PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521434

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521434

France Car Insurance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

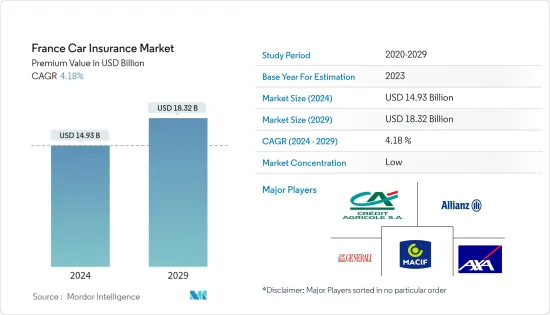

The France Car Insurance Market size in terms of premium value is expected to grow from USD 14.93 billion in 2024 to USD 18.32 billion by 2029, at a CAGR of 4.18% during the forecast period (2024-2029).

The rise of the France car insurance market is primarily driven by an increase in accidents due to France's growing population, the introduction of strict government regulations requiring the purchase of car insurance, and a surge in car sales nationwide. Theft of the car, damage to the vehicle from incidents other than traffic crashes, such as keying, weather-related, or natural disasters, and damage from colliding with stationary objects are all covered financially by French car insurance.

To meet customer demand, build customer loyalty, and take advantage of the opportunities offered by digital technology, French car insurance companies are stepping up in product innovation, mainly in the car insurance sector. To tackle the rise of connected devices, insurers are investing in this new niche and launching related insurance solutions in the car insurance sector.

France Car Insurance Market Trends

Rise in Number of Traffic Accidents

The increase in demand for car insurance is because of the rise in traffic collisions, physical damage, or theft, which builds pressure on insurance companies to invest in high insurance coverage that provides financial security in the form of medical injury or any other damages. Most of the car owners in France depend on car insurance to prevent themselves from financial losses in the future. Car insurance companies in France provide compensation to the policyholder's family members after his/her death. Car insurance companies in France have increased the number of coverages to enhance the customer's experience and to keep up with the competitors in the market.

Increase in Online Car Insurance

The French car insurance market faces deep changes in an increasingly complex and regulated environment. Digital transformation impacts the entire sector, creating new business models, a new customer experience, and a necessary industry evolution. People are preferring online purchases of insurance policies, as they can compare the premium prices and benefits covered in the policy. To satisfy the needs of increasingly demanding, informed, and connected customers, relationship quality becomes an essential element of insurers' value propositions.

France Car Insurance Industry Overview

The French car insurance Market is a fragmented market. All car insurance companies in France are expected to change their systems and processes so that they can develop and accurately price new products and insurance packages. For this, car insurance companies are coming up with new attractive, customizable coverage insurance products. The key players in France's car Insurance Market are Predica-Prevoyance Dialogue Du Credit Agricole, Allianz, Generali Iard, Macif, And Axa France Iard.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Sales of Cars in France Drives The Market

- 4.2.2 Increase in Road Traffic Accidents Drives The Market

- 4.3 Market Restraints

- 4.3.1 Increase in Cost of Claims Made

- 4.3.2 Increase in False Claims and Scams

- 4.4 Market Opportunities

- 4.4.1 Online Car Insurance Products Expanding the Car Insurance Sales

- 4.4.2 Demand for Customised Insurance Products by the Buyers

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights on technology innovation in the Market.

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Coverage

- 5.1.1 Third-Party Liability Coverage

- 5.1.2 Collision/Comprehensive/Other Optional Coverage

- 5.2 By Application

- 5.2.1 Personal Vehicles

- 5.2.2 Commercial Vehicles

- 5.3 By Distribution Channel

- 5.3.1 Direct Sales

- 5.3.2 Individual Agents

- 5.3.3 Brokers

- 5.3.4 Banks

- 5.3.5 Online

- 5.3.6 Other Distribution Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concetration Overview

- 6.2 Company Profiles

- 6.2.1 Predica-Prevoyance Dialogue Du Credit Agricole

- 6.2.2 Allianz

- 6.2.3 Generali Iard

- 6.2.4 Macif

- 6.2.5 Axa France Iard

- 6.2.6 Maaf

- 6.2.7 GMF Assurances

- 6.2.8 Inter Mutuelles Assistance GIE

- 6.2.9 Adrea Mutuelle

- 6.2.10 BPCE Assurances*

7 MARKET FUTURE TRENDS

8 DISCLAIMER AND ABOUT US