PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851307

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851307

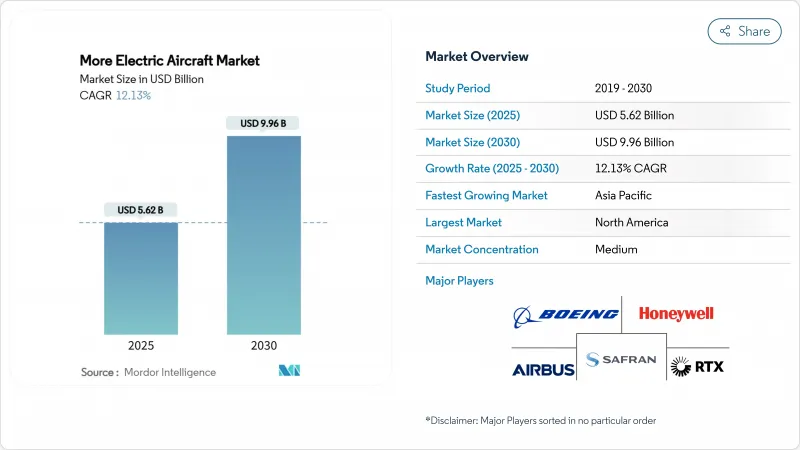

More Electric Aircraft - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The more electric aircraft (MEA) market size is valued at USD 5.62 billion in 2025 and is forecasted to reach a market size of USD 9.96 billion by 2030, advancing at a 12.13% CAGR.

Rising fuel prices, carbon-reduction mandates, and the maturation of high-power electronics push airlines and airframers to swap hydraulic and pneumatic subsystems for electrical architectures. Airlines report fuel-burn savings of up to 20% when engines no longer bleed air for environmental control, while power-dense generators and solid-state batteries support longer electric endurance. Fixed-wing programs such as the B787 prove bleed-less operation in service, and eVTOL developers apply the same logic to urban missions. As a result, incumbents and start-ups race to secure wide-bandgap semiconductors, thermal control materials, and high-voltage certification slots to keep pace with demand.

Global More Electric Aircraft Market Trends and Insights

Electrification Drive to Cut Fuel Burn and CO2

Fuel accounts for 20%-30% of airline operating expense, making kilowatt-class electric powertrains economically attractive in addition to their emission benefits. GE Aerospace's CLEEN III demonstration delivers a 90 kW starter-generator that removes bleed-air plumbing and lets turbofan cores run closer to optimum thrust settings. Collins Aerospace's bleed-less environmental control pack on the 787 illustrates how electrical subsystems lower carbon output while easing maintenance planning. Airlines thus gain predictable inspection intervals and fewer fluid leaks, reducing unscheduled ground time. These dual financial and compliance rewards reinforce continuous investment in electrified line-fit and retrofit programs across fleet types.

Global Emission Regulations Tightening

Binding rules now supplant voluntary pledges. The US Federal Aviation Administration (FAA) adopted fuel-efficiency standards effective April 2024 that set maximum fuel per seat-kilometer for new jets. The European "ReFuelEU" mandate obliges carriers to uplift 6% sustainable aviation fuel by 2030 and 70% by 2050, prompting hybrid-electric architectures that blend drop-in fuels with electric boost. ICAO's global offset scheme requires verifiable emission cuts, forcing OEMs to accelerate electrical integration because incremental engine tweaks cannot satisfy near-term compliance windows. Airbus, for example, publicly targets a zero-emission commercial model by 2035 to stay within regulatory guardrails.

High-Voltage Certification Hurdles

Electric propulsion routinely exceeds 1,000 V DC, yet historical regulations focus on 270 V architectures. The FAA issued special conditions for BETA Technologies' H500A to address new arc-fault and insulation-breakdown modes. Divergent rule-making between the FAA and EASA complicates global validation, obliging developers to engineer for multiple worst-case scenarios. Boeing's B777-9 still faces additional scrutiny for operations without conventional electrical power, underscoring how legacy programs experience certification delays when voltage envelopes widen. These uncertainties lengthen development cycles and inflate budgets, tempering the headline growth rate of the more electric aircraft market.

Other drivers and restraints analyzed in the detailed report include:

- High-Power Motors and SiC/GaN Electronics

- Solid-State Batteries Enable Power-Spike Loads

- Thermal Reliability of Dense Power Modules

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Commercial airframes contributed 39.56% of the more electric aircraft market in 2024 as airlines replaced hydraulics with distributed electrical subsystems to curb maintenance outlay. Carriers highlight predictable life-cycle costs when line-replaceable units are solid-state rather than fluid-powered. Meanwhile, the eVTOL category posts a 15.65% CAGR to 2030, signaling rising investor confidence in city-pair air-taxi operations. Certification milestones by Joby and Archer shifted perceptions from concept to near-term service, unlocking fleet orders from regional operators. Military programs adopt electric actuation chiefly for radar-signature reduction, while business aviation follows for lower cabin noise and airport emissions.

The segment divergence suggests the more electric aircraft market may recalibrate traditional demand metrics. JSX's plan to accept more than 300 hybrid-electric regional aircraft after 2028 illustrates how regional carriers will leapfrog older fleets when viable. Accelerated orders shrink developmental lead times, forcing supply chains to allocate semiconductors first to eVTOL founders. Limited cell production for high-cycle batteries thus becomes a gating item for legacy narrow-body retrofits. Still, retrofit kits for older commercial types gain traction where full fleet renewal is financially prohibitive, ensuring a balanced order mix across aircraft classes.

Fixed-wing designs held 63.55% of the more electric aircraft market size in 2024, thanks to certified reference programs such as the B787 and A350 demonstrating electric environmental control in revenue service. These examples reassure regulators and lessors when approving high-voltage retrofits to narrow-body fleets. At the same time, rotary-wing and powered-lift concepts expand at 12.4% CAGR, buoyed by the step-change in hover efficiency that direct-drive electric motors deliver.

DARPA's XRQ-73 hybrid-electric drone blends rotor lift with fixed-wing cruise and showcases how power electronics endow vertical assets with stealth and endurance. Electra's short-takeoff regional demonstrator collapses the divide further, hinting that future taxonomy will focus on mission profile rather than wing planform. Rotary programs also exploit the absence of gearbox lubrication lines, cutting weight and maintenance. This blurring of categories could spur unified certification frameworks, smoothing entry for unconventional layouts and sustaining platform diversity inside the more electric aircraft market.

The More Electric Aircraft Market Report is Segmented by Aircraft Type (Commercial Aviation, Military Aviation, and More), Platform (Fixed Wing and Rotary Wing), System (Power Generation and Management, Actuation System, Thermal Management System, and More), End-User (OEM and Aftermarket), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 35.23% of 2024 spending as defense budgets backed megawatt demonstrators and the FAA provided early pathways for electric propulsion certification. Established Tier-1 suppliers in the United States anchor a mature ecosystem that co-locates research laboratories, test rigs, and human-capital pipelines. NASA's Electrified Powertrain Flight Demonstration program pairs GE and Boeing engineers to flight-test hybrid propulsion on a regional platform by 2027, reinforcing regional momentum.

Europe ranks second by value, buoyed by Clean Aviation grants and airport decarbonization policies. EU projects such as GOLIAT and EcoPulse channel public funds into liquid-hydrogen handling, superconducting cables, and hybrid-electric flight tests. EASA harmonization with the FAA accelerates transatlantic validation for eVTOLs, shortening time-to-market for dual-registry operators. Nevertheless, European suppliers face currency inflation in semiconductor procurement, prompting joint ventures with Asian foundries to secure wafer allocations.

Asia-Pacific records the highest growth at a 12.45% CAGR. China's Civil Aviation Administration earmarked dedicated low-altitude corridors for eVTOL logistics and passenger shuttles, compressing commercial deployment timelines. State plans to build a trillion-yuan general-aviation industry by 2030, injecting subsidies and regulatory certainty to attract foreign Tier-2 suppliers. Japan and South Korea focus on urban demonstrator flights for Expo-type events, offering a showcase before broader certification. However, airport readiness lags. India explores electric regional turboprops for short-haul routes under the UDAN connectivity scheme. The region's diverse market entries collectively translate into sustained order books for battery, motor, and avionics vendors, ensuring Asia-Pacific remains the principal volume driver in the more electric aircraft market.

- Airbus SE

- The Boeing Company

- Collins Aerospace (RTX Corporation)

- Safran SA

- Honeywell International Inc.

- General Electric Company

- Rolls-Royce plc

- BAE Systems plc

- Parker-Hannifin Corporation

- Moog Inc.

- Eaton Corporation plc

- Thales Group

- Liebherr Group

- Crane Co.

- Diehl Aviation GmbH

- GKN Aerospace (Melrose plc)

- magniX USA, Inc.

- Ampaire Inc.

- Wright Electric Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Electrification drive to cut fuel burn and CO2

- 4.2.2 Global emission regulations tightening

- 4.2.3 High-power motors and SiC/GaN electronics

- 4.2.4 Solid-state batteries enable power-spike loads

- 4.2.5 ESG-driven retrofit demand for APUs

- 4.2.6 Stealth-focused electric actuation (defense)

- 4.3 Market Restraints

- 4.3.1 High-voltage certification hurdles

- 4.3.2 Thermal reliability of dense power modules

- 4.3.3 Scarcity of aero-grade SiC supply chain

- 4.3.4 Airport MRO infrastructure lag

- 4.4 Value-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Aircraft Type

- 5.1.1 Commercial Aviation

- 5.1.2 Military Aviation

- 5.1.3 Business and General Aviation

- 5.1.4 Unmanned Aerial Vehicles (UAV)

- 5.1.5 Urban Air Mobility/eVTOL

- 5.2 By Platform

- 5.2.1 Fixed Wing

- 5.2.2 Rotary Wing

- 5.3 By System

- 5.3.1 Power Generation and Management

- 5.3.1.1 Electric Power Generation

- 5.3.1.2 Power Conversion

- 5.3.1.3 Power Distribution

- 5.3.2 Actuation System

- 5.3.2.1 Flight Control Actuation

- 5.3.2.2 Landing Gear Actuation

- 5.3.3 Thermal Management System

- 5.3.4 Engine Start System

- 5.3.5 Environmental Control System

- 5.3.6 Others

- 5.3.1 Power Generation and Management

- 5.4 By End-user

- 5.4.1 OEM

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 France

- 5.5.2.3 Germany

- 5.5.2.4 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Airbus SE

- 6.4.2 The Boeing Company

- 6.4.3 Collins Aerospace (RTX Corporation)

- 6.4.4 Safran SA

- 6.4.5 Honeywell International Inc.

- 6.4.6 General Electric Company

- 6.4.7 Rolls-Royce plc

- 6.4.8 BAE Systems plc

- 6.4.9 Parker-Hannifin Corporation

- 6.4.10 Moog Inc.

- 6.4.11 Eaton Corporation plc

- 6.4.12 Thales Group

- 6.4.13 Liebherr Group

- 6.4.14 Crane Co.

- 6.4.15 Diehl Aviation GmbH

- 6.4.16 GKN Aerospace (Melrose plc)

- 6.4.17 magniX USA, Inc.

- 6.4.18 Ampaire Inc.

- 6.4.19 Wright Electric Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment