PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550326

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550326

Germany Surveillance Analog Camera - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

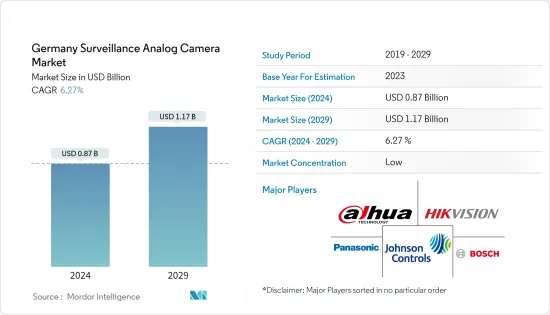

The Germany Surveillance Analog Camera Market size is estimated at USD 0.87 billion in 2024, and is expected to reach USD 1.17 billion by 2029, growing at a CAGR of 6.27% during the forecast period (2024-2029).

Analog security cameras continue to significantly influence the German market, maintaining a strong presence within the security industry. Despite the increasing adoption of digital IP cameras, analog security cameras retain a substantial market share due to their cost-effectiveness and ease of use.

Key Highlights

- Analog security cameras provide cost-effectiveness, ease of installation, compatibility with existing infrastructure, and reliability, making them a preferred option for budget-conscious small- to medium-sized enterprises. While adopting analog surveillance might appear technologically regressive, for many users, utilizing existing analog setups or integrating modern analog cameras results in substantial advancements in cost savings, cybersecurity, camera coverage, and video analytics.

- Germany significantly prefers analog cameras, particularly in urban areas where security cameras, or CCTVs, monitor every public corner. Berlin, in particular, is one of Europe's most surveilled cities, with approximately 12 cameras per 1,000 residents, according to various sources.

- Rising crime rates in Germany are driving an increase in public video surveillance. In 2023, the first year without pandemic restrictions, Germany experienced a notable rise in violent crime, according to police data. Reports from Bundeskriminalamt, based on exclusive data access, indicated an 8.6% increase in violent crime, totaling 214,099 cases-a 15-year high. Cases of dangerous bodily harm also rose by nearly 7%, reaching a record 154,541.

- In response to these security challenges, the German lower house of parliament approved a set of new measures. These measures emphasize that security concerns will prevent over-privacy considerations, particularly when establishments such as shopping centers seek approval for camera installations. These developments collectively indicate a growing demand for analog cameras in Germany.

- However, factors such as the growing prominence of IP cameras and technological limitations of analog continues to remain among the major challenges for market growth, as a significant segment of consumers are gravitating more toward IP cameras, despite them being a bit costlie, due to the advanced features and functionality they boast.

Germany Surveillance Analog Camera Market Trends

Growing Number of Small- and Medium-sized Businesses in the Country Supports the Market's Growth

- Germany's economy is significantly supported by its small- and medium-sized enterprises (SMEs) despite the presence of globally recognized large corporations. SMEs constitute over 99% of all German businesses, totaling about 3.2 million entities. With the SME segment expanding, the analog surveillance camera market is anticipated to witness significant growth opportunities during the forecast period.

- In the current dynamic business environment, small business owners face numerous challenges, including securing their assets, employees, and customers. Surveillance systems play a critical role in addressing these security concerns. The primary advantage of video surveillance systems is their ability to deter unauthorized access and reduce theft. Strategically placed cameras can prevent potential burglaries and internal theft, thereby creating a secure environment for all stakeholders.

- Due to budget constraints, many small businesses prefer analog surveillance systems. The recent introduction of high-definition analog (HD Analog) cameras, with resolutions up to 8MP (4K Ultra HD) and features such as Wide Dynamic Range (WDR) and enhanced low-light performance, has expanded the applicability of analog systems. These modern HD analog cameras can utilize existing coaxial cables, providing a cost-effective upgrade solution.

- Retail and wholesale are the major sectors wherein the prominence of SMEs are significant. With the retail sales in the country increasing, the number of enterprises entering the retail sector is also increasing, creating a favorable ecosystem for the growth of the market studied as the demand for cost-effective surveillance solutions are usually higher in this segment. According to the German Retail Federation (HDE) and Statistisches Bundesamt, total revenue from retail sales in Germany, increased to EUR 650.3 billion (~USD 707.5 billion) in 2023, compared to EUR 526.8 billion (~USD 573.20 billion) in 2018.

Government Segment to Remain a Significant Demand Driver

- Germany has faced several terrorist attacks, notably in central Berlin, Paris, and Brussels. Coupled with a significant influx of migrants, these events prompted the German government to bolster its security measures. This included a comprehensive overhaul and enhancement of the nation's internal security. The heightened terror risks, mounting public safety worries, surging migration rates, and an expanding defense budget collectively set the stage for robust growth in the security market.

- Germany's regulations on surveillance cameras are significantly more stringent than many other countries. The country's increased focus on national security, driven by events such as Russia's invasion of Ukraine and the ongoing conflict, has accelerated the implementation of a new strategic plan.

- In June 2023, German Chancellor Olaf Scholz introduced the nation's first "National Security Strategy." This strategy aims to establish a more cohesive approach to foreign and security policies and ensure Berlin is better prepared for geopolitical developments.

- The recent years also witnessed a notable growth in violent crimes in Germany owing to which the emphasis of the government and public security authorities on implementing advanced security and surveillance technologies has been growing, creating a favorable ecosystem for the market's growth. For instance, according to Bundeskriminalamt, the Federal Criminal Police Office of Germany, in 2023, the number of violent crime cases recorded in Germany increased to 214.1 thousand, compared to 185.38 thousand in 2018.

Germany Surveillance Analog Camera Industry Overview

The German surveillance analog camera market is fragmented in nature, with several players operating in the market. Considering the growing competition owing to the entry of more players, vendors continuously try to increase their market presence by introducing new products, expanding their operations, or entering into strategic mergers and acquisitions, partnerships, and collaborations. Some of the major players include Dahua Technology Co. Ltd, Axis Communications AB, Hangzhou Hikvision Digital Technology Co. Ltd, Panasonic Corporation, and Bosch Security.

- July 2024: The Clearway Group, a prominent European security services provider, finalized the acquisition of the SECONTEC Group, a Germany-based firm. Clearway's expertise lies in safeguarding individuals, properties, and assets. The company offers customized security solutions, blending a wide array of specialized services with cutting-edge technology. Its offerings span from CCTV and alarm systems, suitable for both temporary and permanent setups, to robust monitoring services from top-tier alarm and video monitoring stations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 An Assessment of Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Cost Effectiveness and Affordability is Driving their Demand

- 5.1.2 Increasing Crime Rate Across Parts of the Country

- 5.2 Market Restraints

- 5.2.1 Technological Limitation and Availability of Substitutes

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Government

- 6.1.2 Banking

- 6.1.3 Healthcare

- 6.1.4 Transportation and Logistics

- 6.1.5 Industrial

- 6.1.6 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Bosch Security Systems Incorporated

- 7.1.2 Dahua Technology Co. Ltd

- 7.1.3 Hangzhou Hikvision Digital Technology Co. Ltd

- 7.1.4 Panasonic Corporation

- 7.1.5 Johnson Controls Inc.

- 7.1.6 Axis Communications AB

- 7.1.7 Honeywell Security Group

- 7.1.8 Samsung Group

- 7.1.9 Hanwha Vision Co. Ltd

- 7.1.10 FLIR Systems

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET