PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1402963

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1402963

Estonia Property & Casualty Insurance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

The Estonia property & casualty insurance market is expected to register a CAGR greater than 5% during the forecast period.

Property and casualty insurance in Estonia is provided by insurance companies registered in Estonia, Estonian branches of foreign insurers, and foreign insurers operating internationally. Most property and casualty insurance premium is written by Estonian insurers, followed by branches of the foreign insurer and foreign insurer operating internationally.

The COVID-19 crisis on the economy affected the revenue base of the property and casualty insurance sector. The restrictions imposed by the government and the general economic downturn caused by the COVID-19 crisis affected the demand for services and goods for which non-life insurance companies offer insurance coverage.

Except for motor third-party liability insurance and travel insurance, practically all types of insurance premiums in Estonia had increased. The number of non-life insurance companies in Estonia were existing at 13 in number last year. Value of gross premium written by non life insurance companies had observed a continuous growth over the years existing at USD 195.05 million creating a growing market for P&C insurance.

Estonia Property & Casualty Insurance Market Trends

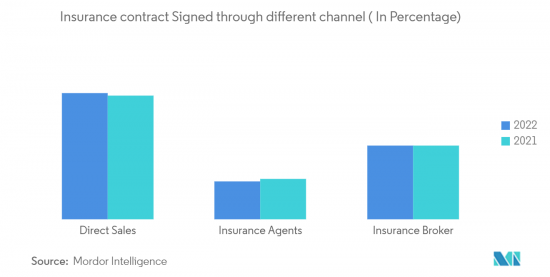

Direct Sales leading P&C Insurance market

Direct sales of property and casualty insurance through the insurer or employee is a major insurance distribution channel in Estonia. The majority of insurance contracts were signed directly with the insurer or an employee, and this method accounted for 51% of new contract premiums. Insurance agents accounted for about 18% of new contract premiums, while insurance brokers accounted for 31%.

With the increasing contribution of the direct sale in P&C insurance, the Value of gross premiums written by property insurance companies in Estonia increased to USD 48.68 million last year.

Motor Vehicle Insurance Leading Property And Casualty Insurance in Estonia

Land vehicle insurance is the largest segment of Estonia's property and casualty insurance. For the first half of last year, USD 67.26 Million was paid for land vehicle insurance, followed by USD 59.67 Million for property insurance. In contrast, motor third-party liability insurance premiums observed a decline.

The value of motor vehicle insurance in Estonia has observed a continuous increase over the years, increasing to a value of USD 52 Million last year, and is expected to grow further with an increase in per capita consumer spending in Estonia.

Estonia Property & Casualty Insurance Industry Overview

The property and casualty insurance market in Estonia is highly competitive. An increasing number of non-life insurance companies are registered in Estonia, which include branches of foreign insurance companies. P&C Insurance holds the largest market share in the non-life insurance market in Estonia, followed by ERGO Insurance and Swedbank P&C, holding more than 50% of the non-life insurance market share. Other P&C insurance companies existing in Estonia include Salva Insurance Limited, Compensa Vienna Insurance Group, ADB Estonia, and AB Lietuvos draudimas.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Self service insurance through Mobile apps increasing Non-life insurance penetration

- 4.2.2 Increase in Natural catastrophe driving new business opportunity for P&C insurance

- 4.3 Market Restraints

- 4.3.1 Decline in companies operating in Estonia Insurance Market

- 4.3.2 Cybersecurity risk affecting the Market

- 4.4 Market Opportunities

- 4.4.1 Continuously Increasing Financial Literacy rate in Indonesia

- 4.4.2 Increasing sales of passengers cars in Estonia

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insight on Various Government Regulations in the Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Motor Insurance

- 5.1.2 Property Insurance

- 5.1.3 Civil Liability Insurance

- 5.1.4 Financial Loss Insurance

- 5.1.5 Others

- 5.2 By Distribution Channel

- 5.2.1 Direct

- 5.2.2 Agents

- 5.2.3 Brokers

- 5.2.4 Other Distribution Channel

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 IF Property and Casualty Insurance

- 6.1.2 ERGO Insurance

- 6.1.3 AB Lietuvos draudimas Estonia branch

- 6.1.4 Swedbank P&C Insurance

- 6.1.5 BTA Baltic Insurance Company

- 6.1.6 Salva Kindlustus

- 6.1.7 Compensa Vienna Insurance Group, ADB Estonia branch

- 6.1.8 LHV Kindlustus

- 6.1.9 VIG Group

- 6.1.10 Lietuvos Draudimas

- 6.1.11 Inges Kindlustus*

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 DISCLAIMER