PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1637858

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1637858

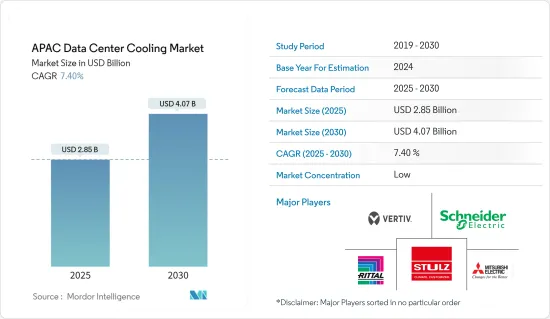

APAC Data Center Cooling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The APAC Data Center Cooling Market size is estimated at USD 2.85 billion in 2025, and is expected to reach USD 4.07 billion by 2030, at a CAGR of 7.4% during the forecast period (2025-2030).

Due to the surge in Internet usage and the number of data centers due to enormous computational requirements by artificial intelligence (AI) and media applications in Asia-Pacific (APAC), the data center cooling market has had massive growth.

According to the International Energy Agency (IEA), the need for digital services is continuously increasing. Since 2010, the global population of internet users has nearly doubled, while global web traffic has increased 20-fold. On the other hand, significant advances in energy efficiency have helped to restrain the increase in energy demand from data centers and data transmission systems, each contributing to 1-1.5% of worldwide power use. Substantial government and business efforts on energy efficiency, research and development, and decarbonizing power supply and supply chains are required to cut energy demand and emissions significantly over the next decade to meet the Net Zero by 2050 Scenario.

Development in IT Infrastructure in emerging countries of APAC is propelling the market. The data center energy demand increased from 66 TWh in 2019 to 72 TWh in 2022 in Asia, according to IEA data released in October 2022.

Companies in the APAC region are trying to tackle this issue by setting up Green data centers that use Free air cooling systems instead of traditional Air conditioners. The increasing trends toward deploying green data centers for managing, storing, and distributing information have helped many software businesses decrease energy consumption and total energy costs.

However, adaptability demands and power outages in Asia-Pacific are a challenge to the growth of the market. A typical data center cooling system must be pre-engineered, standardized, and modular. It is expected to be flexible and scalable to match the data center's requirements in the region. This is challenging today, with firms looking to lower costs and not spend much on high-end customized cooling systems.

The players in the market are collaborating with cooling fluids providers to provide better products to their customers. For instance, in August 2023, Singapore's SK Enmove partnered with Dell and immersion cooling expert GRC to provide cooling fluids. The lubrication company is moving into immersion cooling. It will provide dielectric coolants to fill GRC's tubs, which will hold the Dell kit and be supplied and supported by the server maker. SK Enmove will develop specialized cooling fluids based on its high-quality lube base oil, while Dell and GRC will produce server designs and tubs designed for immersion cooling.

APAC Data Center Cooling Market Trends

Information Technology Industry to Witness Highest Growth

The Information Technology (IT) vertical has driven transformative advancements in various industries. One area that has witnessed remarkable growth due to IT innovation is the market studied.

Moreover, Asia-Pacific is experiencing significant growth in this segment. As a thriving demand hub for technology and digital transformation, the IT sector has risen to the challenge, propelling the development of the market studied to new heights.

Cloud storage use has expanded over the years as SaaS provider expansion has enabled cloud storage providers to expand their capacity, which is likely to raise demand for data center cooling systems. Cloud storage companies like Microsoft, AWS, and Google are expanding their storage capacity to enable more efficient cloud workflow. These firms are investing in hyperscale transactions.

As data-driven technologies, cloud computing, artificial intelligence, and (IoT) continue to evolve, the demand for data centers has skyrocketed. Companies are expanding their digital footprints, requiring larger data centers or multiple smaller facilities spread across various regions. This growth has introduced new challenges in managing the cooling needs of these sprawling infrastructures.

China is Expected to Witness Significant Market Share

Data center cooling is a market that is expanding quickly in Asia-Pacific due to the region's growing data center infrastructure, rising adoption of digital services, and the emergence of cloud computing. The need for data centers is increasing significantly and placing a greater emphasis on effectiveness and maximum uptime.

China is putting much effort toward overtaking its competitors globally in the construction of data centers. The use of 5G, wearable technology, the Internet of Things (IoT), and artificial intelligence generates a booming demand for processing capacity as larger organizations attempt to scale up their data centers to assure the stability and reliability of data services.

Accelerator processors are entering the enterprise data center as artificial intelligence and comparable workloads become commonplace in numerous Chinese industries. All latency-sensitive services demand zero-latency technologies that use accelerating systems to handle information rapidly. The cooling requirements for these hardware accelerators are considerable and range from 200 W to more. The cooling requirements of a single machine can be almost 1 kW when paired with a powerful server. In the region's data centers, this has increased the use of immersion cooling technologies.

Microsoft Azure and Amazon Web Services are constructing massive global cloud data center networks. Alibaba Group, the cloud computing division of China's largest e-commerce company, uses a data center cooling solution that submerges server motherboards in liquid coolant to compete with these advancements. This technique makes use of liquid's more effective ability to transport heat than air. The energy efficiency enhancements of the immersion cooling solution led to a 20% decrease in data center operating expenses.

APAC Data Center Cooling Industry Overview

The Asia-Pacific data center cooling market is fragmented as the advantages offered by the technology and aid from the government by imposing efficiency regulations on data centers are expected to help the growth of the data center cooling market directly. Market penetration is growing with a strong presence of major players in established markets. With the increasing focus on innovation, the demand for new technologies is growing, which, in turn, is driving investments for further developments. Key players are Vertiv Co., Schneider Electric SE, STULZ GMBH, etc.

In May 2024, Rittal developed a modular cooling system in collaboration with multiple hyperscalers. This solution boasts a cooling capacity exceeding 1 MW, achieved through direct water cooling. It's specifically tailored to cater to the high power densities of AI applications.

In April 2024, Vertiv unveiled its latest lineup of high-density data center infrastructure solutions tailored specifically for enterprises delving into AI. The Vertiv 360AI series is crafted to cater to AI-driven data centers' augmented cooling and power demands.

In March 2024, Rittal Private Limited marked the opening of its new Integration Centre, specifically tailored for Cooling Units and Liquid Cooling Package (LCP) solutions, at its Bangalore, India manufacturing plant. This strategic move bolsters the company's production capabilities and positions it to cater to the escalating demand for Industrial Cooling Solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview (Coverage: A detailed analysis of the current regional trends related to Data Center Cooling are included in this section)

- 4.2 Key cost considerations for Cooling

- 4.2.1 Analysis of the key cost overheads related to DC operations with an eye on DC Cooling

- 4.2.2 Key innovations and developments in Data Center Cooling

- 4.2.3 Key energy efficiency practices adopted in Data Centers

5 MARKET DYNAMICS

- 5.1 Market Drivers (Key factors such as the increased emphasis on energy consumption, move towards green solutions are mapped based on their relative impact over the next 5-7 years)

- 5.2 Market Challenges (Key factors such as the dynamic nature of regulations, evolving customer needs are mapped based on their relative impact over the next 5-7 years)

- 5.3 Market Opportunities

- 5.4 Comparison of raised floor with containment & raised floor without commitment

- 5.5 Industry Ecosystem Analysis

6 ANALYSIS OF THE CURRENT REGIONAL DATA CENTER FOOTPRINT

- 6.1 Regional Analysis of IT Load Capacity & Area Footprint of Data Centers (for the period of 2017-2030)

- 6.2 Regional Analysis of the Established DC Markets and Emerging DC Hotspots in APAC region (we will include coverage by highlighting major established and emerging DC markets)

- 6.3 Regional Analysis of Regulatory Framework On DC Cooling

7 DATA CENTER COOLING MARKET SEGMENTATION

- 7.1 By Cooling Technology (Key trends, market size estimates & projections for the period of 2022-2029 and future outlook)

- 7.1.1 Air-based Cooling

- 7.1.1.1 CRAH

- 7.1.1.2 Chiller and Economizer

- 7.1.1.3 Cooling Tower (covers direct, indirect & two-stage cooling)

- 7.1.1.4 Others

- 7.1.2 Liquid-based Cooling

- 7.1.2.1 Immersion Cooling

- 7.1.2.2 Direct-to-Chip Cooling

- 7.1.2.3 Rear-Door Heat Exchanger

- 7.1.1 Air-based Cooling

- 7.2 By End-user Vertical

- 7.2.1 IT & Telecom

- 7.2.2 Retail & Consumer Goods

- 7.2.3 Healthcare

- 7.2.4 Media & Entertainment

- 7.2.5 Federal & Institutional agencies

- 7.2.6 Other end-users

- 7.3 By Country

- 7.3.1 China

- 7.3.2 India

- 7.3.3 Japan

- 7.3.4 Australia

- 7.3.5 New Zealand

- 7.3.6 Singapore

- 7.3.7 South Korea

- 7.3.8 Malaysia

- 7.3.9 Indonesia

- 7.3.10 Philippines

- 7.3.11 Taiwan

- 7.3.12 Hong Kong

- 7.3.13 Thailand

- 7.3.14 Vietnam

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Vertiv Group Corp.

- 8.1.2 Stulz GmbH

- 8.1.3 Schneider Electric SE

- 8.1.4 Rittal Gmbh & Co. KG

- 8.1.5 Mitsubishi Electric Corporation

- 8.1.6 Johnson Controls Inc.

- 8.1.7 Munters Group

- 8.1.8 Eaton Corporation plc

- 8.1.9 Daikin Industries Limited

- 8.1.10 Asetek A/S

9 INVESTMENT ANALYSIS

10 MARKET OPPORTUNITIES AND FUTURE TRENDS