PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1440355

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1440355

Mental Health Apps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

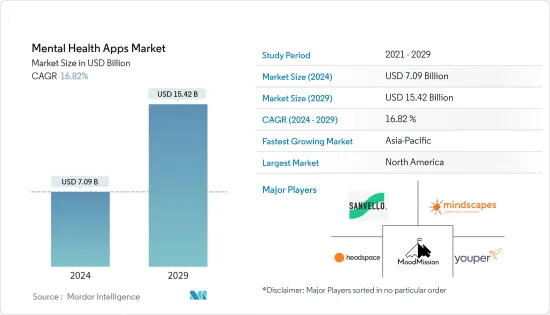

The Mental Health Apps Market size is estimated at USD 7.09 billion in 2024, and is expected to reach USD 15.42 billion by 2029, growing at a CAGR of 16.82% during the forecast period (2024-2029).

The COVID-19 outbreak substantially impacted the mental health apps market and greatly boosted the digital health industry worldwide. The pandemic phase witnessed an upsurge in the usage of mental health apps for coping with conditions due to the limitations and restrictions on social distancing and isolation, affecting individuals' mental states. For instance, as per the article published in December 2021 by PubMed, due to the increased demand for services from mental health professionals, many people struggled to access in-person services, which led to an augmented demand for online and telehealth services, including a 50% increase in the number of Australian young people aged 18-25 who were accessing online mental health help and increased the downloads of mental health apps. Additionally, as per the article published in March 2021 in PubMed, among the 16 most downloaded apps, 10 were meditational, 13 showed increased downloads, and 11 apps showed a 10% increase in downloads after the pandemic started. As per the analysis, the market is anticipated to witness growth in the post-pandemic phase due to the rise in awareness regarding mental health and the increase in technological advancements in m-health services.

Furthermore, the major factors boosting the growth of mental health apps are the increasing awareness of the importance of mental health, the surge in mental disorders, the rise in strategic initiatives undertaken by several companies within the mental healthcare industry, and the growing usage of mental health applications. For instance, as per the State of Mental Health in America 2022 report, the number of youths experiencing a severe major depressive episode (MDE) increased by 197,000 from the 2021 dataset. Thus, the rise in the incidence of depressive disorders leads to a surge in demand for mental health apps, which is thereby expected to boost market growth over the forecast period.

Owing to the increasing awareness among the population, several companies, organizations, and governmental bodies are engaged in developing and launching mental health apps across various platforms. For instance, in April 2021, the GOI virtually launched the "MANAS" app to promote well-being across age groups. Furthermore, numerous companies are involved in launching newer apps into the market to help individuals with mental disorders. For instance, in October 2021, the Y Combinator-backed MentalHappy app initiated the goal of making mental health care accessible, affordable, and stigma-free by developing low-cost peer support groups within the app to boost access to conditions such as coping with anxiety, life after divorce, and black mental health. Similarly, in November 2021, Koo App & Fortis launched an awareness campaign on World Mental Health Day. Furthermore, in April 2022, Talkspace, a provider of virtual behavioral health services, launched Talkspace Self-Guided, a suite of offerings for employers designed to help executives, managers, and teams prioritize and build emotional intelligence (EQ) and mental wellness in and out of the workplace.

Thus, due to the rise in mental health issues and the surge in new mental health application launches, the market is expected to witness significant growth over the forecast period. However, data privacy and research concerns are major factors hindering the market's growth.

Mental Health Apps Market Trends

Depression and Anxiety Management Segment is Expected to Witness Significant Growth Over the Forecast Period

The depression and anxiety management segment is expected to witness significant growth over the analysis period owing to factors such as the increasing burden of depression and anxiety, growing initiatives about depression and anxiety, and the launch of several mental health apps for managing depression and anxiety.

For instance, as per the September 2021 update by the WHO, depression is a common mental disorder worldwide, with an estimated 3.8% of the population affected, including 5.0% of adults and 5.7% of adults older than 60 years. Moreover, as per the Mental Health America 2022 report, the number of people affected by mental illness in Texas is found to be 3.6 million in 2022. As the number of mental illness cases, such as depression or anxiety, increases, the chance of utilizing mental health apps rises, thereby boosting market segment growth. Thus, the statistics indicate that the use of mental health apps for coping with these mental conditions is anticipated to surge over the coming years owing to the ease of access and integration of advanced technologies such as artificial intelligence and machine learning for tracking the underlying mental stressors.

Additionally, several market players are launching mental health apps, contributing to the segment's growth. For instance, in August 2021, Headspace and the on-demand mental healthcare app Ginger reported merging into a single company, called Headspace Health, to offer support for mental health symptoms ranging from anxiety to depression to more complex diagnoses and sell directly to consumers and employers. Similarly, in September 2021, Delhi AIIMS developed two mobile apps, Shaksham and Disha, to assist patients dealing with anxiety and depression.

Thus, due to the rise in depression and anxiety issues and the surge in new mental health application launches, the depression and anxiety segment is expected to witness growth over the forecast period.

North America is Expected to Hold a Significant Share in the Market and Expected to do Same in the Forecast Period

North America is anticipated to witness growth in the mental health apps market owing to factors such as the well-established healthcare IT industry, sophisticated technological infrastructure, the rising usage of mobile applications, and the increasing burden of stress, depression, and anxiety. Some other factors boosting the market's growth include the rising awareness about mental health and the initiatives undertaken by the market players.

For instance, as per a February 2022 update by the National Alliance on Mental Illness (NAMI), in the United States, a total of 26.3 million adults received virtual mental health services. As per the same source, 1 in 5 adults in the United States experiences mental illness, whereas 1 in 20 adults in the United States experiences serious mental illness. Thus, this has greatly stimulated the use of mental apps among Americans, ultimately augmenting the market's growth.

Likewise, in August 2021, K Health, a United States-based data-driven virtual primary care platform providing affordable, personalized healthcare, acquired Trust, the mental health app that connects people and providers for on-demand text-based therapy to integrate mental and physical health, disciplines that are often treated separately in the traditional healthcare system. Additionally, in April 2021, Life Clips, Inc., based in the United States, reported that its subsidiary Cognitive Apps Software had successfully launched its Yuru 3-in-1 tool for understanding and managing mental health. Moreover, in February 2022, Noble, a new innovative, mental health-focused company, launched its new app, offering automated between-session support and therapist-created, research-backed content for clients. Such developments indicate the growing demand for mental health apps in the country, thereby contributing to market growth.

Thus, as a result of the rise in mental illness and the huge number of new mental health app launches, North America is expected to witness growth in the mental health app market over the forecast period.

Mental Health Apps Industry Overview

The mental health apps market is fragmented, with several global and domestic players. The key players are adopting different growth strategies to enhance their market presence, such as partnerships, agreements, collaborations, new product launches, geographical expansions, mergers, and acquisitions. Some key players in the market are CVS Health Corporation, Sanvello Health, Inc., Mindscapes, Headspace, Inc., and Youper, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Awareness Pertaining to the Importance of Mental Health

- 4.2.2 Upsurge in Mental Conditions Worldwide

- 4.3 Market Restraints

- 4.3.1 Privacy and Research Concerns

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Platform Type

- 5.1.1 Android

- 5.1.2 iOS

- 5.1.3 Other Platform Types

- 5.2 By Application

- 5.2.1 Depression and Anxiety Management

- 5.2.2 Stress Management

- 5.2.3 Meditation Management

- 5.2.4 Other Application Types

- 5.3 By End User

- 5.3.1 Home Care Settings

- 5.3.2 Mental Hospitals

- 5.3.3 Other End Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 MoodMission

- 6.1.2 Sanvello Health, Inc.

- 6.1.3 Mindscapes

- 6.1.4 Headspace Inc.

- 6.1.5 Youper Inc.

- 6.1.6 K Health Inc.

- 6.1.7 Calm

- 6.1.8 Happify Health

- 6.1.9 MoodTools

- 6.1.10 CVS Health Corporation

- 6.1.11 Zavfit

- 6.1.12 Talkspace

- 6.1.13 Real

- 6.1.14 Wysa

7 MARKET OPPORTUNITIES AND FUTURE TRENDS