PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521609

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521609

United States Insurance Brokerage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

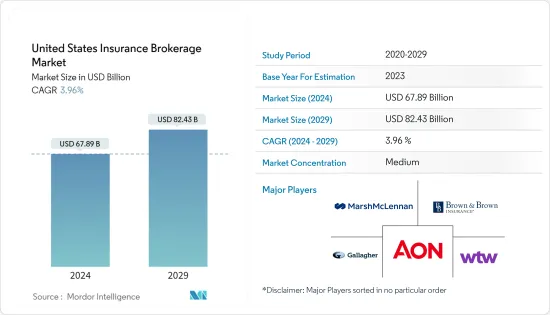

The United States Insurance Brokerage Market size is estimated at USD 67.89 billion in 2024, and is expected to reach USD 82.43 billion by 2029, growing at a CAGR of 3.96% during the forecast period (2024-2029).

The United States insurance brokerage market is growing at a steady rate. Insurance brokerage is a type of activity currently serving about 80% of insurance operations in developed economies. An insurance broker deals with the client to understand their need and negotiate deals with the insurance company on behalf of the client. The pandemic is pressing insurance companies to respond urgently to megatrends such as climate change and digitalization. In addition to this, various government initiatives regarding insurance policies present a significant opportunity for the growth of the insurance brokerage market.

Insurance broker includes individuals or businesses that work for their client's benefit. Brokers are said to be the primary distribution channel for retail and commercial insurance in non-life and group life sectors. Insurance brokerage institutions have adopted various strategies, such as mergers and acquisitions, to gain a competitive advantage over their rivals. In addition, the expansion due to the presence of digital brokers and the integration of IT & analytic solutions are the major driving factors for the insurance brokerage market.

United States Insurance Brokerage Market Trends

Increasing Merger & Acquisition Deals in Insurance Brokerage Market

Merger and acquisition activities in the insurance industry have increased in the past few years. The M&A activity has been profitable for the insurance broker and insurance companies as it helps them capture more market share. This is an attempt to help the brokerage company to safeguard its future enterprise value. The merger and acquisition in the industry has witnessed a dip in recent years as compared to the previous year but is expected to show a steady rise in the forecasted period.

Increasing Digitalization is Driving the Insurance Brokerage Market

Digitalization in insurance and other sectors is growing due to various factors, such as the growing adoption of AI and online platforms. The insurance industry is dependent on human agents, but due to the pandemic, the companies are unable to visit clients physically. Insurance companies have started digital platforms, which are changing the way customers interact and the way businesses operate. These factors are influencing the digital adoption by many insurance brokers and companies in the period. This adoption has made the revenue rise for insurance brokerage in the United States.

United States Insurance Brokerage Industry Overview

The insurance brokerage market is moderately fragmented, with the presence of many players. The market presents opportunities for growth during the forecasted period which is expected to further drive market competition. The competitive landscape shows all the strategies, such as acquisitions and mergers, done by players to have the largest market share in the United States. The key players in the market include Marsh & McLennan Companies Inc., Aon Plc., Willis Tower Watson Plc., Arthur J. Gallagher & Co., and Brown & Brown, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Life Insurance is Driving the Market

- 4.2.2 Increasing Digital Adoption in the Insurance Industry is Driving the Market

- 4.3 Market Restraints

- 4.3.1 Increasing Cost Acts as a Restraint to the Market

- 4.4 Market Opprtunities

- 4.4.1 The Insurance Brokers can Leverage Regulatory Landscape as an Opportunity

- 4.4.2 Leveraging Technology to Interact with Customers

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights on Technology Innovation in Life and Non-Life Insurance Market.

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Insurance Type

- 5.1.1 Life Insurance

- 5.1.2 Property & Casualty Insurance

- 5.2 By Brokerage Type

- 5.2.1 Retail Brokerage

- 5.2.2 Wholesale Brokerage

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concetration Overview

- 6.2 Company Profiles

- 6.2.1 Aon Plc.

- 6.2.2 Marsh & Mclennan Companies Inc.

- 6.2.3 Willis Tower Watson Plc.

- 6.2.4 Arthur J. Gallagher & Co.

- 6.2.5 Brown & Brown, Inc.

- 6.2.6 Amphenol Corporation

- 6.2.7 Hub International Ltd

- 6.2.8 NFP Corp.

- 6.2.9 Ameritrust Group, Inc.

- 6.2.10 USI Ins*

7 MARKET FUTURE TRENDS

8 DISCLAIMER AND ABOUT US