PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685760

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685760

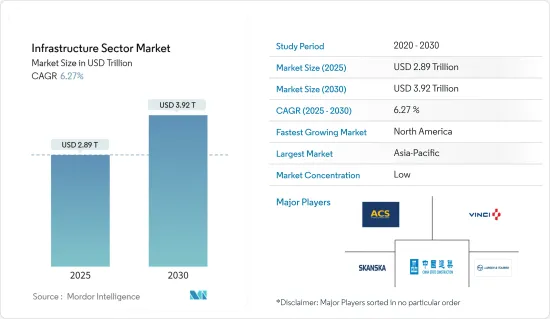

Infrastructure Sector - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Infrastructure Sector Market size is estimated at USD 2.89 trillion in 2025, and is expected to reach USD 3.92 trillion by 2030, at a CAGR of 6.27% during the forecast period (2025-2030).

Key Highlights

- COVID-19 had a negative impact on national economies and the economic livelihood of governments, businesses, and individuals. But significantly lower usage rates in infrastructure during the pandemic and the resulting shortfall in financing and maintenance received the attention of local and national governments, which focused on allocating financial resources to meet the immediate needs of healthcare and supply chains during the pandemic. COVID-19 caused a demand and supply shock that resulted in construction interruptions or delays due to a lack of personnel, supply chain disruptions, or delays in government approvals throughout the world. In many sectors, assets dependent on user fees faced a dramatic decrease in demand, resulting in substantial revenue losses for project sponsors. This increased project risks, such as default events, termination, insolvency, or governments breaching contracts.

- Although heavily impacted by the disruptions caused by the COVID-19 pandemic, the global infrastructure construction output still expanded in 2020, as governments around the world sought to stimulate economic activity through investments in transport infrastructure and clean energy.

- Ultimately, the global shift to sustainable infrastructure requires interventions and collaborative action from multiple participants. The interventions include not just public-private cooperation and consolidated effort but also new ways of measuring the impact and developing innovative instruments geared to financing green infrastructure projects. Factors important at a national and regional level include regulatory frameworks, subsidies, and tax regimes. These overlapping considerations mean that funding and building sustainable infrastructure is arguably one of the biggest and most complex challenges the global financial and political system has ever faced. But it is a challenge that must be overcome.

- Infrastructure is relatively underinvested in advanced technologies compared to other capital-intensive industries. In the current environment, pressure due to capacity reduction and the rising costs may encourage asset owners and project managers to accelerate the adoption of technologies such as artificial intelligence and robotics. There is also an opportunity to reduce maintenance capital expenses using technologies such as intelligent drones. These drones lessen the need for onsite workers, thus increasing safety. They can dramatically improve preventative maintenance, inspecting, and scoping. They work faster than existing methods and provide more detailed information about required repairs.

- More broadly, the shift to remote working arrangements across many industries has underlined the growing need for secure, resilient, cloud-based technologies, and connective infrastructure. Growing usage of cloud technology is expected to boost the demand for data transmission and storage assets including fiber networks, data, edge datacentres, and telecommunication towers that are already popular among infrastructure investors.

Infrastructure Construction Market Trends

Growing Investment in Transport Infrastructure

According to the research, until 2040, more than USD 2 trillion worth of investments in transport infrastructure is expected annually to support economic growth. Stakeholders are under pressure to accelerate infrastructure development due to rapid urbanization, soaring freight service demand, and the COVID-19 response stimulus programs in several nations.

The rapid pace of development and continuous urbanization is a key factor in the expenditure on transport infrastructure. The Federal Aviation Administration (FAA) of the US Department of Transportation gave funds totaling more than USD 479 million for airport infrastructure in 2021 to 123 projects at airports in all 50 states, Puerto Rico, and American Samoa.

For the past two-three years, aviation travel was halted due to the global pandemic. The CAAC (Civil Aviation Administration of China) said that by the end of 2020, China had 241 accredited transport airports. About 114 airport construction projects were either started or continued during the pandemic, and there were 58 more airports overall compared to that just eight years earlier.

SURGING INFRASTRUCTURE INVESTMENT IN ASIA-PACIFIC

Infrastructure is a major target of the pandemic response and stimulus measures adopted by advanced countries and regions, which are expected to boost global project finance. Asia was the only region to demonstrate growth in project numbers and values.

FDI inflows to the Asia-Pacific region were steady during the pandemic; the region stood out as a desirable location for foreign investors. For instance, the Government of India received considerable and consistent inflows of FDI (foreign direct investment) over the past ten years, despite the country's GDP decelerating steadily in recent years.

Infrastructure is one of the key elements that help the Indian economy grow and remain competitive in the industrial sector, leading to better growth. The possibility of infrastructure projects overrides bureaucratic delays, implementation delays, and delays in the implementation of land acquisition policies, the three major obstacles facing India's infrastructure sector.

To speed up infrastructure projects, the present administration has pledged to minimize these delays, simplify the process, and promote transparency. A number of infrastructure projects totaling INR 111 lakh crore (USD 1.5 trillion) were announced by the government as part of the NIP (National Infrastructure Pipeline) for FY 2019-25.

The government initially allocated the amount for 6,835 projects, but by the end of 2021, that number had increased to 7,400. Majority of the project's worth comprises roads, housing, urban development, railroads, renewable energy, conventional power, and irrigation.

The Philippines' government pushed for infrastructure development to spark a significant economic recovery in 2021. The Department of Public Works and Highways received USD 6.5 billion for bridge construction, flood management, asset preservation, and transportation network development as part of the 2021 national budget, which placed a heavy emphasis on infrastructure projects.

For investments in rail transportation, land public transportation, and maritime infrastructure, the Department of Transportation received USD 1.3 billion.

Infrastructure Construction Industry Overview

The global infrastructure construction market is highly fragmented and competitive, with a mix of domestic and international players existing in all countries and regions.

Some of the top players worldwide include ACS Actividades de Construccion y Servicios SA (ACS Group), VINCI, China State Construction Engineering Corp. Ltd, Skanska AB, Larsen & Toubro, Kajima Corporation, Hochtief Aktiengesellschaft, China Communications Construction Group Ltd, Balfour Beatty, Bouygues Group, Fluor Corporation, and Hyundai Engineering & Construction Co. Ltd (HDEC).

There are many types of construction sectors that are considered part of the industry. Building, engineering, specialty construction, and planning and development are a few sectors that comprise this booming industry. The revenue generated by the global construction industry significantly increased in recent years. European and Chinese construction contractors generated the largest share of construction contract revenues worldwide.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Industry Outlook (Current Economic and Construction Market Scenario)

- 4.1.1 GDP, Fiscal Policy, Monetary Policy, Economic Activity

- 4.1.2 Inflation

- 4.1.3 Interest Rates

- 4.1.4 Exchange Rates

- 4.1.5 Consumer Confidence

- 4.1.6 Infrastructure Spending

- 4.1.7 Development Indices Ranking

- 4.2 Regulatory Environment, Compliance Processes, EHS Trends and Key Policy Initiatives for the Global Infrastructure Sector

- 4.3 Technological Innovations in the Construction Sector

- 4.4 Market Dynamics

- 4.4.1 Drivers

- 4.4.2 Restraints

- 4.4.3 Opportunities

- 4.4.4 Porter's Five Forces Analysis

- 4.4.5 Industry Value Chain Analysis

- 4.5 Impact of COVID - 19 on the Market

5 MARKET SEGMENTATION (Market Size By Value)

- 5.1 By Type

- 5.1.1 Social Infrastructure

- 5.1.1.1 Schools

- 5.1.1.2 Hospitals

- 5.1.1.3 Defense

- 5.1.1.4 Other Infrastructure

- 5.1.2 Transportation Infrastructure

- 5.1.2.1 Railways

- 5.1.2.2 Roadways

- 5.1.2.3 Airports

- 5.1.2.4 Ports

- 5.1.2.5 Waterways

- 5.1.3 Extraction Infrastructure

- 5.1.3.1 Oil and Gas

- 5.1.3.2 Other Extraction (Minerals, Metals, and Coal)

- 5.1.4 Utilities Infrastructure

- 5.1.4.1 Power Generation

- 5.1.4.2 Electricity Transmission & Distribution

- 5.1.4.3 Water

- 5.1.4.4 Gas

- 5.1.4.5 Telecoms

- 5.1.5 Manufacturing Infrastructure

- 5.1.5.1 Metal and Ore Production

- 5.1.5.2 Petroleum Refining

- 5.1.5.3 Chemical Manufacturing

- 5.1.5.4 Industrial Parks and Clusters

- 5.1.5.5 Other Infrastructure

- 5.1.1 Social Infrastructure

- 5.2 By Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Latin America

- 5.2.5 Middle East & Africa

6 GLOBAL INFRASTRUCTURE SECTOR- INVESTMENT ANALYSIS

- 6.1 Includes Direct Investment -Public, Private and PPP

- 6.2 Indirect Investment (INVITs, IOCs, Others)

- 6.3 EPC, BOT, Others-Infrastructure Project Financing Models and Market Trends

7 COMPETITIVE LANDSCAPE

- 7.1 Competition Overview (Overview and Market Share Analysis)

- 7.2 Company Profiles

- 7.2.1 ACS Actividades de Construccion y Servicios S.A. (ACS Group)

- 7.2.2 VINCI SA

- 7.2.3 China State Construction Engineering Corporation Ltd

- 7.2.4 Skanska AB

- 7.2.5 Larsen & Toubro

- 7.2.6 Kajima Corporation

- 7.2.7 Hochtief Aktiengesellschaft

- 7.2.8 China Communications Construction Group Ltd

- 7.2.9 Balfour Beatty

- 7.2.10 Bouygues Group

- 7.2.11 Fluor Corporation

- 7.2.12 Hyundai Engineering & Construction Co. Ltd (HDEC)*

8 FUTURE OUTLOOK OF THE MARKET