PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550140

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550140

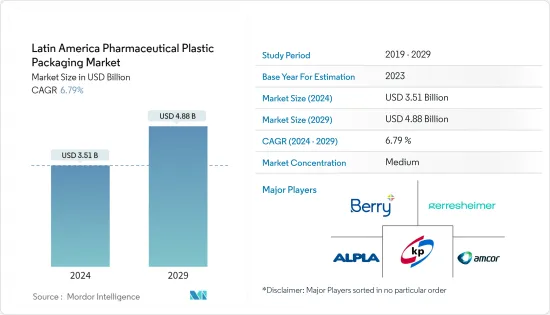

Latin America Pharmaceutical Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Latin America Pharmaceutical Plastic Packaging Market size is estimated at USD 3.51 billion in 2024, and is expected to reach USD 4.88 billion by 2029, growing at a CAGR of 6.79% during the forecast period (2024-2029).

Key Highlights

- Pharmaceutical plastic packaging advantages include no contamination, lightweight, barrier-resistant, safe, convenient, and cost-effective. Plastic is considered one of the primary packaging materials used in the pharmaceutical industry. The pharmaceutical industry is increasing, creating a need for packaging to treat non-communicable and communicable diseases. The demand for plastic packaging in pharmaceutical manufacturing is growing as it protects pharmaceuticals from damage, biological contamination, and external influences.

- Brazil and Mexico are significant contributors to the market share in the Latin American pharmaceutical industry. The countries are the mature markets in the region. The pharmaceutical market in the country witnessed various acquisitions, product innovations, and strategic expansion. Owing to the benefits offered by plastic materials, this is expected to aid the growth of the pharmaceutical plastic packaging market in the region.

- Brazil has the most significant healthcare market in Latin America, with around 9.5% of GDP expenditure on healthcare. According to the International Trade Administration, around 7,191 hospitals are there in the country. In 2022-23, there were about 90,9000 drugstores in the country. Such growth in hospitals would increase the opportunities for pharmaceutical plastic packaging vendors nationwide to serve the growing packaging need for prescribed pharmaceuticals.

- The region's expanding pharmaceutical production, the increased availability of over-the-counter medicines, and significant investments made by local businesses contribute to the enormous growth of the region's pharmaceutical industry. These trends would lead to a rise in the demand for pharmaceutical plastic packaging in the area.

- Additionally, factors like the rising cost of medical care and the expanding tendency of different end-users, such as hospitals and medication makers, are anticipated to fuel the use of the product during the forecast period. The increased demand for pharmaceuticals is a result of technological advancements in the industry, which directly creates demand for plastic bottles, vials, and other packaging materials.

- The senior population is increasing rapidly and is expected to continue during the forecast period, leading to high demand for pharmaceuticals and market growth. The increase in the incidence of chronic diseases such as cancer and infectious diseases, as well as the aging population needing advanced and patient-friendly packaging, is also expected to lead to the blister packaging market's growth during the forecast period. Blister packaging is a convenient and easy-to-use packaging format for solid oral medicines. This is especially true for older patients who often have difficulty opening medicine bottles. At the same time, the blister packaging keeps children safe.

Latin America Pharmaceutical Plastic Packaging Market Trends

Need for Protective and Barrier-Resistant Packaging for Pharmaceutical Products is Propelling the Sales of Plastic Bottles and Containers

- There are several types of packaging for pharmaceutical bottles. Drugs are typically kept in glass and plastic bottles. Plastic bottles and containers have an advantage over glass bottles, as glass bottles are breakable and heavier than plastic bottles. Plastic bottles are used widely to package several liquid and solid medicines, including syrups, capsules, tablets, nose, and eye drops. Plastic is strong, lightweight, and flexible and can be made into packaging in various forms and sizes. The market for pharmaceutical plastic bottles has grown due to technological development and increased use of plastic bottles for oral solid and liquid medications.

- There is a rising demand for ready-to-use or RTU bottles. These products make hospital operations more efficient by removing the product preparation or transport requirement before patient administration. Lowering the likelihood of a preparation error might save waste and expenses, improve convenience and workflow, increase accuracy and compliance, and promote high-quality patient care.

- Notably, there is an upswing in demand for pharmaceutical pet bottles with a suitable gas barrier. High resistance to oxygen and water vapor may fully satisfy the unique storage needs of pharmaceutical packaging. In February 2023, Berry Global Healthcare launched a new PET bottle for pharmaceutical syrup and herbal products. The company offers eight complementing closures with tamper-evident and child-resistant features, which helps clients take advantage of the rising need for child-resistant and tamper-evident packaging.

- The pharmaceuticals industry is anticipated to generate demand for tamper-evident caps and closures, as they offer child-resistant and contamination-free packaging. Companies are searching for products that can provide a longer shelf life. With many manufacturers now shipping products, it is necessary to design packaging to drive transport and sustain its integrity in different environmental conditions.

- Technological progressions in plastic packaging have resulted in innovations in the development of industry products. Also, the product and availability of plastic resin in the country aid in the growth. The plastic and resin production in Mexico for 2022 was USD 28.22 billion and reached USD 28.73 billion by the end of 2023, according to the International Trade Administration and the US Department of Commerce. Many companies are spending significantly on R&D activities to develop different and cost-effective products, and the innovations in this market are increasing. The demand for plastic caps and closures is expected to grow as the latest packaging formats for pharmaceuticals use innovative solutions, such as caps with droppers, spray pumps, and resealable openings.

Rising Investment by Pharmaceutical Companies in Brazil Aids the Market's Growth

- The Brazilian pharmaceutical and drug industry ranks sixth globally, according to the International Trade Administration and the US Department of Commerce. The sales of pharmaceuticals in Brazil accounted for USD 20.67 billion in 2022 and reached around USD 24 billion by the end of 2023. The increasing population, along with the high number of aged people in the country, is the major factor driving the sales of pharmaceutical products.

- According to the Brazilian Institute of Geography and Statistics (IBGE), Brazil's Unified Healthcare System (SUS) is the single health service provider to around 72% of the country's population. The country has a limited number of pharmaceutical product manufacturing companies. This has led the country to depend on foreign imports for pharmaceutical products.

- The Brazilian government is focusing on raising disease response standards and driving the pharmaceutical trade. In the South America Summit in 2023, the President of the country and the twelve other leaders pledged cooperation on a variety of agendas by the Brasilia Consensus. This includes the elimination of unilateral trade measures and increasing investment and market access. The country is now focusing on improving pharmaceutical research and productivity to reduce dependence on foreign imports. This will create growth opportunities for the domestic pharmaceutical manufacturing sector, ultimately impacting the pharmaceutical plastic packaging demand in the country.

- In addition, to help the international pharmaceutical companies to establish their presence by licensing, registering and commercializing products in the country, Tanner Pharma's Licensing, Acquisition, and Commercialization (LAC) division was established. This attracts international pharmaceutical manufacturing companies to take advantage of the opportunity. For instance, in June 2023, Neuraxpharm Group announced the establishment of affiliates in the two largest pharmaceutical markets in Latin America, Brazil and Mexico.

- The increasing number of pharmaceutical companies in the country is expected to propel the demand for packaging products, which is expected to fuel the growth of pharmaceutical plastic packaging in the country. Plastic packaging solutions such as bottles, pouches, and blisters are preferred for packing pharmaceutical products and maintaining the property of the product.

Latin America Pharmaceutical Plastic Packaging Industry Overview

The Latin American pharmaceutical plastic packaging market is semi-consolidated. Key players operating in the market include Amcor Group Inc., Gerresheimer AG, Berry Global Group Inc., Klockner Pentaplast Group, ALPLA Group, and Greiner Packaging International GmbH. Players in the market are trying to increase their market share in the region through product innovation, acquisitions, and expansions.

- January 2024: ALPLApharma, a division of Alpla Group, announced the joint venture with Inden Pharma. The joint venture benefited the company from the expertise and experience of the partner in the pharmaceutical market.

- October 2023: Gerresheimer AG announced the partnership with Rezemo for sustainable closures for primary packaging solutions in the pharmaceutical, cosmetics, food, and beverages industries. The partnership strategy will help the company step toward advancing environmentally friendly packaging solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Need for Protective and Barrier-Resistant Packaging for Pharmaceutical Products Propel the Sales of Plastic Bottles and Containers

- 5.1.2 Rising Aging Population in the Region is Fueling the Demand for Convenient Pharmaceutical Packaging Solutions such as Blisters

- 5.2 Market Challenges

- 5.2.1 Availability of Alternative Material for Pharmaceutical Packaging

6 MARKET SEGMENTATION

- 6.1 By Raw Material

- 6.1.1 Polypropylene (PP)

- 6.1.2 Polyethylene Terephthalate (PET)

- 6.1.3 Low Density Polyethylene (LDPE)

- 6.1.4 High Density Polyethylene (HDPE)

- 6.1.5 Other Raw Materials

- 6.2 By Product Type

- 6.2.1 Solid Containers

- 6.2.2 Dropper Bottles

- 6.2.3 Nasal Spray Bottles

- 6.2.4 Liquid Bottles

- 6.2.5 Oral Care

- 6.2.6 Pouches

- 6.2.7 Vials and Ampoules

- 6.2.8 Cartridges

- 6.2.9 Syringes

- 6.2.10 Caps and Closure

- 6.2.11 Other Product Types

- 6.3 By Country

- 6.3.1 Brazil

- 6.3.2 Mexico

- 6.3.3 Argentina

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Group Inc.

- 7.1.2 Gerresheimer AG

- 7.1.3 Berry Global Group Inc.

- 7.1.4 Videplast Industria de Embalagens Ltda

- 7.1.5 Klockner Pentaplast Group

- 7.1.6 ALPLA Group

- 7.1.7 Greiner Packaging International GmbH

- 7.1.8 Plastimax SA

- 7.1.9 Pretium Packaging

- 7.1.10 Maxipet SA de CV

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET