PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850376

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850376

Toothpaste - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

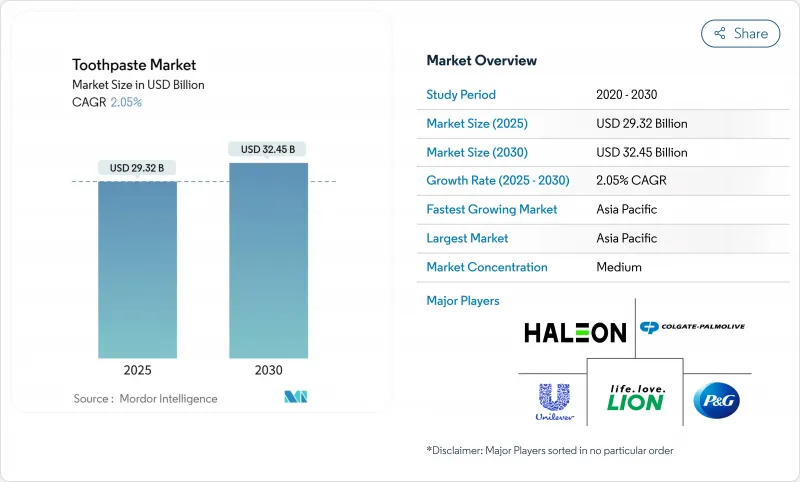

The Toothpaste Market size is estimated at USD 29.32 billion in 2025, and is expected to reach USD 32.45 billion by 2030, at a CAGR of 2.05% during the forecast period (2025-2030).

In mature economies, growth is steady, while emerging nations are experiencing significant expansion due to increasing awareness of oral hygiene. The market benefits from its essential nature as a daily-use product, which insulates it from severe cyclicality. Regulatory bodies continue to endorse fluoride formulations, reinforcing consumer confidence and sustaining baseline demand. Additionally, brand owners are leveraging innovation by incorporating advanced features, such as enamel-strengthening amino acids, into standard toothpaste formulations to maintain their competitive edge. Simultaneously, the growing demand for natural and transparent ingredient-based products is fueling the rapid growth of natural toothpaste lines. Furthermore, sustainability regulations and evolving omnichannel purchasing behaviors are transforming cost structures. In response, market players are redesigning packaging solutions and intensifying their digital engagement strategies to adapt to these changes.

Global Toothpaste Market Trends and Insights

Growing consumer shift toward herbal and natural formulation-based products

As consumers grow wary of synthetic ingredients and with regulatory bodies backing traditional remedies, the demand for herbal and natural toothpaste is on the rise. This trend underscores a significant shift: health-conscious buyers now value ingredient transparency more than brand loyalty. In India, for instance, Dabur has noted a 31% market penetration for its natural products, alongside a 13% growth in its portfolio. The World Health Organization's endorsement of herbal remedies, particularly those featuring neem, clove, and turmeric, has bolstered their credibility in dental care. Furthermore, the advent of nanotechnology in herbal formulations promises to boost the bioavailability of these ingredients, bridging the performance gap with conventional products. This innovation is paving the way for hybrid products that meld traditional herbal elements with cutting-edge delivery systems, catering to the changing preferences of consumers. Yet, manufacturers face a challenge: navigating the intricate web of regulatory standards that differ widely across regions, especially when it comes to defining and standardizing natural products.

Sensitive tooth-based toothpaste gaining popularity

The aging population's susceptibility to dentin exposure and gum recession is driving demand for sensitivity-focused toothpaste. In 2023, 19% of U.S. adults reported toothache-related issues, highlighting a market opportunity for targeted oral care solutions . Premium-priced products with clinically validated ingredients like potassium nitrate and strontium chloride appeal to healthcare professionals and informed consumers. Industry leaders are addressing specific oral health needs; for instance, in February 2025, Sensodyne launched its Clinical Repair range, including Deep Clean and Active White variants. Rising demand for whitening products, despite sensitivity challenges, is fostering innovation in dual-benefit formulations. Consumer education and dental professionals remain critical to driving product adoption.

Prevalence of traditional way of tooth cleaning

Traditional oral hygiene practices, such as the use of neem sticks and miswak, continue to limit the penetration of toothpaste in rural and economically disadvantaged markets, particularly in Sub-Saharan Africa and South Asia. These practices, rooted in generational knowledge and perceived natural benefits, create resistance to commercial toothpaste adoption that extends beyond affordability challenges. The World Health Organization reports that only 1.5 billion people globally use fluoride toothpaste regularly, despite its proven effectiveness in preventing dental caries, underscoring the persistence of traditional methods even in markets with improving economic conditions . This issue is further exacerbated by inadequate oral health education infrastructure in rural areas, where traditional methods are often regarded as culturally relevant and environmentally sustainable. To address this, manufacturers must implement culturally aligned marketing strategies and develop cost-effective product formulations that facilitate a gradual transition, while respecting traditional practices and addressing concerns about chemical ingredients.

Other drivers and restraints analyzed in the detailed report include:

- Aggressive marketing and advertising by brands

- Product differentiation in terms of ingredients and functionality

- Concern over chemical ingredients used

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Functional and medicated toothpaste lines, growing at a 2.55% CAGR, are outpacing the mature standard class, which still holds 55.45% of revenue. Consumers are increasingly paying premiums for targeted relief or cosmetic benefits, despite plateauing volumes. Dentist-endorsed products command a 25% price premium, stabilizing margins amid rising raw material costs. Meanwhile, private-label brands are commoditizing the lower market end, pushing branded players to accelerate innovation and strengthen patent protections. Ingredients like arginine, stannous fluoride, and herbal synergists are driving functional toothpaste growth, supported by modular manufacturing that reduces scale-up time.

While standard toothpaste variants continue to dominate market penetration owing to retailers' focus on high-turn SKUs and consumers' reliance on familiar sensory cues, there's a shift underway. Omnichannel shelf algorithms are increasingly spotlighting problem-solution keywords, bridging the discovery gap that once hindered specialized pastes. Looking ahead, functional sub-brands are poised to capture nearly one-third of the toothpaste market. However, this growth hinges on companies consistently updating their claims with verifiable in vivo data and exercising price discipline to prevent downgrading in more cost-sensitive segments.

Conventional formulas dominated with 74.35% share in 2024, yet natural and organic alternatives expanded 2.95% annually. The natural toothpaste segment is experiencing accelerated growth in the Asia-Pacific region, driven by consumer trust in Ayurveda-based ingredients. Leading companies are incorporating neem, charcoal, and coconut derivatives with low-dose fluoride to deliver a balance of performance and safety. Differentiation in the competitive landscape is achieved through ingredient-origin narratives, recyclable packaging, and cruelty-free certifications.

Although the natural toothpaste market remains relatively small in absolute revenue terms, its high gross margins and strong brand-community engagement enhance profitability. However, regulatory harmonization remains a challenge, as inconsistent definitions of 'natural' require multinational companies to manage region-specific compliance, increasing operational complexity. Over the forecast period, hybrid toothpaste formulations combining botanical actives with clinically validated synthetic ingredients are expected to attract crossover consumers, mitigating the risk of cannibalization across product tiers.

The Toothpaste Market Report is Segmented by Product Type (Standard Toothpaste, Functional/Medicated Toothpaste), Category (Conventional, Natural/Organic), End User (Kids, Adults), Distribution Channel (Supermarkets/Hypermarkets, Convenience/Grocery Stores, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, the Asia-Pacific region contributed 34.57% of global revenues and is projected to achieve a 4.25% CAGR, outperforming all other regions. Key growth drivers include high population density, an expanding middle class, and government-supported oral health initiatives. Rural households are increasingly shifting from traditional neem twigs to modern packaged toothpaste, driven by messaging that highlights hygienic convenience. Local players such as Patanjali and Lion are intensifying competition with culturally relevant herbal products, prompting multinational companies to adapt by localizing flavors with ingredients like miswak and matcha.

North America, a mature yet high-value market, is experiencing stable volumes alongside a noticeable premiumization trend. Consumer preferences for sustainability and ingredient transparency are shaping purchasing decisions, leading to the early adoption of recyclable HDPE tubes and fluoride-xylitol hybrid toothpaste. Additionally, regulatory guidance from the FDA on maximum fluoride ppm has strengthened consumer trust, enabling mid-single-digit value growth despite stagnant volumes.

Europe, similar to North America in market maturity, places a stronger emphasis on sustainability, driving rapid adoption of mono-material barrier tubes certified for curbside recycling. However, rising price pressures are mitigated by the growing presence of discount retailers in Southern and Eastern Europe, necessitating cost optimization even for eco-friendly product lines. While Western Europe's toothpaste market remains significant, price-sensitive consumers are increasingly opting for store brands. To counter this shift, leading brands are employing digital coupons and loyalty app strategies to secure shelf space.

- The Procter and Gamble Company

- Unilever PLC

- Colgate-Palmolive Company

- Haleon PLC

- Lion Corporation

- Dabur India Limited

- Church and Dwight Co. Inc.

- Sunstar Group

- Katjes International GmbH & Co. KG

- Yunnan Baiyao Group Co. Ltd.

- Vicco Laboratories Ltd

- Livionex Inc

- Perrigo Company plc

- Himalaya Global Holdings Ltd.

- Kao Corporation

- Amway Corporation (Glister)

- Patanjali Ayurved Limited

- Ludovico Martelli Srl (Marvis)

- The Honest Company Inc.

- Dr. Bronner's Magic Soaps

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing consumer shift toward herbal and natural formulation-based products

- 4.2.2 Sensitive tooth-based toothpaste gaining popularity

- 4.2.3 Aggressive marketing and advertising by brands

- 4.2.4 Product differentiation in terms of ingredients and functionality

- 4.2.5 Favorable government initiatives on oral hygiene

- 4.2.6 Deterring oral health surge market growth

- 4.3 Market Restraints

- 4.3.1 Prevalence of traditional way of tooth cleaning

- 4.3.2 Concern over chemical ingredients used

- 4.3.3 Fluctuating raw material prices

- 4.3.4 Availablity of counterfeit products

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Standard Toothpaste

- 5.1.2 Functional/Medicated Toothpaste

- 5.2 By Category

- 5.2.1 Conventional

- 5.2.2 Natural/Organic

- 5.3 By End User

- 5.3.1 Adult

- 5.3.2 Kids

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarkets

- 5.4.2 Convenience/Grocery Stores

- 5.4.3 Pharmacies/Drug Stores

- 5.4.4 Online Retail Stores

- 5.4.5 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 The Procter and Gamble Company

- 6.4.2 Unilever PLC

- 6.4.3 Colgate-Palmolive Company

- 6.4.4 Haleon PLC

- 6.4.5 Lion Corporation

- 6.4.6 Dabur India Limited

- 6.4.7 Church and Dwight Co. Inc.

- 6.4.8 Sunstar Group

- 6.4.9 Katjes International GmbH & Co. KG

- 6.4.10 Yunnan Baiyao Group Co. Ltd.

- 6.4.11 Vicco Laboratories Ltd

- 6.4.12 Livionex Inc

- 6.4.13 Perrigo Company plc

- 6.4.14 Himalaya Global Holdings Ltd.

- 6.4.15 Kao Corporation

- 6.4.16 Amway Corporation (Glister)

- 6.4.17 Patanjali Ayurved Limited

- 6.4.18 Ludovico Martelli Srl (Marvis)

- 6.4.19 The Honest Company Inc.

- 6.4.20 Dr. Bronner's Magic Soaps

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK