PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549829

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549829

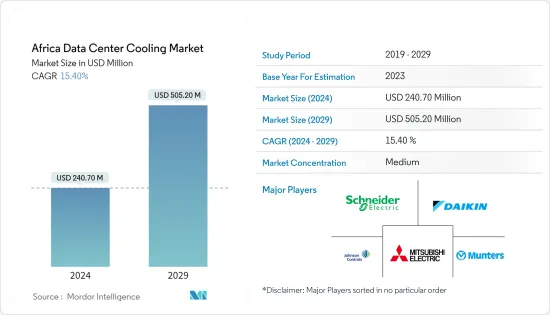

Africa Data Center Cooling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Africa Data Center Cooling Market size is estimated at USD 240.70 million in 2024, and is expected to reach USD 505.20 million by 2029, growing at a CAGR of 15.40% during the forecast period (2024-2029).

The increasing demand for cloud computing among SMEs, government regulations for local data security, and growing investment by domestic players are some of the major factors driving the demand for data centers in Africa.

Under Construction IT Load Capacity: The upcoming IT load capacity of the African data center construction market is expected to reach 1,226 MW by 2029.

Under Construction Raised Floor Space: The region's construction of raised floor area is expected to increase 5.2 million sq. ft by 2029.

Planned Racks: The region's total number of racks to be installed is expected to reach 260K units by 2029. South Africa is expected to house the maximum number of racks by 2029.

Average temperatures in Africa range from 15°C to 36°C in summer and -2°C to 26°C in winter. Africa's heavy reliance on rain-fed agriculture makes it highly vulnerable to climate variability and change. The choice of cooling technology is typically based on the geographic location of the data center.

Planned Submarine Cables: Close to 70 submarine cable systems connect Africa; many are under construction. One submarine cable expected to begin service in 2024 is Africa-1, spanning over 10,000 kilometers with a landing point in Port Said, Egypt, and Ras Ghareb, Egypt.

Africa Data Center Cooling Market Trends

Information Technology Industry to Witness Highest Growth

- Africa is emerging as a potential data center market. Africa Data Centers, a subsidiary of Liquid Telecom, has installed an additional floor to accommodate 160 racks at its facility in Nairobi, Kenya. The newly opened floor directly responds to the enormous demand for colocation and hosting services in Africa. This will enable further data center cooling equipment installations in the region.

- South Africa, Nigeria, and Egypt have approximately 89 million, 163 million, and 75.6 million smartphone connections in the region, respectively. Around 60% of users in Nigeria and 21% in South Africa use digital wallets such as M-Pesa to process transactions. Netflix, Disney+, and Amazon Prime are major OTT players in the region, with Netflix leading the African market subscriber base of around 6.4 million in 2022. These services are available in selected countries such as Nigeria, South Africa, Botswana, Kenya, Mauritius, Madagascar, Seychelles, Tanzania, Togo, Zimbabwe, and Zambia. Along with these developments, the growing number of data centers processing data has increased the demand for cooling equipment in the region.

- 5G service rolls out in 43 African countries, and improving bandwidth speeds will lead to higher data consumption. Along with these developments, the growing number of data centers processing data has increased the demand for cooling equipment in the region.

- Africans tend to prefer mobile services over broadband. For example, the percentage of people using broadband could increase from 19% in 2016 to 29% in 2020 and reach 51% by 2029. The transition from 4G to 5G and the introduction of more fiber optic cables will likely increase the demand for Tier 3 and Tier 4 data centers in the region. These data centers may need to accommodate the diverse digital services and IoT environments required to implement automation and development across the continent. These developments will increase the market demand in this region.

- The need for data localization is driving cloud aggregators to set up cloud data centers in the region. This confirms the growing demand and attractiveness of regional investment, driving the growth of sectors such as cloud. This will also accommodate the increased use of refrigeration equipment in the region.

South Africa Accounts for the Largest Market Share

- The data consumption of various end-user industries in the South African market is gradually increasing. Increasing adoption of e-commerce, especially in e-commerce and retail, is one of the main drivers underpinning the growing demand for colocation services in the country, followed by fashion, sports, health, and beauty products. This equates to an increase in data center cooling equipment.

- The establishment of special economic zones (SEZs), free trade zones (FTZs), and investments in smart cities are boosting the South African data center construction industry. With the increase in the number of data centers, the use of cooling equipment is increasing in the country.

- Cloud usage, data localization, and new technologies such as 5G and IoT are rising. The increasing adoption of advanced IT infrastructure and the shift from on-premises to colocation and managed services are expected to drive investors to develop data center facilities in the country in the coming years. The increase in data centers corresponds to the increase in domestic cooling equipment usage.

- With the South African market favoring smartphones, data center capacity must expand to keep up with the growing data. Smartphones generate large amounts of data that require real-time processing and analysis. Data centers have to deal with huge amounts of data. Therefore, as smartphone users grow, the need for additional racks/servers in South African data centers will likely increase. This is in response to an increase in the number of data centers, which means increased demand for cooling equipment in the country.

Africa Data Center Cooling Industry Overview

The African data center cooling market is highly competitive and consists of many significant players, some of which currently dominate. Market penetration is growing with a strong presence of major players, such as Schneider Electric SE, Daikin Industries Ltd, Johnson Controls International PLC, Mitsubishi Electric Corporation, and Munters Group AB in established markets. With the increasing focus on innovation, the demand for new technologies, such as liquid-based cooling and portable cooling technologies, is also growing, which, in turn, is driving investments for further developments in the region.

In May 2024, Rittal developed a modular cooling system in collaboration with multiple hyperscale data center operators. This solution boasts a cooling capacity exceeding 1 MW, achieved through direct water cooling. It's specifically tailored to cater to the high-power densities of AI applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Dynamics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Trend of High-Performance Computing across Europe

- 4.2.2 Growing Rack Power Density

- 4.3 Market Restraints

- 4.3.1 High Initial Investments

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of the COVID-19 Impact

5 MARKET SEGMENTATION

- 5.1 Cooling Technology

- 5.1.1 Air-based Cooling

- 5.1.1.1 CRAH

- 5.1.1.2 Chiller and Economizer

- 5.1.1.3 Cooling Tower

- 5.1.1.4 Other Air-based Cooling

- 5.1.2 Liquid-based Cooling

- 5.1.2.1 Immersion Cooling

- 5.1.2.2 Direct-to-chip Cooling

- 5.1.1 Air-based Cooling

- 5.2 End User

- 5.2.1 IT & Telecommunication

- 5.2.2 BFSI

- 5.2.3 Government

- 5.2.4 Media & Entertainment

- 5.2.5 Other End Users

- 5.3 Country

- 5.3.1 South Africa

- 5.3.2 Nigeria

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Stulz GmbH

- 6.1.2 Rittal GMBH & Co.KG

- 6.1.3 Schneider Electric SE

- 6.1.4 Vertiv Group Corp.

- 6.1.5 Mitsubishi Electric Hydronics & IT Cooling Systems SpA

- 6.1.6 Asetek A/S

- 6.1.7 Johnson Controls International PLC

- 6.1.8 Fujitsu General Limited

- 6.1.9 Airedale International Air Conditioning

- 6.1.10 Emerson Electric Co.

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS