PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1694047

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1694047

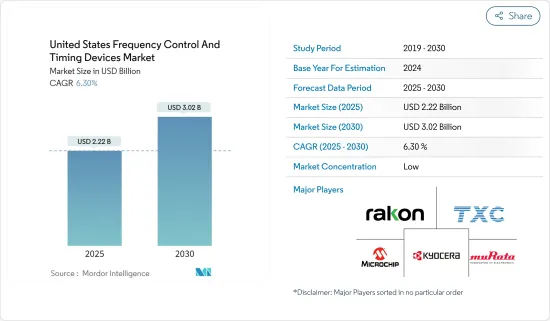

United States Frequency Control And Timing Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The United States Frequency Control And Timing Devices Market size is estimated at USD 2.22 billion in 2025, and is expected to reach USD 3.02 billion by 2030, at a CAGR of 6.3% during the forecast period (2025-2030).

Frequency control devices play a pivotal role in electronic systems, providing the necessary signals and timing controls for the precise transmission of information. By leveraging principles applied to quartz crystals, MEMS, and ceramic resonators, these devices can generate stable oscillations, ensuring clocking and timing stability in digital systems.

Key Highlights

- The market is being propelled by the rising adoption of 5G smartphones and the expanding 5G network coverage globally. In the United States, consumer tech retail sales are projected to climb by 2.8% to reach a substantial USD 512 billion in 2024, as reported by CTA.

- Furthermore, the integration of artificial intelligence features is expected to drive upgrades across various devices, including PCs and smartphones, this year. Looking ahead, chip manufacturers are homing in on infusing more AI capabilities into devices to bolster sales and encourage upgrades.

- Additionally, industry leaders highlight that augmented reality and virtual reality headsets will be key growth drivers in the coming years. At CES 2024, one can expect diverse extended reality devices, ranging from VR headsets by Meta Platforms (META) to smart glasses by Xreal.

- The frequency control and timing devices market is a critical segment within the electronics industry, providing essential components for various applications. However, the high costs of developing and producing these devices challenge the market's growth.

- Post-pandemic geopolitical tensions, including the Russia-Ukraine War and US-China tensions, have cast a shadow on market growth. Notably, major vendors responding to the Russia-Ukraine conflict halted sales in the region due to stringent government restrictions from Europe and the United States.

- For example, Texas Instruments ceased sales to Russia, Iran, and Belarus starting in February 2022. The Russia-Ukraine conflict is poised to significantly impact the electronics industry. It has further exacerbated existing semiconductor supply chain challenges and the persistent chip shortage. This disruption could lead to price volatility and potential shortages in key raw materials like nickel, palladium, copper, titanium, and aluminum, directly affecting the production of products.

US Frequency Control and Timing Devices Market Trends

MEMS Oscillator to Witness Significant Growth

- Microelectromechanical system (MEMS) oscillators serve as precise timing devices, producing stable reference frequencies crucial for various applications. These frequencies are pivotal in electronic system sequencing, data transfer management, defining radio frequencies, and time measurement. MEMS oscillators offer a compact design, delivering precise timekeeping that's resilient against shocks and vibrations. Their durability makes them well-suited for a wide range of applications spanning industrial, commercial, and consumer sectors.

- The recent surge in portable and wearable electronics underscores the push to minimize energy usage and size across electronic components, notably oscillators. Clock circuits are increasingly favoring MEMS-based oscillators for their dual benefits: precise frequency generation and energy efficiency.

- The rising adoption of smartphones and mobile devices across the United States is poised to fuel substantial growth in the MEMS oscillator market in the coming years. MEMS oscillators, known for their reliability, low power consumption, and high performance, find a natural fit in smartphones. Their compatibility with standard semiconductor techniques further streamlines their manufacturing and integration processes. Consequently, as smartphone usage continues to surge, the demand for MEMS oscillators is set to escalate.

- The surge in IoT adoption is driving the demand for MEMS oscillators in the United States. Known for their compact design, energy efficiency, and precision, MEMS oscillators are ideal for IoT applications. They ensure accurate timing and synchronization, enhancing data accuracy and fitting IoT devices' size and power constraints. This makes them the preferred choice for manufacturers and developers. MEMS oscillators boost the reliability and performance of IoT devices, enabling seamless operations in smart homes, industrial automation, and healthcare. Their ability to meet stringent timing requirements is fueling the demand for MEMS oscillators, reflecting the expanding IoT landscape in the United States.

Automotive Industry to be the Fastest Growing End User

- Oscillators have ascended to a pivotal role in modern vehicles. Today's cars are essentially high-speed networks on wheels; without timing chips, they'd grind to a halt. Even the internet itself hinges on these crucial components. The future trajectory of semiconductors in the automotive sector is being shaped by two dominant forces: electrification and autonomous driving.

- Electrification, primarily driven by the rising adoption of hybrid and electric vehicles (EVs), is poised for a significant surge in the coming decade. According to the IEA, new electric car registrations in the United States hit 1.4 million in 2023, marking a robust 40% increase from 2022. While the growth rate in 2023 was slightly slower than the previous years, the overall demand for electric vehicles remained resilient.

- This momentum is fueled by the industry's focus on slashing battery costs, enhancing charging infrastructure, and extending the driving range of EVs. Concurrently, vehicles are getting 'smarter,' brimming with sensors and intelligent systems. This sets the stage for the second major trend: autonomous driving. These once ' luxury ' features are commonplace, from collision-avoidance systems to automatic parking and lane-change sensors, laying the groundwork for advanced driver-assistance systems (ADAS), autonomous driving, and sophisticated telematics.

- Media reports reveal that the National Highway Traffic Safety Administration (NHTSA) mandated Automatic Emergency Braking (AEB) on all new vehicles, effective 2029. Under this new regulation, all new passenger vehicles sold in the USA weighing under 10,000 lbs(4,500 kg) must be equipped with this safety technology. The US government estimates that this move could potentially save up to 400 lives annually and prevent thousands of injuries. Automakers are required to comply by September 1, 2029, with a grace period extending to low-volume manufacturers. These regulations are notably bolstering the frequency control and timing device market.

US Frequency Control and Timing Devices Industry Overview

The United States frequency control and timing devices market is fragmented, where the sustainable competitive advantage through innovation is considerable. The competition will only increase, considering the anticipated surge in demand from new customers from the end-user industries, and some of the players include Murata Manufacturing Co. Ltd, Kyocera Corporation, Rakon Limited, Microchip Technology Inc., TXC Corporation

- April 2024 - Kyocera Avx, a manufacturer of advanced electronic components, unveiled a new manufacturing and design center for high-quality, low-noise quartz crystal frequency control products under the name Kyocera Avx Components Corporation (Erie). The newly established production facility is expected to manufacture over 1.2 million patented and unparalleled low-power OCXO (oven-controlled crystal oscillators) and a range of TCXO (temperature-computed crystal oscillators) and VCXO (voltage-computed crystal oscillators).

- February 2024 - Rakon displays its initial extended holdover solution for modern radio networks and telecommunications data centers at MWC Barcelona 2024. The Error Exchange OCXO (MercuryXE2) is a version of Rakon's recently launched Mercury compact IC-OCXO. It improves the system's current synchronization abilities on a network synchronizer evaluation board by incorporating frequency error exchange processing and aging compensation, thereby increasing the holdover performance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 Aftereffects and Macro Economic Trends on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of 5G Augmenting the Demand for Frequency Control and Timing Devices

- 5.1.2 Rising Demand for Advanced Automotive Applications

- 5.2 Market Challenges

- 5.2.1 High Cost of Development

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Crystals

- 6.1.2 Oscillator

- 6.1.2.1 Temperature Compensated Crystal Oscillator (TCXO)

- 6.1.2.2 Voltage-controlled Crystal Oscillator (VCXO)

- 6.1.2.3 Oven-controlled Crystal Oscillator (OCXO)

- 6.1.2.4 MEMS Oscillator

- 6.1.2.5 Other Types of Oscillators

- 6.1.3 Resonators

- 6.1.4 Saw Filters

- 6.1.5 Real Time Clocks

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Computer and Peripherals

- 6.2.3 Communications/Server/Data Storage

- 6.2.4 Consumer Electronics

- 6.2.5 Industrial

- 6.2.6 Defense and Aerospace

- 6.2.7 IoT (Wearables, Fitness Tracker, Smart Home Devices, Smart Cities, Smart Lighting System, and Others)

- 6.2.8 Other End-user Industries (Healthcare, Oil and Gas, Agriculture, Retail, Test and Measurement, and Others)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Murata Manufacturing Co. Ltd

- 7.1.2 Kyocera Corporation

- 7.1.3 Rakon Limited

- 7.1.4 Microchip Technology Inc.

- 7.1.5 TXC Corporation

- 7.1.6 Seiko Epson Corporation

- 7.1.7 Daishinku Corporation

- 7.1.8 Hosonic Technology (Group) Co. Ltd

- 7.1.9 Nihon Dempa Kogyo Co. Ltd

- 7.1.10 SiTime Corporation

- 7.1.11 SIWARD Crystal Technology Co. Ltd

- 7.1.12 Texas Instruments Inc.

- 7.1.13 NXP Semiconductors

- 7.1.14 Abracon LLC

- 7.1.15 CTS Corporation

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS