PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906877

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906877

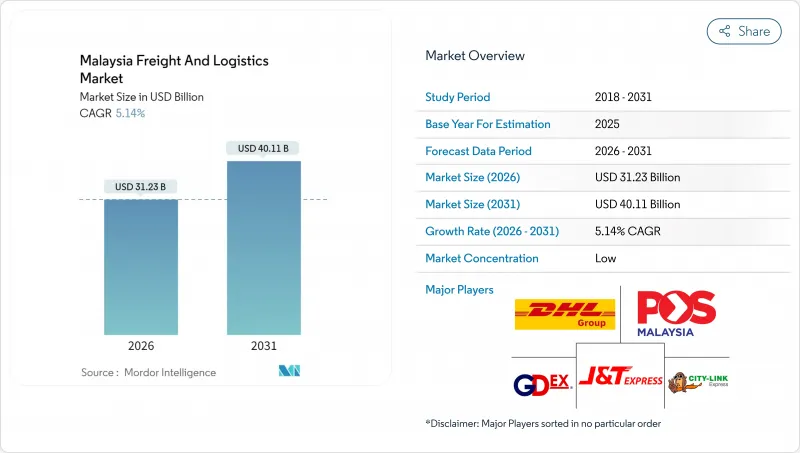

Malaysia Freight And Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Malaysia freight and logistics market is expected to grow from USD 29.70 billion in 2025 to USD 31.23 billion in 2026 and is forecast to reach USD 40.11 billion by 2031 at 5.14% CAGR over 2026-2031.

Port Klang's rise to the world's 10th-busiest container port, extensive government funding for rail and highway projects, and sustained e-commerce momentum are reshaping supply-chain networks, warehouse automation priorities, and carrier partnerships across the Malaysia freight and logistics market. Foreign direct investment reached MYR 378.5 billion (USD 82.3 billion) in 2024, creating 207,000 jobs and expanding demand for cross-border forwarding, value-added distribution, and specialized manufacturing logistics. Consumers' preference for same-day delivery is accelerating last-mile network densification, while regulatory moves such as targeted diesel subsidies and simplified customs windows are easing cost pressures and border friction. Global carriers are deepening local ties to secure air-cargo uplift, sea-freight allocations, and temperature-controlled capacity, reinforcing Malaysia's hub role within ASEAN and the broader Asia-Pacific trade lattice.

Malaysia Freight And Logistics Market Trends and Insights

Explosive B2C E-commerce Volumes Drive Last-Mile Innovation

Same-day fulfillment has become a standard expectation, with leading platforms shipping 95% of orders within 24 hours. Free-delivery preferences among 64.8% of internet users are forcing providers in the Malaysia freight and logistics market to adopt automated sortation, micro-fulfillment centers, and data-driven route planning. Retailers such as MR DIY achieved 200% efficiency gains after installing robotic systems, proving that automation now underpins competitive advantage. Partnerships like UPS-Ninja Van extend global express products to 52 retail outlets, offering exporters wider belly-hold access and digital tracking that aligns with rising SME participation in regional trade. The cumulative impact adds capacity resilience and service diversity, supporting the near-term growth trajectory of the Malaysia freight and logistics market.

Surge in FDI-Led Manufacturing Output Transforms Industrial Logistics

Record MYR 378.5 billion (USD 82.3 billion) investment approvals in 2024 are channeling funds toward semiconductor fabs, advanced automotive components, and renewable-energy assemblies. Semiconductor investments are triggering demand for electrostatic-discharge-compliant packaging, secure robotics, and bonded-warehouse clearance lanes. Precision-engineering firms such as MKS Instruments are building "super centers" that require synchronized inbound raw-material flows and high-frequency outbound shipments. Cross-border tax incentives inside the Johor-Singapore Special Economic Zone are expected to add 100 projects and 20,000 skilled jobs, anchoring new corridors for the Malaysia freight and logistics market. As ESG criteria tighten, investors also prioritize multimodal nodes near renewable energy and rail spurs, reinforcing long-term freight diversification.

Port Congestion Constrains Capacity Despite Infrastructure Investment

Average vessel waiting times of 1.3-1.46 days at Port Klang, alongside yard utilization above 90%, undermine schedule dependability. The Malaysia Maritime Single Window, launched in February 2025, has trimmed documentation cycles from five days to mere hours, but physical quay expansions will still lag near-term TEU growth. Westports Holdings' multi-decade expansion blueprint aims to propel total capacity far beyond present limits, yet Red Sea rerouting has already intensified arrival bunching and yard overflow. As global carriers reallocate boxes, the Malaysia freight and logistics market faces short-term charter premium spikes and inventory imbalances that erode margin gains from higher throughput.

Other drivers and restraints analyzed in the detailed report include:

- Government Mega-Projects Unlock Regional Connectivity

- RCEP Integration Accelerates Intra-ASEAN Trade Flows

- Chronic Truck-Driver Shortage Threatens Operational Scalability

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Manufacturing held 38.98% of Malaysia freight and logistics market share in 2025, supported by Penang's MY 431 billion (USD 93.7 billion) export engine and Selangor's electronics clusters. Multinationals require bonded trucking corridors, ESD-safe warehouses, and secure-freight escorts, driving service differentiation. Growth in electric vehicle components and renewable energy equipment further expands the Malaysia freight and logistics market size for oversized container handling and specialized rigging. Wholesale and retail trade, although smaller in absolute dollars, is on pace for a 5.46% CAGR between 2026-2031 as disposable incomes rise and digital payment adoption widens. Supermarket chains like 99 Speed Mart plan to double store counts, demanding multi-temperature cross-docks and micro-fulfillment centers proximate to consumption hotspots.

Agriculture, fishing, and forestry depend on certified halal cold chains to penetrate Middle-East demand pools, giving algorithm-driven temperature traceability platforms greater commercial pull. Construction logistics ties directly to mega-projects such as the RTS Link and Penang Airport expansion, requiring heavy-lift cranes, night-time convoy escorts, and synchronized just-in-time material sequencing. Oil, gas, and mining remain cyclical but sustain steady demand for ISO tank containers, hull-cleaning services, and pipeline maintenance parts, anchoring a baseline for the Malaysia freight and logistics industry amid commodity swings.

Freight transport generated 55.62% of Malaysia freight and logistics market revenue in 2025, reflecting entrenched manufacturing exports and regional distribution flows. The Malaysia freight and logistics market size linked to courier, express, and parcel solutions is growing faster at a 5.86% CAGR (2026-2031) as e-retailers outsource same-day coverage to multi-modal carriers. Automated hubs, such as UPS-Ninja Van's expanded Klang Valley outlets, harness address-verification software and IoT tags to trim failed-delivery rates. As online orders fill truck bays, operators retrofit depots with tilt-tray sorters and deploy electric vans to navigate congestion nodes near Kuala Lumpur. The segment also benefits from 16 trade pacts that suppress cross-border clearance fees and harmonize labeling, easing SME access to overseas buyers. Continuous parcel-density escalation strengthens bargaining power with airline belly-hold providers, but margin compression remains a risk if diesel subsidies phase down faster than productivity gains materialize.

Beyond CEP, warehousing and forwarding units explore pay-as-you-use charging, allowing micro-enterprises to lease bins rather than full pallet slots. Temperature-controlled shipping aligns with Malaysia's halal-certification standards, opening premium lanes for value-added consolidation of seafood, confectionery, and biologics. The freight transport share of the Malaysia freight and logistics market is expected to decline marginally by 2031 as parcel and contract-logistics activities absorb disproportionate capital. Yet specialized trucking for oversized project cargo-solar panels, turbines, refinery vats-continues to anchor baseline volumes. Technology readiness, regulatory clarity, and workforce availability will largely determine whether incumbents or new entrants capture the incremental value.

The Malaysia Freight and Logistics Market Report is Segmented by End User Industry (Agriculture, Fishing, and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, and Others) and by Logistics Function (Courier, Express, and Parcel (CEP), Freight Forwarding, Freight Transport, Warehousing and Storage, and Other Services). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- City-Link Express

- CJ Logistics Corporation

- DHL Group

- DSV A/S (Including DB Schenker)

- FedEx

- FM Global Logistics Holdings Bhd

- GDEX Group

- Hellmann Worldwide Logistics

- Hextar Technologies Solutions Bhd

- J&T Express

- Keretapi Tanah Melayu Bhd

- Kuehne+Nagel

- MMC Corporation Bhd

- NYK (Nippon Yusen Kaisha) Line

- POS Malaysia Bhd

- SF Express (KEX-SF)

- SkyNet Worldwide Express, Inc.

- Taipanco Sdn Bhd

- Tiong Nam Logistics Holdings Bhd

- Transocean Holdings Bhd

- United Parcel Service of America, Inc. (UPS)

- Xin Hwa Holdings Bhd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Demographics

- 4.3 GDP Distribution by Economic Activity

- 4.4 GDP Growth by Economic Activity

- 4.5 Inflation

- 4.6 Economic Performance and Profile

- 4.6.1 Trends in E-Commerce Industry

- 4.6.2 Trends in Manufacturing Industry

- 4.7 Transport and Storage Sector GDP

- 4.8 Export Trends

- 4.9 Import Trends

- 4.10 Fuel Price

- 4.11 Trucking Operational Costs

- 4.12 Trucking Fleet Size by Type

- 4.13 Major Truck Suppliers

- 4.14 Logistics Performance

- 4.15 Modal Share

- 4.16 Maritime Fleet Load Carrying Capacity

- 4.17 Liner Shipping Connectivity

- 4.18 Port Calls and Performance

- 4.19 Freight Pricing Trends

- 4.20 Freight Tonnage Trends

- 4.21 Infrastructure

- 4.22 Regulatory Framework (Road and Rail)

- 4.23 Regulatory Framework (Sea and Air)

- 4.24 Value Chain and Distribution Channel Analysis

- 4.25 Market Drivers

- 4.25.1 Explosive B2C E-Commerce Volumes

- 4.25.2 Surge in FDI-led Manufacturing Output

- 4.25.3 Government Mega-Projects (ECRL, Pan-Borneo Highway)

- 4.25.4 RCEP-Driven Cross-Border Trade Flows

- 4.25.5 Rising Demand for Certified Halal Logistics

- 4.25.6 Cold-Chain Build-Out for Vaccines and Biologics

- 4.26 Market Restraints

- 4.26.1 Port and Last-Mile Congestion

- 4.26.2 Chronic Truck-Driver Shortage

- 4.26.3 Domestic Cabotage Policy Limits Coastal Shipping

- 4.26.4 Tightening Euro-VI - Like Emission Rules, Capex Squeeze

- 4.27 Technology Innovations in the Market

- 4.28 Porter's Five Forces Analysis

- 4.28.1 Threat of New Entrants

- 4.28.2 Bargaining Power of Buyers

- 4.28.3 Bargaining Power of Suppliers

- 4.28.4 Threat of Substitutes

- 4.28.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Logistics Function

- 5.2.1 Courier, Express, and Parcel (CEP)

- 5.2.1.1 By Destination Type

- 5.2.1.1.1 Domestic

- 5.2.1.1.2 International

- 5.2.1.1 By Destination Type

- 5.2.2 Freight Forwarding

- 5.2.2.1 By Mode of Transport

- 5.2.2.1.1 Air

- 5.2.2.1.2 Sea and Inland Waterways

- 5.2.2.1.3 Others

- 5.2.2.1 By Mode of Transport

- 5.2.3 Freight Transport

- 5.2.3.1 By Mode of Transport

- 5.2.3.1.1 Air

- 5.2.3.1.2 Pipelines

- 5.2.3.1.3 Rail

- 5.2.3.1.4 Road

- 5.2.3.1.5 Sea and Inland Waterways

- 5.2.3.1 By Mode of Transport

- 5.2.4 Warehousing and Storage

- 5.2.4.1 By Temperature Control

- 5.2.4.1.1 Non-Temperature Controlled

- 5.2.4.1.2 Temperature Controlled

- 5.2.4.1 By Temperature Control

- 5.2.5 Other Services

- 5.2.1 Courier, Express, and Parcel (CEP)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Key Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 City-Link Express

- 6.4.2 CJ Logistics Corporation

- 6.4.3 DHL Group

- 6.4.4 DSV A/S (Including DB Schenker)

- 6.4.5 FedEx

- 6.4.6 FM Global Logistics Holdings Bhd

- 6.4.7 GDEX Group

- 6.4.8 Hellmann Worldwide Logistics

- 6.4.9 Hextar Technologies Solutions Bhd

- 6.4.10 J&T Express

- 6.4.11 Keretapi Tanah Melayu Bhd

- 6.4.12 Kuehne+Nagel

- 6.4.13 MMC Corporation Bhd

- 6.4.14 NYK (Nippon Yusen Kaisha) Line

- 6.4.15 POS Malaysia Bhd

- 6.4.16 SF Express (KEX-SF)

- 6.4.17 SkyNet Worldwide Express, Inc.

- 6.4.18 Taipanco Sdn Bhd

- 6.4.19 Tiong Nam Logistics Holdings Bhd

- 6.4.20 Transocean Holdings Bhd

- 6.4.21 United Parcel Service of America, Inc. (UPS)

- 6.4.22 Xin Hwa Holdings Bhd

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment