PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1639421

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1639421

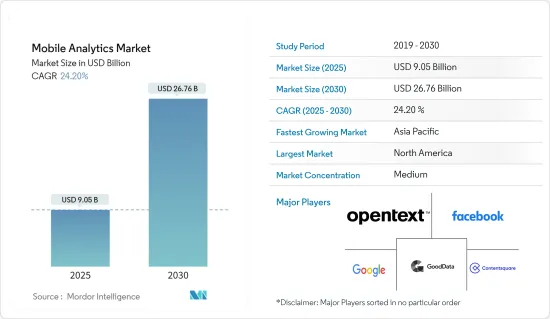

Mobile Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Mobile Analytics Market size is estimated at USD 9.05 billion in 2025, and is expected to reach USD 26.76 billion by 2030, at a CAGR of 24.2% during the forecast period (2025-2030).

The main factor driving the market is the adoption of innovative technologies like artificial intelligence, big data, and machine learning by several mobile analytics businesses.

Key Highlights

- Mobile apps are now more frequently used by consumers to do daily tasks. These applications use a huge amount of data. A powerful analytics system is needed to manage and analyze this enormous amount of data effectively. In this context, data analytics is quite important. It helps diverse businesses use these apps to gain data-driven insight. Mobile App Analytics is to monitor activity within mobile applications. This research can reveal how users interact with a program and whether a specific incident led users to uninstall it. Tracking interaction, technical data, conversion funnels, and other metrics can also assist in determining whether an app makes sense for both the audience and the business and can direct its future development.

- ITU predictions nearly 5.3 billion people or about 66% of the global population - were utilizing the Internet last year. With enhanced Artificial Intelligence (AI) and machine learning models, mobile analytics solutions, including app analytics, are becoming smarter. The majority of app management metrics are evolving beyond simply presenting information to incorporate data analytics modeling and dashboarding. Google is utilizing Firebase to reinvent analytics for mobile devices. Notifications, attribution, invitations, storage, deep links, AdMob, and AdWords are all packed together to give companies and consumers the greatest insights. For example, Google Analytics and Microsoft Clarity have developed app analytics assistants for corporate leaders to uncover fascinating insights without the need for data mining.

- Product and marketing teams can create positive feedback loops with mobile analytics data. As they update their site or app, launch campaigns, and release new features, they can test the impact of these changes on their audience. Based on how audiences respond, teams can make further changes that yield even more data and lead to more testing. This creates a virtuous cycle that polishes the product. Mobile analytics, which depends on apps, is far more convenient and accurate than traditional web-based analytics platforms. As most mobile analytics tools use an SDK to track user activity, vendors can use various codes to track custom events, depending on the operating system.

- Unlike web analytics, SDKs do not depend on cookies to uniquely identify a user. Hence, compared to several other approaches, mobile analytics will likely generate more accurate results. Also, mobile phones are responsible for most internet traffic globally compared to general desktop usage.

- However, mobile analytics businesses still need to address data security problems. Due to sensitive data breaches, app analytics firms lost a large number of users and income. Some pirates break into user accounts in order to steal important information from legitimate users. These credentials are sold, and users' sensitive data is transferred using peer-to-peer file-sharing protocols or a VPN. Injection attacks, Denial of Service (DoS) assaults, and virus attacks pose data security threats by allowing access to data management software and putting data confidentiality at risk.

- The COVID-19 pandemic impacted multiple sectors, including mobile marketing and advertising. In the short term, companies have curtailed their marketing spending till the situation stabilizes. However, in the future, the shift of advertising budget from traditional marketing like print and outdoor activities to digital and mobile marketing would witness a spike, with end-users being indoors and preferring to consume content primarily on their mobile phones or TV. Social distancing, thus positively impacting the usage of mobile marketing analytics.

Mobile Analytics Market Trends

Retail Industry Holds Significant Market Share

- Retail management has become an intricate process with customer satisfaction as its central theme, shifting from focusing on products. Shopper expectations are increasing where. They expect personalization at all levels, faster fulfillment options, and unified omnichannel experiences. Competitive pressures are also increasing, and the definition of commerce continues to evolve.

- Retailers are using mobile as a powerful marketing platform. The retail sector, especially e-commerce operations, is expected to be the primary demand for mobile analytics solutions. Efforts of e-commerce companies to create personalized shopping experiences are expected to draw considerable revenues to the mobile analytics market globally.

- An enormous market is available for mobile analytics providers because of the expanding global retail and e-commerce industries. The industries will continue to grow significantly with the development of internet infrastructure, creating a significant potential for local suppliers. For instance, According to the National Retail Federation, revenues from over retail outlets in the United States exceeded USD 4.86 trillion last year. Furthermore, retail industry sales are predicted to rise between 6% and 8%, and e-commerce retail sales exceeded USD 1.17 trillion last year, growing at an 11-13% annual pace. Mobile analytics solutions for e-commerce and retail are increasingly popular in nations including the United States, India, China, South Korea, Taiwan, and others.

- Moreover, the retail industry has emerged as one of the dynamic industries in India, which is anticipated to reach nearly USD 1.3 trillion by 2024, according to the India Brand Equity Foundation.

- The market's vendor activity points to expanding collaborations between retailers and mobile analytics platforms to meet various emerging needs, including new customer acquisition and retention. Such long-term alliances have significantly contributed to the market under study's expansion.

- The retail industry has become more dynamic as a result of increased digitization throughout the retail industry, the growth of multi-channel operations, and the creation of retail analytics solutions. Since retail organizations must handle a massive quantity of data, such as customer purchasing habits, every encounter and data point can potentially make the retail sector more effective and successful. Retailers are investing in developing technology to improve labor procedures. The adoption of mobile analytics boosts retail revenue and customer service effectiveness.

Asia Pacific to Occupy Significant Market Share

- The Asia Pacific, mobile analytics market, is expected to grow significantly over the forecast period owing to the surge of smartphone device utilization and an increasing number of mobile business emails. According to a TRAI report, India's telecom subscriber base reached 1170.45 million at the end of October last year.

- Additionally, the expanding Indian retail and e-commerce industry presents a sizable market for mobile analytics providers. The industries will continue to grow significantly with the improvement of the nation's internet infrastructure, creating a major potential for local suppliers. Major hubs for e-commerce and retail-driven mobile analytics solutions are emerging in cities like Delhi, Mumbai, Bangalore, and Hyderabad. According to IBEF, India's social commerce sector has the ability to develop to USS 16 to 20 billion in the year 2025, at a CAGR between 55% to 60%, while the country's e-commerce market is predicted to reach USD 111 billion by 2024, and USD 200 billion by 2026.

- As smartphones become more popular, there is an increasing need for mobile analytics services in the APAC area. Customers also employ mobile analytics for a fundamental study of mobile data traffic. The mobile analytics market is driven by the proliferation of phones and tablets, the rising need for smart cybersecurity solutions, and income from internet services.

- Companies with a large audience differentiate their offering, replicating the success of 'super-apps' seen elsewhere in Asia. For example, GoJek and Grab are offering users across South Eastasia a range of features, such as ride-hailing, payment systems, food delivery, e-commerce, publishing, and their business model, is one that is catching on in the Indian market. For instance, Truecaller - an app that allows its 140 million daily active users to screen calls from strangers and bots - plans to implement a credit loaning system. Users based in India can also use the app to record calls, send messages, and complete payments.

- Furthermore, most of India's digital ad spend was mobile-focused before the coronavirus pandemic, and this global event has acted as a catalyst for this trend. Between 45-55% of organizations' digital advertising budgets are spent on mobile, which is anticipated to increase to more than 65% in the last year. As per Exchange4Media, ad budgets invest heavily in rich media, social media marketing, and paid search. Such trends are expected to drive further the growth of the market studied.

Mobile Analytics Industry Overview

The Global Mobile Analytics Market is dominated by a few giants, like OpenText Corporation, Facebook Inc., Google LLC, Microsoft Corporation, and Contentsquare SaaS, which occupy most of the market share. They are emphasizing R&D activities related to mobile analytics. Some of the recent developments in the market are:

- April 2022 - Mobile Marketing and Roomvo collaborated to build a visualizer analytics module available on Mobile Marketing's client site. According to the firm, using strong analytics from Roomvo, merchants can acquire new levels of insight into their customers and make data-driven business choices, from inventory systems to promotion planning.

- November 2022 - Vianova established a strategic alliance with on-demand transportation company Fenix to deliver mobility expertise to the Middle East. Fenix employs Vianova's mobile analytics platform in five countries, including Saudi Arabia, United Arab Emirates, Bahrain, and Qatar, to get insights about its fleets and increase collaboration with cities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Mobile Analytics Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Smartphone Revolution to Generate Enormous Data

- 5.1.2 Data Explosion from E- commerce Likely to Propel the Market

- 5.2 Market Challenges

- 5.2.1 Challenges Regarding Security Breach

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Application Analytics

- 6.1.2 Campaign Analytics

- 6.1.3 Service Analytics

- 6.1.4 Other Applications

- 6.2 By End-User Vertical

- 6.2.1 Retail

- 6.2.2 BFSI

- 6.2.3 Government

- 6.2.4 IT and Telecom

- 6.2.5 Media and Entertainment

- 6.2.6 Other End-User Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 OpenText Corporation

- 7.1.2 Facebook Inc.

- 7.1.3 GoodData Corporation

- 7.1.4 Google LLC

- 7.1.5 Contentsquare SaaS

- 7.1.6 Microsoft Corporation

- 7.1.7 Oracle Corp.

- 7.1.8 Adobe Inc.

- 7.1.9 Salesforce.com Inc

- 7.1.10 AppsFlyer Ltd

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS