Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692019

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692019

China Animal Protein - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 217 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

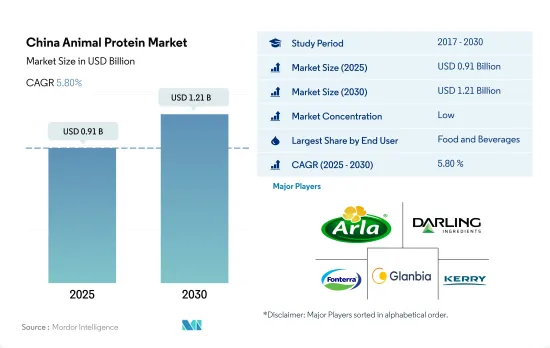

The China Animal Protein Market size is estimated at 0.91 billion USD in 2025, and is expected to reach 1.21 billion USD by 2030, growing at a CAGR of 5.80% during the forecast period (2025-2030).

Protein-infused products demand lead the domination of food and beverages sector in the country

- Animal protein has major applications in the Chinese food and beverage industry. The beverages segment accounted for a major share of the overall market, holding 27% of the volume in 2022, followed by the snacks segment, which accounted for a volume share of 20.52% in 2022. The food and beverage segment is likely to outpace other applications in terms of volume, recording an expected CAGR of 5.06% during the forecast period (2023-2029). This situation is attributed to the rising disposable incomes of consumers. In 2021, an average household in China spent approximately USD 98.67 per capita on buying snacks and beverages per year.

- The increased consumption of whey protein in the snacks and beverages sub-segments contributed to its huge market share. Many companies are actively working to gain larger shares in the market. Nutritional Growth Solutions Ltd (NGS) is developing protein-infused beverages to tap into the growing market. In 2020, the company launched a Healthy Height Whey Protein shake, specially made for children. In October 2020, Chinaprotein Bar Ffit8 recorded the biggest sales value for its protein bars, recorded at USD 2.74 million. The company adds whey protein hydrolysate to its products. The added WPH aids in the rapid absorption of amino acids in the body.

- Supplements and animal feed are the other major end-user industries for animal protein, holding prominent shares in the market. In terms of growth, the personal care and cosmetics segment outpaced other segments. It is expected to record a CAGR of 8.59% in terms of value during the forecast period. In 2020, the sector held less than 1% of the market volume and value. The rising demand for premium beauty products with identifiable ingredients is expected to boost the market.

China Animal Protein Market Trends

Animal protein's consumption growth fuels opportunities for key players in the ingredients segment

- The graph given depicts the per capita consumption of animal protein in China. In the past, adults across China mainly ignored milk and dairy products (including milk protein) because they were seen as food for children or the elderly. However, this trend has changed in recent years. The nation of nearly 1,400 million people is now the second-largest consumer of dairy products in the world. China imports products from various other countries, ranging from New Zealand-based dairies to German industries. The Chinese animal protein market has witnessed a huge demand for high-quality protein ingredients from health-conscious people. The per capita consumption increased from 40 grams in 2016 to 45.1 grams in 2021.

- Organic milk protein is most widely consumed in China. The organic segment witnesses a dynamic demand, with around 57% of mothers considering organic products. Arla Foods introduced two innovative 'organic kiddies snack' concepts by using its Nutrilac range of functional protein ingredients in 2021. Fonterra launched SureProteinTM SoftBar 1000, a milk protein bar that is exceptionally soft and has a relatively short chew time.

- The Chinese market is witnessing rapid growth in the demand for collagen protein in food applications. This product is already well-established and marketed in Western countries. Its demand in China is being fueled by the rising awareness of the impact of beauty-oriented nutritional products. This trend is known as "oral beauty" or "beautiful eating" in China. China is the largest market for whey protein in Asia-Pacific. The Chinese personal care market witnessed an increase in the demand for whey protein as it is widely used in the production of various weight management and beauty products.

China's domestic meat production increased due to the outbreak of African Swine Fever

- Meat from cattle, chicken, and pig with bone, raw milk from cattle and goats, skim milk of cows, and dry whey powder make up the production of animal protein, and the same data is given in the graph. The Dietary Guidance for Chinese Residents recommends a daily intake of 300 grams of dairy products. The US exports skimmed milk powder, cheese, and whey powder following the implementation of the Section 301 tariff exclusion. The Chinese government promotes processed dairy products, including cheese, whey, and butter, as good sources of protein.

- In 2020, milk production in China witnessed moderate growth due to the COVID-19 pandemic. This was mainly due to transport restrictions and reduced dairy processing activities. The fall in production was mainly observed in small farms. Large farms were less affected due to contract farming with major dairy manufacturers. The production of most dairy products, including fluid milk, dropped by 5%-11% in 2020. China's import of fluid milk increased to 980,000 MT in 2021, as per the USDA. The European Union is the major supplier of fluid milk to China, followed by New Zealand.

- China's domestic beef production increased due to the outbreak of African Swine Fever. Beef was promoted in China as a healthy protein option in salads or processed ready-to-eat meal packs. In December 2022, China's National Conference of Agricultural and Rural Affairs decided to set an annual pork production target of 55 million metric tons for the country's five-year plan, which is approximately 35% above the current production rate. Cattle and pigs across the country account for large-scale breeding and production purposes, thereby providing sufficient raw material for collagen production.

China Animal Protein Industry Overview

The China Animal Protein Market is fragmented, with the top five companies occupying 29.67%. The major players in this market are Arla Foods AmbA, Darling Ingredients Inc., Fonterra Co-operative Group Limited, Glanbia PLC and Kerry Group PLC (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 90185

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 End User Market Volume

- 3.1.1 Baby Food and Infant Formula

- 3.1.2 Bakery

- 3.1.3 Beverages

- 3.1.4 Breakfast Cereals

- 3.1.5 Condiments/Sauces

- 3.1.6 Confectionery

- 3.1.7 Dairy and Dairy Alternative Products

- 3.1.8 Elderly Nutrition and Medical Nutrition

- 3.1.9 Meat/Poultry/Seafood and Meat Alternative Products

- 3.1.10 RTE/RTC Food Products

- 3.1.11 Snacks

- 3.1.12 Sport/Performance Nutrition

- 3.1.13 Animal Feed

- 3.1.14 Personal Care and Cosmetics

- 3.2 Protein Consumption Trends

- 3.2.1 Animal

- 3.3 Production Trends

- 3.3.1 Animal

- 3.4 Regulatory Framework

- 3.4.1 China

- 3.5 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 4.1 Protein Type

- 4.1.1 Casein and Caseinates

- 4.1.2 Collagen

- 4.1.3 Egg Protein

- 4.1.4 Gelatin

- 4.1.5 Insect Protein

- 4.1.6 Milk Protein

- 4.1.7 Whey Protein

- 4.1.8 Other Animal Protein

- 4.2 End User

- 4.2.1 Animal Feed

- 4.2.2 Food and Beverages

- 4.2.2.1 By Sub End User

- 4.2.2.1.1 Bakery

- 4.2.2.1.2 Beverages

- 4.2.2.1.3 Breakfast Cereals

- 4.2.2.1.4 Condiments/Sauces

- 4.2.2.1.5 Confectionery

- 4.2.2.1.6 Dairy and Dairy Alternative Products

- 4.2.2.1.7 RTE/RTC Food Products

- 4.2.2.1.8 Snacks

- 4.2.3 Personal Care and Cosmetics

- 4.2.4 Supplements

- 4.2.4.1 By Sub End User

- 4.2.4.1.1 Baby Food and Infant Formula

- 4.2.4.1.2 Elderly Nutrition and Medical Nutrition

- 4.2.4.1.3 Sport/Performance Nutrition

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 5.4.1 Arla Foods AmbA

- 5.4.2 Darling Ingredients Inc.

- 5.4.3 Fonterra Co-operative Group Limited

- 5.4.4 FoodChem International Corporation

- 5.4.5 Gansu Hua'an Biotechnology Group

- 5.4.6 Glanbia PLC

- 5.4.7 Kerry Group PLC

- 5.4.8 Koninklijke FrieslandCampina NV

- 5.4.9 Linxia Huaan Biological Products Co. Ltd

- 5.4.10 Luohe Wulong Gelatin Co. Ltd

6 KEY STRATEGIC QUESTIONS FOR PROTEIN INGREDIENTS INDUSTRY CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.