PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665363

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665363

Pharmaceutical Plastic Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

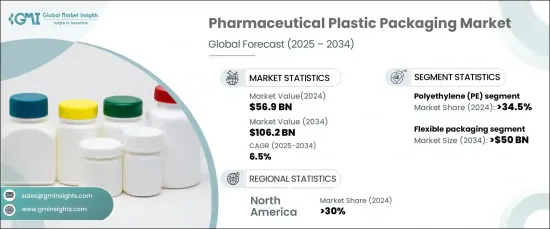

The Global Pharmaceutical Plastic Packaging Market, valued at USD 56.9 billion in 2024, is projected to grow at a CAGR of 6.5% between 2025-2034. The industry is undergoing significant changes, driven by innovations in safety, user-friendliness, and adherence to regulatory requirements. One of the key trends contributing to this growth is the rising demand for tamper-evident and child-resistant packaging. As consumer safety becomes a top priority, manufacturers are increasingly incorporating advanced features like breakable caps, tamper seals, and visual indicators to enhance protection and prevent unauthorized access to products.

The market is categorized by material types, including polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), polyvinyl chloride (PVC), and others. The polyethylene (PE) segment holds a dominant market share of 34.5% in 2024. Polyethylene is widely favored for its versatility, durability, and affordability, making it ideal for manufacturing various pharmaceutical packaging solutions such as bottles, containers, and flexible packaging. Its resistance to moisture and chemicals makes it particularly effective at protecting sensitive medications during storage and transportation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $56.9 Billion |

| Forecast Value | $106.2 Billion |

| CAGR | 6.5% |

In terms of packaging types, the market is divided into flexible and rigid packaging. Flexible packaging is expected to grow at a CAGR of 7.5%, reaching USD 50 billion by 2034. This segment is rapidly gaining traction in the pharmaceutical packaging industry, offering key advantages like convenience, cost-effectiveness, and sustainability. Flexible packaging includes products like pouches, sachets, blister packs, and strip packs, which are commonly used for packaging pharmaceuticals such as tablets, capsules, powders, and liquids. These packaging solutions provide excellent protection against moisture, oxygen, and light, helping to preserve the integrity and extend the shelf life of pharmaceutical products.

North America pharmaceutical plastic packaging market held 30% in 2024. In the United States, the market is seeing rapid growth, driven by a focus on sustainability and the integration of smart technologies. Manufacturers are increasingly adopting eco-friendly materials, such as recycled plastics and biodegradable options, to meet environmental goals. Additionally, technologies like QR codes and RFID tags are being incorporated to enhance product traceability, authenticity, and patient engagement, further propelling the market forward.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Disruptions

- 3.1.3 Future outlook

- 3.1.4 Manufacturers

- 3.1.5 Distributors

- 3.2 Profit margin analysis

- 3.3 Key news & initiatives

- 3.4 Regulatory landscape

- 3.5 Impact forces

- 3.5.1 Growth drivers

- 3.5.1.1 Rising prevalence of chronic diseases and aging population

- 3.5.1.2 Growing adoption of child-resistant and tamper-evident packaging

- 3.5.1.3 Growth of telemedicine fueling need for secure home-delivery packaging

- 3.5.1.4 Rising use of unit dose and multi-dose packaging formats

- 3.5.1.5 Rapid expansion of biologics necessitating specialized packaging

- 3.5.2 Industry pitfalls & challenges

- 3.5.2.1 Balancing cost-efficiency with high-performance packaging solutions

- 3.5.2.2 Challenges in recycling multi-layer and specialized plastic packaging

- 3.5.1 Growth drivers

- 3.6 Growth potential analysis

- 3.7 Porter’s analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material, 2021-2034 (USD Billion & Kilo Tons)

- 5.1 Key trends

- 5.2 Polyethylene (PE)

- 5.3 Polypropylene (PP)

- 5.4 Polyethylene Terephthalate (PET)

- 5.5 Polyvinyl Chloride (PVC)

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion & Kilo Tons)

- 6.1 Key trends

- 6.2 Bottles

- 6.3 Blister packs

- 6.4 Syringes and vials

- 6.5 Films and wraps

- 6.6 Tubes

- 6.7 Pouches and sachets

- 6.8 Others

Chapter 7 Market Estimates & Forecast, By Packaging Type, 2021-2034 (USD Billion & Kilo Tons)

- 7.1 Key trends

- 7.2 Flexible packaging

- 7.3 Rigid packaging

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion & Kilo Tons)

- 8.1 Key trends

- 8.2 Oral drugs

- 8.3 Injectable drugs

- 8.4 Topical drugs

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion & Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Amcor

- 10.2 APG Pharma

- 10.3 Aptar

- 10.4 Berry Global

- 10.5 Bormioli

- 10.6 CL Smith

- 10.7 Comar

- 10.8 Constantia

- 10.9 Drug Plastics

- 10.10 DWK

- 10.11 Frapak

- 10.12 Gerresheimer

- 10.13 Klockner

- 10.14 Medicopack

- 10.15 Nelipak

- 10.16 Origin Pharma

- 10.17 Plascene

- 10.18 Silgan