PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550338

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550338

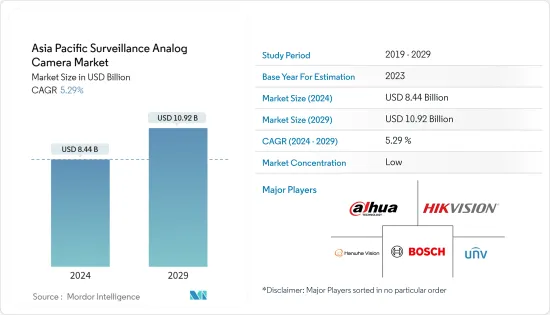

Asia-Pacific Surveillance Analog Camera - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Asia Pacific Surveillance Analog Camera Market size is estimated at USD 8.44 billion in 2024, and is expected to reach USD 10.92 billion by 2029, growing at a CAGR of 5.29% during the forecast period (2024-2029).

Key Highlights

- The Asia-Pacific surveillance camera market is experiencing significant growth, fueled by rising security apprehensions. While digital and IP camera technologies are rapidly gaining ground, analog surveillance cameras continue to see demand in diverse applications due to their superior image quality, scalability, and advanced features such as remote monitoring and easy integration with other smart devices. This is primarily due to their simplicity and cost-effectiveness, even as their digital counterparts surge ahead.

- While traditional analog cameras have seen relatively slower growth in recent years, there has been significant headway in the sector. High-definition analog options like HD-TVI and HD-CVI offer superior image quality. They leverage the existing coaxial cables, making them a cost-effective upgrade for current analog setups. Technological degradation also helps the analog cameras market thrive in growing competition from IP-based surveillance cameras.

- Key nations in the Asia-Pacific, including China, Japan, South Korea, and India, play a crucial role in driving market expansion. As digital surveillance gains global traction, Southeast Asia's emerging economies increasingly adopt analog solutions due to their cost advantages. Despite the rising popularity of digital alternatives, analog cameras persist due to their affordability and ease of implementation.

- Government initiatives in the region aimed at bolstering public safety are driving the need for surveillance cameras. These efforts are complemented by investments in smart city projects, further propelling the market's growth. Highlighting the commitment to infrastructure, the Indian government unveiled plans to allocate around USD 134 billion in 2024. Echoing this, China's investment in infrastructure saw a notable 6% uptick in 2023, a trend mirrored in several East Asian nations.

- Across the region, analog cameras are predominantly utilized in transportation networks, covering highways, railways, and airports. With expansive territories and dense populations in countries such as India, China, and Southeast Asia, these cameras are crucial for monitoring traffic, managing incidents, and enhancing safety. Particularly, China and India have each developed robust traffic surveillance systems, with a significant dependence on analog cameras.

- Other sectors are also leveraging analog cameras. Retailers, for example, deploy them to prevent theft and enhance security. Retailers in this region prefer analog cameras due to their easy setup and cost-effectiveness. Given the region's scale, healthcare institutions rely on these cameras to monitor patient areas, entrances, and sensitive zones, which are crucial for maintaining patient safety and preventing unauthorized access.

- Despite the market's projected robust growth, challenges arise, particularly with the rapid uptake of IP cameras. As businesses and governments increasingly favor advanced surveillance systems, the demand for analog cameras may decline. This trend is further accentuated by a rising number of regional end users opting for AI-enhanced high-tech cameras. However, it is worth noting that smaller businesses and specific market niches are expected to maintain their affinity for analog cameras, attracted by their cost-effectiveness, longevity, and ease of use.

Asia-Pacific Surveillance Analog Camera Market Trends

Cost Effectiveness and Affordability to Drive the Market

- The Asia-Pacific region, encompassing diverse economies from advanced nations such as Japan and South Korea to emerging markets like Indonesia, Vietnam, India, and China, offers a distinct backdrop for the uptake of surveillance technologies. Particularly in these emerging economies, cost considerations reign supreme across a multitude of industries and applications. Consequently, the relatively lower initial investments associated with analog systems make them attractive.

- Countries in the region, notably China, Japan, India, and several Southeast Asian nations, host a significant concentration of analog surveillance camera manufacturers. This dense presence is crucial in pushing down prices, making analog surveillance equipment increasingly accessible. For instance, Prama, an Indian manufacturer, operates within India and boasts a wide array of surveillance cameras encompassing analog options.

- China is a hub for affordable surveillance analog cameras, with many manufacturers like Hikvision, Dahua Technology, and Zhejiang Uniview Technologies Co. Ltd. This dense network of manufacturers not only enhances accessibility but also fuels market expansion. The resulting fierce competition among these vendors helps maintain competitive prices, further fueling adoption rates.

- China's embrace of analog surveillance is propelled by its cost-effectiveness and a robust network of local manufacturers. The nation's consistent uptrend in public security investments further solidifies its dedication to bolstering surveillance. Meanwhile, in India, where cost is a key consideration, analog surveillance systems are prevalent, notably in small to medium-sized businesses and public sector ventures.

- The prevalence of MSME enterprises in the Asia-Pacific region positions it as a promising market for analog surveillance cameras. SMEs, often operating under budget constraints, tend to favor cost-effective surveillance solutions. India, as highlighted by the Ministry of MSMEs, boasts over 13.83 million micro-enterprises, constituting a significant 96% of the nation's MSME landscape. China, on the other hand, leads the pack with over 50 million SMEs, a figure that's notably high. This trend is mirrored in several other Asian nations.

Government Sector to Remain Among the Key Demand Drivers

- Several factors influence the government sector's choice of analog surveillance technology, including budget constraints, current infrastructure, and the imperative for enhanced public safety. Municipalities are progressively deploying surveillance cameras in public areas to combat crime and improve safety.

- These cameras, strategically placed in parks, busy streets, and other high-traffic areas, actively monitor and record activities. They are instrumental in deterring crime and safeguarding residents. Given the financial constraints many municipalities face, the cost-effectiveness of analog cameras is a pivotal factor in their adoption. For instance, in 2023, the Delhi Civic Body in India announced the installation of more than 10,000 CCTV cameras at school sites to ensure the safety and security of students. A similar trend is observed in countries like Singapore and China, creating a favorable ecosystem for the growth of the market studied.

- Police departments use analog cameras to monitor high-risk areas such as crime-prone neighborhoods, transportation hubs, and commercial districts. These cameras help law enforcement officers constantly watch critical areas, enabling quick responses to suspicious activities. With the rising crime rate across several countries, the growing acceptance of advanced surveillance systems in the region is expected to drive the adoption of analog surveillance cameras during the forecast period.

- India has witnessed a rise in crimes against women, prompting stringent government actions. Conversely, China has seen a decline in crime rates, with the government emphasizing the importance of continued vigilance. Japan, however, has experienced a troubling uptick in crime. According to Japan's National Police Agency, criminal offenses surged 17% in 2023, with serious crimes spiking by nearly 30% to 12,372 and robberies increasing by 18.6%.

Asia-Pacific Surveillance Analog Camera Industry Overview

The Asia-Pacific surveillance camera market is fragmented, with major international players competing by offering technologically advanced products. The market features a wide range of manufacturers offering various technologies and solutions. Chinese manufacturers are major contenders and provide tough competition. Many companies compete in the market, offering various surveillance camera types and integration services. Some key market players include Hikvision, Zhejiang Dahua Technology Co. Ltd, Hanwha Vision, and Zhejiang Uniview Technologies Co. Ltd.

April 2024: Hikvision India unveiled its latest iteration of the Turbo HD line, Turbo HD 8.0, designed to elevate the analog security experience. This enhanced version introduces four key features, namely real-time communication, improved night vision, 180-degree video coverage, and an expanded product line. Notable additions include two-way audio support, dual-lens cameras with stitching technology, and smart hybrid light functionality integrated into all Turbo HD cameras. The lineup debuts a cutting-edge pro-series DVR equipped with AcuSense technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 An Assessment of Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Cost Effectiveness and Affordability

- 5.1.2 Government Initiatives Supporting the Adoption of Advanced Surveillance Systems to Curb the Crime Rate

- 5.2 Market Restraints

- 5.2.1 Technological Limitation and the Availability of Substitutes

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Government

- 6.1.2 Banking

- 6.1.3 Healthcare

- 6.1.4 Transportation & Logistics

- 6.1.5 Industrial

- 6.1.6 Other End-user Industries

- 6.2 By Country

- 6.2.1 China

- 6.2.2 Japan

- 6.2.3 India

- 6.2.4 South Korea

- 6.2.5 Indonesia

- 6.2.6 Malaysia

- 6.2.7 Australia and New Zealand

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Zhejiang Dahua Technology Co. Ltd

- 7.1.2 Hangzhou Hikvision Digital Technology Co. Ltd

- 7.1.3 Hanwha Vision

- 7.1.4 ACTi Corporation

- 7.1.5 Bosch Sicherheitssysteme GmbH

- 7.1.6 Lorex Corporation

- 7.1.7 Zhejiang Uniview Technologies Co. Ltd

- 7.1.8 IDIS Ltd

- 7.1.9 Honeywell International Inc.

- 7.1.10 Panasonic Corporation

- 7.1.11 Mivanta

- 7.1.12 Eagle Eye Networks

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET