PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521610

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521610

Europe Car Insurance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

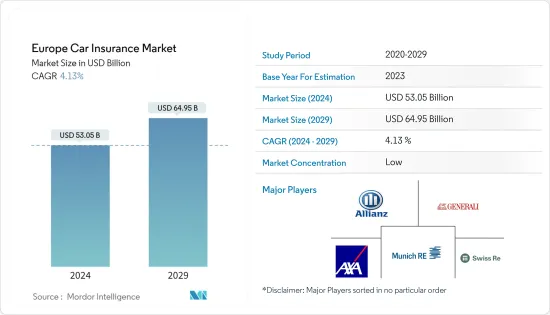

The Europe Car Insurance Market size is estimated at USD 53.05 billion in 2024, and is expected to reach USD 64.95 billion by 2029, growing at a CAGR of 4.13% during the forecast period (2024-2029).

In Europe, people must ensure their car with third party liability while registering the car. This insurance coverage is valid in all European countries. Increasing consumer awareness of the benefits of car insurance as it offers financial protection increases the demand for the car insurance market in Europe.

The factors for the growth of the car insurance market in Europe are an increase in car accidents, strict government rules for purchasing car insurance, and an increase in car sales due to a rise in consumer per capita income. And also the incorporation of new advanced technology into products and services gave rise to third-party liability coverage to the cars.

The new technological advancements made by the European car insurance market provide consumers with various innovative services and use artificial intelligence.

Europe Car Insurance Market Trends

Increase In Online Sales Car Insurance

The transition to digital platforms has become common for most car insurance markets because business models and strategies are changing quickly. Insurance companies are exploreing various distribution channels as it is essential for the insurance company. In developed economies like Europe, most people prefer to buy car insurance online by phone or any other gadget. Due to the Internet penetration rate and the development of online technology, online car insurance sales have become popular in Europe.

Technological Advancements in United Kingdom Car Insurance Market

The technological transformation experienced by the customers in the car insurance sector is the introduction of AI, which helped in claim settlement. Claim settlement is an important step for the car insurance company because it is the way where insurance companies compensate policyholders for damages or losses covered by the car insurance policies. AI can also be used to assess damage to the car, identify fraudulent claims, and track the status of a claim. The driving history of claimants and also circumstances of accidents can be detected with the help of AI. Therefore, technological advancements boost the car insurance market.

Europe Car Insurance Industry Overview

The European car insurance market is highly fragmented, with a large number of players operating in the market studied. Companies have been focusing more on providing customized solutions to attract more customers and enhance their product portfolio. Large insurance players are seeking to team up with emerging Insurtech startups to access new market opportunities. The major players are Allianz SE, Assicurazioni Generali SpA, AXA SA, Munich RE, and Swiss Re AG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Sales of Cars in Europe Drives The Market

- 4.2.2 Increase in Road Traffic Accidents Drives The Market

- 4.3 Market Restraints

- 4.3.1 Increase in Cost of Claims Made

- 4.3.2 Increase in False Claims and Scams

- 4.4 Market Opportunities

- 4.4.1 Online Car Insurance Products Expanding the Car Insurance Sales

- 4.4.2 Demand for Customized Insurance Products by the Buyers

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights on technology innovation in the Market.

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Coverage

- 5.1.1 Third-Party Liability Coverage

- 5.1.2 Collision/Comprehensive/Other Optional Coverage

- 5.2 by Application

- 5.2.1 Personal Vehicles

- 5.2.2 Commercial Vehicles

- 5.3 By Distribution Channel

- 5.3.1 Agents

- 5.3.2 Banks

- 5.3.3 Brokers

- 5.3.4 Other Distribution Channel

- 5.4 By Geography

- 5.4.1 Germany

- 5.4.2 UK

- 5.4.3 France

- 5.4.4 Switzerland

- 5.4.5 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concetration Overview

- 6.2 Company Profiles

- 6.2.1 Allianz SE

- 6.2.2 Assicurazioni Generali SpA

- 6.2.3 AXA SA

- 6.2.4 Munich RE

- 6.2.5 Swiss Re AG

- 6.2.6 Chubb Ltd.

- 6.2.7 GEICO

- 6.2.8 Liberty Mutual Insurance

- 6.2.9 Nationwide Mutual Insurance

- 6.2.10 Porto Seguro S.A*

7 MARKET FUTURE TRENDS

8 DISCLAIMER AND ABOUT US