PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549959

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549959

Physical Security Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

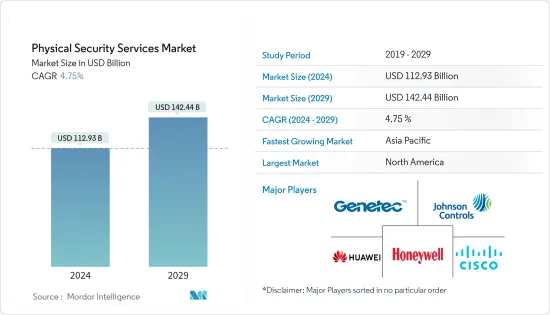

The Physical Security Services Market size is estimated at USD 112.93 billion in 2024, and is expected to reach USD 142.44 billion by 2029, growing at a CAGR of 4.75% during the forecast period (2024-2029).

Key Highlights

- The global demand for physical security services is surging, propelled by economic growth, technological progress, urbanization, and shifting security landscapes. With organizations and governments worldwide prioritizing the protection of their assets, personnel, and activities, the call for holistic security solutions has never been more urgent.

- Urbanization is transforming the global landscape, with more people moving into cities and metropolitan areas. As per the report by Population Reference Burea in 2023, many countries witnessed growth in their urban population. For instance, in North America, the urban population reached 84%, whereas the urban population of Europe reached 75% in 2023. This growing urbanization rate requires advanced security solutions to ensure public safety. The rise in population density in urban areas also correlates with increased crime rates, necessitating enhanced security measures to maintain law and order.

- As the demand grows, many companies providing physical security services are announcing the launch of new solutions to increase their market share. For instance, in May 2024, Verkada, a company that offers cloud-based physical security solutions, announced that it will offer a new AI-powered search in Beta. This new launch will enable customers to search their video security camera footage for people and vehicles.

- Both public and private sectors are significantly boosting their investments in security infrastructure. Governments, in particular, have placed regulatory standards that have prompted the use of security services from the organized sector to safeguard their assets, data, and personnel, resulting in increasing investments in physical security services. For instance, in April 2024, the Cybersecurity and Infrastructure Security Agency (CISA) unveiled the physical security checklist, a new tool aimed at enhancing security readiness for the forefront of US elections. Such developments drive market growth.

- AI, machine learning, and data analytics, when integrated into physical security, offer substantial opportunities. They bolster threat detection, slash response times, and yield actionable insights, thereby boosting the efficacy and efficiency of security operations. Moreover, the rise of smart cities and the widespread adoption of IoT create a vast market for integrated security solutions that can operate seamlessly across various domains.

- One of the primary market restraints is the emergence of cost-effective alternatives from the unorganized sector, primarily in the form of manned guarding services. These services, often provided by smaller firms or individual guards, come at a significantly lower cost compared to their organized. The affordability of these services is attributed to their lower operational expenses, minimal regulatory burdens, and typically reduced employee benefits.

Physical Security Services Market Trends

The Demand for Physical Security Services is Growing in the BSFI Sector

- The demand for physical security services is growing in the BFSI sector, driven by various factors, including increasing regulatory requirements, evolving security threats, the need for advanced technology integration, and maintaining customer trust and safety. The sector is particularly sensitive to security concerns due to the nature of its operations, which involve handling vast amounts of sensitive and financial data. Hence, financial institutions are more focused on adopting physical security services to protect their assets and physical data.

- The BFSI sector faces a growing threat from criminal activities like robbery, vandalism, and fraud. With criminals becoming more sophisticated, heightened physical security measures are imperative, particularly for the BFSI sector. Hence, it has become crucial for banks and financial institutions to safeguard not just their premises but also key assets like ATMs and vaults from potential breaches and theft.

- Further, banks are continuously increasing their physical assets. According to the report by Yahoo Finance, the assets of the large commercial banks in the US increased to USD 13.2 trillion in 2023 from USD 9.1 trillion in 2015, and the assets of small commercial banks increased from USD 3.6 trillion to USD 7 trillion in 2023.

- Similarly, according to the European Central Bank, the banking industries in the European Union are witnessing a growing value of Assets. The value of assets in the fourth quarter of 2021 was USD 32,710.5 million, which increased to USD 33,928.9 million by Q3 2023. This growth in assets increases the threat of theft, vandalism, and other forms of criminal activity. Therefore, the implementation of comprehensive physical security strategies is crucial to safeguard these assets and maintain the trust of customers.

Asia-Pacific is Expected to Witness Major Growth

- Asia-Pacific is expected to witness significant growth in the physical security services market during the forecast period. The region includes some of the world's fastest-growing economies, such as China, India, Japan, and Southeast Asian nations. Robust economic growth has led to increased investments in both the residential and commercial sectors, which has increased the demand for physical security service solutions.

- With the growing infrastructural development, the region is witnessing technological advancements in surveillance systems, such as high-definition cameras, facial recognition, and AI-driven analytics, which have revolutionized physical security. These technologies enable real-time monitoring, predictive analysis, and automated threat detection, making them essential for modern security strategies.

- Also, these technologies are adopted differently across Asia due to economic development, technological improvement, and regulatory settings. AI, IoT, and machine learning are becoming crucial to physical security services, providing better protection in a digital and linked world.

- With the growing demand, many companies are increasing their investments to launch new solutions. For instance, in February 2024, In the latest release of the Axis operating system, AXIS OS, Axis Communications AB announced that the IEEE MAC 802.1sec security standard supported more than 200 network devices, including cameras, intercoms, and 11.8 audio speakers. Demonstrating the company's continued commitment to device and data security, Axis became the first manufacturer of physical safety products supporting MACsec Media Access Control Security.

- In addition, governments across Asia-Pacific are investing significantly in public safety programs and smart city initiatives, which often include extensive security infrastructure. These initiatives aim to enhance the safety and quality of life for citizens, driving demand for advanced physical security services.

Physical Security Services Industry Overview

The physical security services market is competitive and has several major players. However, many companies are increasing their market presence by securing new contracts and acquiring other companies. Key companies in the market include Johnson Controles, Honeywell, Cisco Systems Inc., and Genetec. Players are adopting partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- May 2024: Genetec, a technology provider, announced its launch of unified security, public safety, operations, and business intelligence solutions in partnership with Axis Communications. With this launch, Genetec aims to address important themes around the state of regional physical security and the evolving trends and best practices for safeguarding assets and infrastructure.

- January 2024: LenelS2, a company that offers physical security solutions, announced the launch of a cloud-based security solution, "the element platform." This newly launched solution was designed to be easily installed and simple to use, with a mobile-first, intuitive user interface. Also, it provides information that is available at any time and accessible from anywhere on any device.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.1.1 Coverage includes key trend analysis and KPIs

- 4.1.1.1 Broader Analysis of the Organized Sector and Unorganized Sector for Security Services

- 4.1.1.2 ATM Penetration across Key Countries, etc.

- 4.1.1 Coverage includes key trend analysis and KPIs

- 4.2 Industry Stakeholder Analysis

- 4.3 Impact of Macroeconomic Indicators on the Market

- 4.4 Regulatory Landscape

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Favorable Changes in Regulatory Standards have Prompted the Use of Security Services from the Organized Sector

- 5.1.2 Dynamic Nature of the Security Threats, Especially, has Contributed the Demand for Cash Services to Safeguard Cash Transit

- 5.2 Market Challenges

- 5.2.1 Cost-Effective Alternatives in the form of Manned Guarding Services rendered by the Unorganized Sector

- 5.3 Market Opportunities

- 5.3.1 Increased Demand from Countries with very low Police to Citizen Ratio

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 By Solution

- 6.1.1.1 Access Control System

- 6.1.1.2 Video Surveillance System

- 6.1.1.3 Security Scanning, Metal Detection, and Imaging

- 6.1.1.4 Fire and Life Safety

- 6.1.1.5 Others

- 6.1.2 By Service Type

- 6.1.2.1 Professional Services

- 6.1.2.2 Managed Services

- 6.1.1 By Solution

- 6.2 By End User Industry

- 6.2.1 Manufacturing and Industrial

- 6.2.2 IT and Telecom

- 6.2.3 BFSI

- 6.2.4 Retail

- 6.2.5 Residential

- 6.2.6 Public Infrastructure (Airports, etc.)

- 6.2.7 Other End Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Johnson Controles

- 7.1.2 Honeywell International Inc.

- 7.1.3 Cisco Systems, Inc.

- 7.1.4 Huawei Technologies Co. Ltd

- 7.1.5 Genetec Inc.

- 7.1.6 G4S

- 7.1.7 Securitas

- 7.1.8 Secom

- 7.1.9 Prosegur

- 7.1.10 Brinks

- 7.1.11 Loomis

- 7.1.12 Allied Barton

- 7.1.13 Garda

- 7.1.14 Reliance

8 FUTURE OF THE MARKET