PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1519881

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1519881

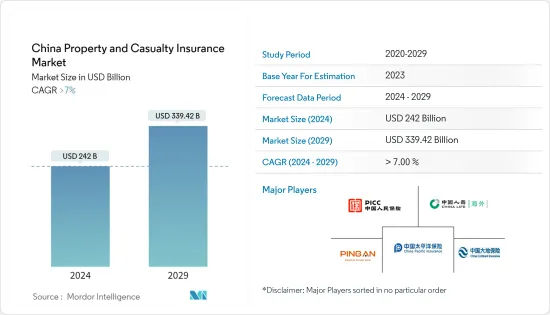

China Property & Casualty Insurance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The China Property & Casualty Insurance Market size in terms of gross written premiums value is expected to grow from USD 242.12 billion in 2024 to USD 341.49 billion by 2029, at a CAGR of 7.12% during the forecast period (2024-2029).

Property and Casualty (P&C) insurance market is one of China's largest insurance, offering a wide variety of products to protect individuals and businesses from damage, liabilities and other risks. As one of the largest insurance markets in the world, the P&C insurance industry in China has seen rapid development in recent years, driven by the country's rapid urbanization, economic growth, government initiatives, and rising awareness of risk management. These factors will continue to drive the growth of the Chinese P&C insurance Market in the coming years. The growth in technological advancement is having a positive impact on the growth of the P&C insurance market. Companies operating in the property and casualty insurance market are adopting new technologies to sustain their position in the market. Furthermore, the growth of the market has been driven by government initiatives to encourage insurance coverage and the emergence of insurtech companies.

However, insurers are facing challenges in terms of competition, regulatory complexity, and the impact of calamity events. While the industry offers considerable growth potential, it also has challenges, such as competitive pressure and exposure to disaster risks. The outlook for the P&C Insurance market in China remains positive as long as insurers continue to adjust to evolving consumer needs, adopt digital transformation, and focus on risk analysis and mitigation.

China P&C Insurance Market Trends

Online Insurance and Digitalization is Driving the Market

The online insurance segment witnessed the fastest growth in China's P&C Insurance market during the forecast period. Because of the easiness of buying online insurance policies, guidance provided regarding discounts, offers, and plans by aggregators boosts the confidence of consumers in buying online insurance. Also, the growing penetration of the internet contributes to the growth of this segment. For instance, in China, there were 1.052 billion internet users at the start of 2023, when internet penetration stood at 73.5%. Furthermore, Fintech is booming, and it's spreading to the insurance industry. Insuretech is using big data, IoT, block chain and cloud computing to enhance existing insurance products, create new insurance products and revolutionize the industry. In China, where the insurance market is growing at a double-digit rate, the disruption caused by Insuretech is revolutionizing the insurance industry. One of the reasons for this is that the Chinese are rapidly adopting and using online ecosystems. Another reason is that Insuretech is supported by a regulatory environment that encourages innovation. As a result, the insurance industry is being transformed by the emergence of new players in the Insuretech space. Some of these players are integrating insurance products in online ecosystems and promoting innovative innovations.

Increasing Automobile Sales Witnessing Upward Trend of China P&C Insurance Market

In November 2023, China's vehicle sales increased 27.4% year-over-year (YoY) to 2.97 million units. This was the fourth month in a row of growth, following a 13.8% YoY increase in October. Sales of energy vehicles increased 30% YoY. In the first 11 months of 2023, sales of new vehicles increased 10.8% compared to a YoY increase of 3.3% in 2022. Energy vehicle sales increased 36.7% YoY. Major four-wheeler companies like BYD, Volkswagen, Toyota, Nissan, and Honda recorded the highest growth in annual sales. The growth in sales numbers highlights the increasing demand for cars in China. Moreover, China saw a strong surge in demand for personal mobility and last-mile deliveries post-pandemic. This increasing trend of automobile sales has risen in the China P&C insurance industry.

China P&C Insurance Industry Overview

The report covers the major players operating in the property and casualty insurance market in China. The market is fragmented. However, it is expected to grow during the forecast period due to an increase in insurtech start-ups, insurance contracts, and other contracts. Among the companies operating in China for P&C insurance are China People's Insurance (PICC), Ping An Insurance, China Pacific Property Insurance Co, China Life Property And Casualty Insurance Co, China United Property Insurance Co, China Continent Property & Casualty Insurance Co, Sunshine Property and Casualty Insurance Co, Taiping General Insurance Co., and they are competing for an increase in their market share in China by launching new insurance products and attracting customers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Economic Growth and Rising Awareness of Risk Management

- 4.3 Market Restraints

- 4.3.1 Intense Competition and Regulatory Complexities

- 4.4 Market Opportunities

- 4.4.1 Digital Transformation by the Companies

- 4.5 Value Chain Analysis

- 4.6 Industry Attractiveness: Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights into Key Trends and Technological Advancements in the Industry

- 4.8 Insights on Various Regulatory Trends Shaping the Market

- 4.9 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Line of Business

- 5.1.1 Motor Insurance

- 5.1.2 Enterprise Property Insurance

- 5.1.3 Home Insurance

- 5.1.4 Liability Insurance

- 5.1.5 Marine Insurance

- 5.1.6 Other Non-Life Insurance

- 5.2 By Distribution Channel

- 5.2.1 Direct Sales

- 5.2.2 Individual Agency

- 5.2.3 Online

- 5.2.4 Bancassurance

- 5.2.5 Other Distribution Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 PICC Property & Casualty Company Limited

- 6.2.2 Ping An Insurance

- 6.2.3 China Pacific Insurance Company Limited

- 6.2.4 China Life Property & Casualty Insurance Company Limited

- 6.2.5 China Continent Property & Casualty Insurance Company Limited

- 6.2.6 China United Insurance Service Inc.

- 6.2.7 Sunshine Insurance Group

- 6.2.8 China Taiping Insurance Group Ltd.

- 6.2.9 China Export & Credit Insurance Corporation

- 6.2.10 Tian an Property Insurance Company *

7 FUTURE OF THE MARKET

8 DISCLAIMER AND ABOUT US