PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549885

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549885

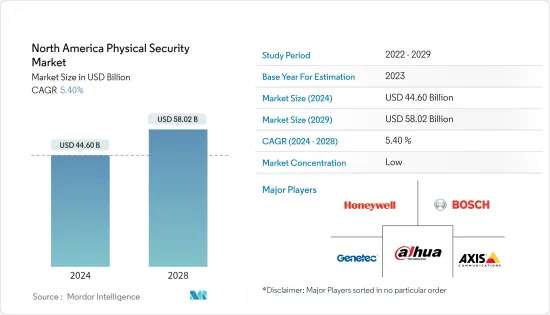

North America Physical Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The North America Physical Security Market size is estimated at USD 44.60 billion in 2024, and is expected to reach USD 58.02 billion by 2029, growing at a CAGR of 5.40% during the forecast period (2024-2029).

Key Highlights

- Physical security is the safeguarding of organizational resources from harm caused by physical occurrences. These occurrences may include natural disasters, such as fires or floods, manufactured threats, such as theft and vandalism, accidents, and accidental damage. Organizations are increasingly relying on the Internet of Things (IoT) and its associated integrations, necessitating enhancing their digital and physical security controls. Virtual computers and applications, whether hosted in the cloud or not, are just as secure as physical servers.

- Physical security systems, including video analytics, IP Cameras, and video management systems, are anticipated to become one of the most promising technologies for enhancing city public safety. Public safety organizations and governments are investing in cutting-edge physical security systems and software to improve productivity and monitor significant transportation hubs.

- The significance of safeguarding the physical environment against crimes like burglaries, theft, vandalism, and fire cannot be emphasized enough. This aspect is expected to significantly contribute to the market's growth. Furthermore, the market is anticipated to gain advantages from technological advancements and innovations in integrated video, sensors, and access systems for Internet of Things (IoT) enabled devices.

- Due to the rise in terrorist and criminal activities, there has been a heightened sense of concern among individuals, procedures, and resources in terms of safety and security. These unfortunate incidents have caused significant damage to various infrastructures and resulted in the loss of countless lives, emphasizing the urgent requirement for physical security measures.

- By combining AI, ML, and analytics with surveillance, numerous untapped potentials can be explored, including the ability to predict crimes and identify ongoing criminal activities in real time. The security team effectively integrates AI-based analytics with surveillance to monitor various potential situations.

- For instance, in June 2023, physical security systems such as surveillance cameras, designed to combat violent crime in cities throughout the United States, were utilized to punish and evict public housing project residents. Across the United States, public housing facilities are being equipped with a new generation of intrusive and powerful surveillance systems, placing excessive control over some of the nation's most vulnerable citizens.

- The government and the relevant regulatory bodies have been urged to install security measures to reduce property damage caused by criminals and other crimes. For example, in July 2023, the Canada Police Board requested 14 new cameras from the police force as part of the 10-year annual capital budget forecast. Tools such as Closed-Circuit Television can assist police in deterring crime, apprehending those who commit crimes, and coordinating and distributing resources.

- North America witnessed the highest global adoption rate of intelligent city infrastructure and technologies. Smart America estimates that US city governments will allocate approximately USD 41 trillion to modernize their infrastructure to capitalize on the Internet of Things (IoT) over the next two decades. A combination of technological developments, real-time access, wireless integration, video analysis, the cost-effectiveness of IP surveillance, and governmental initiatives has positively impacted the implementation of physical security in North America.

North America Physical Security Market Trends

Video Surveillance Systems Are Expected to Hold a Significant Market Share

- The surveillance camera is one of the most crucial components of physical security. Surveillance cameras give criminals a moment of hesitation, often enough to stop them from committing a crime. For instance, in May 2023, the Detroit Police Department (DPD) requested additional vehicle surveillance through the installation of 100 automatic license plate readers. The proposal suggested the structure of four clusters of high-speed cameras at 25 intersections across the city, focusing on areas where vehicles have been reported stolen and recovered.

- Additionally, in July 2023, Roosevelt Island's security camera system was completed, marking a significant milestone in implementing the 10-point Public Safety Plan. The upgrades to the system included the potential to integrate Roosevelt Island's camera system with that of the FBI and New York City Police Department in the future, enhancing law enforcement's capacity to respond to and investigate reported crimes. The system includes adding island cameras, implementing cloud video monitoring, and implementing hardened cybersecurity software.

- In recent years, private-sector, retail, and commercial establishments in the United States have seen an increase in the use of surveillance cameras. In April 2022, Beverly Hills saw an increase in the number of security cameras placed on its streets. This increase in security cameras was more comprehensive than those mounted on street signs, as the police department utilized drones and automated license plate readers. The Beverly Hills Police Department is expected to be able to monitor the live feeds from these cameras in real time.

- Retail store owners are particularly vulnerable to theft and inventory shrinkage, which can have a significant financial impact on their business. Rising retail stores across North America, primarily in Canada, are boosting the demand for physical security systems, such as surveillance cameras, which can reduce the likelihood of these losses.

- For instance, according to Statcan, in terms of retail trade location, Quebec had approximately 32,400 retail stores in 2022. Additionally, in February 2023, Quebec's provincial government responded positively to the announcement of integrating AI into a retail store chain's Closed-Circuit Television (CCTV). The CCTVs have been equipped with software trained to detect suspicious behavior in retail stores, such as shoplifting.

- Airports in the region are beginning to recognize the advantages of utilizing sophisticated surveillance solutions to generate operational intelligence and gain comprehensive situational awareness. Airports across the United States may benefit from implementing facial recognition technology to enhance security measures. In May 2023, TSA (Transportation Security Administration) said it is currently testing facial recognition technology at several airports nationwide. Currently, the technology is in use at 16 airports in the United States.

The United States is Expected to Witness Growth

- The development of video analytics is expected to benefit significantly from the United States, as many prominent businesses in the country necessitate more sophisticated security surveillance solutions. This is primarily due to the availability of advanced technology, the growing demand for real-time actionable data from businesses, and the nation's growing need for advanced public safety systems.

- Surveillance cameras in the United States are becoming increasingly popular as an alternative to traditional analog cameras. These cameras have advanced facial recognition and subject identification capabilities, enabling them to acquire surveillance footage and continually create a vast public database. Additionally, the country's democratic system strongly encourages the implementation of CCTV systems.

- Closed-circuit television (CCTV) systems have a variety of applications, ranging from traffic surveillance to crime prevention. However, the need for physical security systems such as surveillance cameras has grown with the advent of high-resolution video streams, remote access to live streams, and the implementation of technologies such as facial recognition and ring doorbell cameras. For instance, in March 2022, some of the United States' most populous cities were subject to extensive surveillance, with an average of 6 cameras per capita, while the most heavily monitored city, Atlanta, had an average of nearly fifty cameras per capita.

- Physical security helps keep data safe by blocking access to places where it is stored; it also helps protect against cybercrime. Things like RFID key cards, phones, and cameras are all connected to the internet, so hackers can quickly get into them. For instance, according to the FBI, in 2022, California was the leader in cybercrime losses, with over USD 2 billion reported. Florida was second, with around USD 845 million in losses, and New York was third, with USD 777 million.

- In December 2022, representatives of the Dallas City Council and the Dallas Police Department announced plans to expand the monitoring of the city's 7,200 cameras that could potentially assist in resolving or preventing criminal activity. Currently, pole-mounted cameras throughout the city and Starlight cameras at convenience stores are linked to the Fusion Center within Dallas Police Headquarters through live monitoring. The Fusion Center's software and computers alert the police regarding which events are being monitored on which cameras.

- In March 2022, i-PRO Americas Inc., a provider of professional security solutions for surveillance and public safety, announced a collaboration with Extreme Networks. Together, they aim to develop new technology that will significantly enhance large-scale physical security systems' deployment, scalability, and reliability. Through this partnership, a cutting-edge solution was created that offers an agile and dependable virtualized network, empowering users to deploy advanced intelligence at the edge effortlessly.

North America Physical Security Industry Overview

The North American physical security market is fragmented as it is highly competitive and consists of several players. The companies in the market continuously try to increase their market presence by introducing new products, expanding their operations, or entering into strategic mergers and acquisitions, partnerships, and collaborations. Some of the major players include Bosch Security Systems GmbH, Genetec Inc., Honeywell International Inc., Dahua Technology Co. Ltd, Axis Communications AB, Genetec Inc., Hangzhou Hikvision Digital Technology Co. Ltd, and Johnson Controls.

- September 2023: Suprema America and BioConnect agreed to establish a collaborative sales and support structure to provide an outstanding customer experience and integrated solution. Within this partnership, the BioConnect Trust platform seamlessly incorporated Suprema's facial and fingerprint readers while also ensuring strong integration with top PAC providers. Leveraging its extensive experience and Trust Platform, BioConnect effectively links various access control platforms with Suprema's advanced biometric devices for deployment throughout the United States.

- March 2023: Betacom announced the launch of a new AI-driven Perimeter Security System (PSS) with Axis Communications and its partner, Evolon Technology. The PSS solution provides physical threat detection services to airports, warehouses, and manufacturing facilities in a significantly shorter timeframe and at a substantially lower cost than traditional wired or public wireless systems. The PSS system is powered by Axis cameras, equipped with AI-based Evolon image detection, and is connected to Betacom's managed, private, and ultra-high-speed 4G and 5G network.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Awareness Regarding the Physical Security Systems

- 5.1.2 Increasing usage of IP-Based Cameras for Video Surveillance

- 5.1.3 Innovations like AI, ML, IoT in Security Solutions

- 5.2 Market Challenges

- 5.2.1 High Installation Costs

- 5.2.2 Cybersecurity Risks

6 MARKET SEGMENTATION

- 6.1 By System Type

- 6.1.1 Video Surveillance System

- 6.1.1.1 IP Surveillance

- 6.1.1.2 Analog Surveillance

- 6.1.1.3 Hybrid Surveillance

- 6.1.2 Physical Access Control System (PACS)

- 6.1.3 Biometric System

- 6.1.4 Perimeter Security

- 6.1.5 Intrusion Detection

- 6.1.1 Video Surveillance System

- 6.2 By Service Type

- 6.2.1 Access Control as a Service (ACaaS)

- 6.2.2 Video Surveillance as a Service (VSaaS)

- 6.3 By Type of Deployment

- 6.3.1 On-Premises

- 6.3.2 Cloud

- 6.4 By Organization Size

- 6.4.1 SMEs

- 6.4.2 Large Enterprises

- 6.5 By End-user Industry

- 6.5.1 Government Services

- 6.5.2 Banking and Financial Services

- 6.5.3 IT and Telecommunications

- 6.5.4 Transportation and Logistics

- 6.5.5 Retail

- 6.5.6 Healthcare

- 6.5.7 Residential

- 6.5.8 Other End-user Industries

- 6.6 By Country

- 6.6.1 United States

- 6.6.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Honeywell International Inc.

- 7.1.2 Bosch Security Systems GmbH

- 7.1.3 Genetec Inc.

- 7.1.4 Dahua Technology Co. Ltd

- 7.1.5 Axis Communications AB

- 7.1.6 Johnson Controls

- 7.1.7 Kastle Systems

- 7.1.8 Wesco International (Anixter Inc.)

- 7.1.9 Hangzhou Hikvision Digital Technology Co. Ltd

- 7.1.10 HID Global Corporation

- 7.1.11 Vidsys Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET