, enabled by 5G and private-LTE slices, transform asset-tracking and predictive-maintenance practices, while additive manufacturing finds niche uptake in on-rig parts printing. Cybersecurity platforms wrap the entire stack, attracting sustained double-digit spend growth every year.

Second-order momentum follows the same pattern. Edge-cloud nodes clustered at telecom central offices trim millisecond latency for factory-floor vision systems, and AI-as-a-Service APIs help SMEs deploy chatbots without building in-house models. Governments back Arabic-language AI research, fostering sovereign-model ecosystems that set data-residency benchmarks. Within this growing mosaic, other technologies, quantum research labs, neuromorphic chip prototypes, and photonic interconnects receive seed funding but remain long-horizon bets. Collectively, these dynamics solidify the Middle East digital transformation market as a laboratory for next-generation enterprise stacks.

BFSI seized 18.55% of the Middle East digital transformation market share in 2025 owing to early adoption of core-bank modernization, instant-payments platforms, and open-banking APIs. Yet healthcare is racing ahead at a 25.95% CAGR as telehealth, AI-enabled diagnostics, and electronic health records mandates proliferate. Dubai Healthcare City Authority's pilot that auto-reviews medical claims demonstrates how AI slashes processing time by 35%. Manufacturing and energy players integrate digital twins with advanced process control systems, reducing unplanned downtime by high single-digit percentages. Retailers roll out omnichannel apps, in-store analytics, and AI recommendation engines that lift conversion rates. Transportation and logistics operators digitize end-to-end freight visibility and deploy autonomous yard-management solutions, while the public sector intensifies e-government and smart-city implementations.

The net effect is a broadening customer base. As frontier use cases prove ROI, cross-industry benchmarking accelerates technology migration. Hospitals adopt banking-style identity verification; retail borrows predictive-maintenance algorithms from oil and gas. That cross-pollination deepens integration opportunities for service providers and cements a fast-cycling innovation loop inside the Middle East digital transformation market.

The Middle East Digital Transformation Market Report is Segmented by Technology Type (AI and ML, Extended Reality, Iot, Industrial Robotics, Blockchain, and More), End-User Industry (Manufacturing, Oil and Gas Utilities, Retail and E-Commerce, and More), Deployment Mode (On-Premise, Cloud, Hybrid), Enterprise Size (Large Enterprises, Smes), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Cisco Systems Inc.

- IBM Corporation

- Microsoft Corporation

- SAP SE

- Oracle Corporation

- Accenture PLC

- Siemens AG

- Amazon Web Services Inc.

- Google LLC

- Huawei Technologies Co. Ltd.

- Ericsson AB

- stc Group

- G42 Holding Ltd

- Etisalat by eand

- Ooredoo Group

- Techcarrot FZ LLC

- Alareeb ICT

- Baarez Technology Solutions

- Deloitte Touche Tohmatsu Ltd.

- Ernst and Young (E&Y) Global Limited

- PwC International Limited

- Capgemini SE

- Cognizant Technology Solutions

- Wipro Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Evolution and Adoption Roadmap

- 4.3 Market Drivers

- 4.3.1 Government mega-initiatives accelerating ICT and AI spend

- 4.3.2 Hyperscale cloud region rollouts cutting transformation costs

- 4.3.3 5G and fiber network densification enabling IoT scale-up

- 4.3.4 Sovereign wealth and private-capital surge into AI infrastructure

- 4.3.5 Emergence of sovereign AI and national LLM projects

- 4.3.6 Telecom-infrastructure monetization unlocking digital CAPEX

- 4.4 Market Restraints

- 4.4.1 Chronic shortage of senior digital talent and AI specialists

- 4.4.2 Heightened cybersecurity and data-sovereignty compliance risks

- 4.4.3 GPU and advanced-server supply bottlenecks

- 4.4.4 Energy-water constraints for hyperscale data center cooling

- 4.5 Value Chain Analysis

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology Type

- 5.1.1 Artificial Intelligence and Machine Learning

- 5.1.2 Extended Reality (VR and AR)

- 5.1.3 Internet of Things (IoT)

- 5.1.4 Industrial Robotics

- 5.1.5 Blockchain

- 5.1.6 Digital Twin

- 5.1.7 Additive Manufacturing

- 5.1.8 Cybersecurity

- 5.1.9 Cloud and Edge Computing

- 5.1.10 Other Technologies

- 5.2 By End-User Industry

- 5.2.1 Manufacturing

- 5.2.2 Oil and Gas Utilities

- 5.2.3 Retail and E-commerce

- 5.2.4 Transportation and Logistics

- 5.2.5 Healthcare

- 5.2.6 BFSI

- 5.2.7 Telecom and IT

- 5.2.8 Government and Public Sector

- 5.2.9 Other End-user Industries

- 5.3 By Deployment Mode

- 5.3.1 On-Premise

- 5.3.2 Cloud

- 5.3.3 Hybrid

- 5.4 By Enterprise Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises (SMEs)

- 5.5 By Country

- 5.5.1 Saudi Arabia

- 5.5.2 United Arab Emirates

- 5.5.3 Qatar

- 5.5.4 Kuwait

- 5.5.5 Other Middle-East Countries (Israel, Bahrain, Iran, Oman, Jordan, etc.)

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Cisco Systems Inc.

- 6.4.2 IBM Corporation

- 6.4.3 Microsoft Corporation

- 6.4.4 SAP SE

- 6.4.5 Oracle Corporation

- 6.4.6 Accenture PLC

- 6.4.7 Siemens AG

- 6.4.8 Amazon Web Services Inc.

- 6.4.9 Google LLC

- 6.4.10 Huawei Technologies Co. Ltd.

- 6.4.11 Ericsson AB

- 6.4.12 stc Group

- 6.4.13 G42 Holding Ltd

- 6.4.14 Etisalat by eand

- 6.4.15 Ooredoo Group

- 6.4.16 Techcarrot FZ LLC

- 6.4.17 Alareeb ICT

- 6.4.18 Baarez Technology Solutions

- 6.4.19 Deloitte Touche Tohmatsu Ltd.

- 6.4.20 Ernst and Young (E&Y) Global Limited

- 6.4.21 PwC International Limited

- 6.4.22 Capgemini SE

- 6.4.23 Cognizant Technology Solutions

- 6.4.24 Wipro Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment