Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521623

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521623

Singapore Container Transshipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

PUBLISHED:

PAGES: 150 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

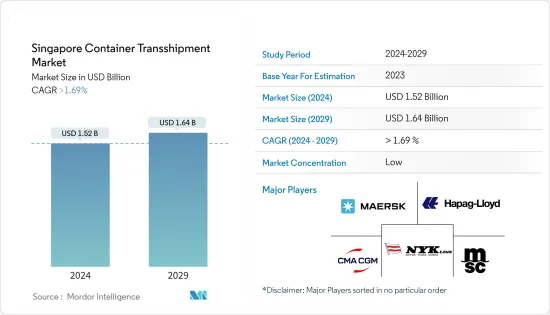

The Singapore Container Transshipment Market size is estimated at USD 1.52 billion in 2024, and is expected to reach USD 1.64 billion by 2029, growing at a CAGR of greater than 1.69% during the forecast period (2024-2029).

Key Highlights

- International Pte Ltd (PSA) enjoyed a record-breaking year as it handled container volumes amounting to 94.8 million Twenty-foot Equivalent Units (TEUs) across its port terminals around the world for the year ended 31 December 2023.

- The flagship terminal in Singapore handled 38.8 million TEUs, an increase of 4.8%, and the terminals outside Singapore held 56 million TEUs, up by 3.9% year on year. Compared to the same period in 2022, the group's volume grew by 4.3%.

- It is strategically located at the crossroads of major shipping corridors that connect Asia, Europe, and North America. The port has 67 deepwater anchorages and more than 200 quay cranes, making it a modernized and effective place to transport goods.

- Ship traffic to and from Singapore is a major concern for many businesses and industries in the Asia-Pacific region. The biggest transshipment hub in the world, Singapore, is a container port that handles around 20% of all containers. Increasing e-commerce growth and technology advancements are booming the supply chain in the region, hence increasing the transshipment market in Singapore.

Singapore Container Transshipment Market Trends

Increasing Trade Activities are Boosting the Market Growth in the Country

- The complex interplay of trade activities, infrastructure, and strategic advantages has made the Singapore container transshipment market successful. Efficient transshipment hubs are needed to cope with the increase in trade volumes. Singapore's central location and connectivity make it well-placed to benefit from this growth.

- For example, according to the sources, by 2022, Singapore's trade in goods and services amounted to USD 19.7 billion, an increase of 13 %. In 2022, Singapore's trade surplus was around USD 40.22 billion. It also reports that Singapore's trade-to-GDP ratio remained at around 336.86% in 2022, which is comparable to 2021.

- Mainland China, the United States, and Malaysia were Singapore's largest trading partners in 2023. Imports from Malaysia and the US outpaced exports to these countries by Singapore in terms of imports into mainland China. The total value of Singapore's merchandise trade amounted to around SGD 1.37 trillion in 2022.

- Exports amounted to SGD 710 billion (USD 528.15 billion), while total imports of goods from the country were around SGD 655 billion (USD 487.24 billion). Singapore's merchandise trade increased by 17 % compared to last year. Imports, exports, and reexports of both oil and nonoil commodities form part of Singapore's merchandise trade sector.)

- In 2022, Singapore imports about SGD 319 billion (USD 237 billion) worth of machines and transport equipment, the country's most valuable import commodity. The import of miscellaneous manufactured articles, with a value of SGD 52.8 billion (USD 39 billion), followed. About SGD 363.5 billion (USD 270 billion) worth of machinery and transport equipment, followed by SGD 83 billion for chemicals and chemical products, were shipped from 2022 to 2022.

Growing Chemicals and Petrochemicals Segment

- Singapore's chemicals and petrochemicals industry is poised for growth as the regional and global economy is forecasted to recover in the aftermath of the COVID-19 outbreak. Singapore is a leading chemical hub; Singapore exported over SGD 80 billion in chemicals and chemical products in 2022, and over 25,000 people are employed by the industry.

- The meteoric growth of the chemical sector in Singapore results from years of heavy investments in infrastructure and the success of the industrial Jurong Island complex, where over 100 global chemicals firms have located operations. Along with a strong physical and financial structure, Singapore's stable social and political environment and skilled workforce have nurtured innovation and collaboration in the industry for decades.

- The last few years have been turbulent, such that Singapore's overall chemicals output in March 2023 fell by 11.8% year-on-year. Petrochemical exports experienced a steep drop, with June marking the tenth straight month of contraction, falling 34% year-on-year to SGD 1.07 billion.

- The logistics industry is constantly innovating to improve efficiency and safety in transporting dangerous goods. Singapore actively supports these advancements, attracting companies that are developing technologies like smart containers and digital tracking systems. The recent expansion of Jurong Port, specifically designed for handling dangerous goods, will further boost Singapore's capacity and capabilities.

Singapore Container Transshipment Industry Overview

The container transshipment market in Singapore is competitive due to competition between major container terminal operators. These operators compete by attracting container shipping lines to their terminals. The major players in the market are MSC, CMA CGM, Maersk Line, Ever Green Marine Corporation, and Pacific International Lines, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50002074

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technology Advancements in the Market

- 4.3 Government Regulations and Initiatives in the Market

- 4.4 Spotlight on Transhhipment Rates

- 4.5 Value Chain/Supply Chain Analysis

- 4.6 Impact on COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 E-commerce is Booming the Market

- 5.1.2 Increasing Intra-Regional Trade

- 5.2 Market Restraints

- 5.2.1 Lack of Skilled Labor

- 5.2.2 Competition From the Global Players

- 5.3 Market Opportunities

- 5.3.1 Technology Advancements and Digitalization

- 5.3.2 Increasing Investments in the Port Developments

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers/ Buyers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Container Type

- 6.1.1 General

- 6.1.2 Refrigerator

- 6.2 By End-User

- 6.2.1 Automotive

- 6.2.2 Mining & Minerals

- 6.2.3 Agriculture

- 6.2.4 Chemicals & Petrochemicals

- 6.2.5 Pharmaceuticals

- 6.2.6 Food & Beverages

- 6.2.7 Retail

- 6.2.8 Other End Users

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 Maersk Line

- 7.2.2 Mediterranean Shipping Company (MSC)

- 7.2.3 CMA CGM

- 7.2.4 Pacific International Lines (PIL)

- 7.2.5 Evergreen Marine Corporation

- 7.2.6 Hapag-Lloyd

- 7.2.7 Orient Overseas Container Line (OOCL)

- 7.2.8 Wan Hai Lines

- 7.2.9 SITC Container Lines

- 7.2.10 NYK Line

- 7.2.11 ZIM Integrated Shipping Services*

- 7.3 Other Companies

8 FUTURE OF THE MARKET

9 APPENDIX

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.