PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408842

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408842

Canada Student Loans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

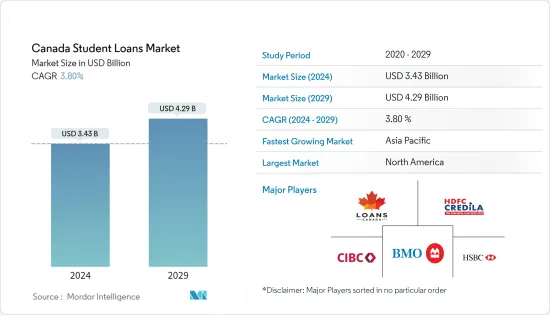

The Canada Student Loans Market size is estimated at USD 3.43 billion in 2024, and is expected to reach USD 4.29 billion by 2029, growing at a CAGR of 3.80% during the forecast period (2024-2029).

In Canada, students can apply for grants and loans to help them pay for their post-secondary education through the Canada Student Financial Assistance Program. The support is available for both full-time and part-time students. The application is done through the student's province or territory of residence. There is no need to pay back grants, and the loans become payable after finishing post-secondary education. There are huge variations in the cost of undergraduate tuition fees depending on the field of study, with degrees in the medical field being the most expensive. The highest tuition fees in 2021/22 were for dentistry, USD 22,731, medicine, USD 14,604, and veterinary medicine, USD 14,374. However, graduates from these programs are likely to have a higher median employment income two years after graduating compared to other fields of study.

In recent years, higher education tuition fees have been on the rise, and so has the amount of student debt in Canada. Even though Canadian students can receive grants and loans from the Canada Student Financial Assistance Program, many are forced to use student credit cards, student lines of credit, and personal bank loans to cover the rising cost of fees and living. Approximately 1.9 million Canadians owed the federal government a total of USD 23.5 billion in student loans as of July 2022, a number that only keeps growing further when including provincial loans and private debt. The tuition fees are now 13 times more than they were 50 years ago. Over 1.7 million Canadians have student loans.

Canada Student Loans Market Trends

Increased Cost of Tuition Fees is Driving the Market

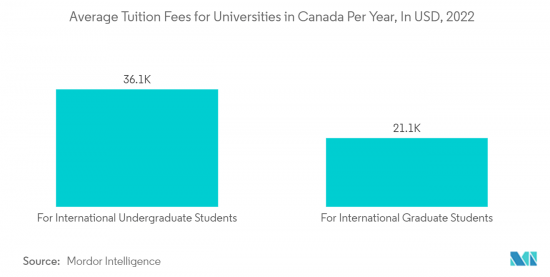

Canada is a popular study destination for international students, offering prestigious universities, vivid student cities, and a well-organized lifestyle. Tuition fees in Canada for international students in 2023 reflect the many opportunities the country has to offer: there are both expensive and cheap universities in Canada. Tuition fees at Canadian universities are a bit high but generally lower as compared to countries like the United Kingdom, US, or Australia. University fees may vary yearly.

Full-time students enrolled in undergraduate programs paid USD 6,693 in tuition fees in the 2021-2022 academic year. The average fees were up 1.7% from the previous year. The average cost of graduate programs rose by 1.5% to USD 7,472. The fees did not change in Ontario or Newfoundland and Labrador but rose in other provinces and territories. Increases in undergraduate tuition fees ranged from 1.1% in Prince Edward Island to Alberta's 7.5%. The large increase in Alberta was because of the restructuring of tuition fees in the whole province. This is expected to lead to the growth of the student loan market in Canada.

Canada Student Financial Assistance Program is Expected to Boost Growth of the Market

The Government of Canada recognizes the importance of student financial assistance to help post-secondary students achieve their educational goals and, ultimately, succeed as contributing members of a productive workforce. Through the CSFA Program, the Government of Canada funds about 60% of a full-time student's financial need. The province or territory covers the remaining 40%. In this way, the CSFA Program works collaboratively with provincial and territorial governments to deliver student financial assistance to eligible students. Quebec, Nunavut, and the Northwest Territories do not participate in the CSFA Program but receive annual alternative payments in support of their student financial assistance programs. Applicants in the remaining 10 jurisdictions are assessed for federal and provincial grants and loans through a single application process.

In the 2021 to 2022 academic year, over 763,000 post-secondary students received financial assistance from the CSFA Program in the form of grants, loans, or in-study interest subsidies. The CSFA Program provided USD 3.3 billion in non-repayable Canada Student Grants (CSGs) to approximately 544,000 students and USD 2.9 billion in Canada Student Loans (CSLs) to 558,000 students. In addition, the 3 non-participating jurisdictions will receive USD 999.2 million in alternative payments based on the CSFA Program's expenses and revenues for the 2021 to 2022 academic year.

Canada Student Loans Industry Overview

The Canadian education/student loans market is consolidated. The Government of Canada, through the Canada Student Loans Program, provides the majority of student loans to Canadian students. Some of the major players in the market are Loans Canada, HDFC Credila, CIBC Bank, BMO Bank, and HSBC Bank.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Higher Education Demand is Driving the Market

- 4.2.2 Government Initiatives are Driving the Market

- 4.3 Market Restraints

- 4.3.1 Risk of Default is Restraining the Market

- 4.4 Market Opportunities

- 4.4.1 Technology Integration is Providing Market Opportunities

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights on Current Trends and Innovations in the Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Federal/Government Loan

- 5.1.2 Private Loan

- 5.2 By Repayment Plan

- 5.2.1 Standard Repayment Plan

- 5.2.2 Graduated Repayment Plan

- 5.2.3 Repayment Plan, Revised Pay As You Earn (REPAYE)

- 5.2.4 Income Based

- 5.2.5 Other Repayment Loans

- 5.3 By Age Group

- 5.3.1 24 or Younger

- 5.3.2 25 to 34

- 5.3.3 Above 35

- 5.4 By End-User

- 5.4.1 Graduate Students

- 5.4.2 High School Student

- 5.4.3 Other End-Users

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Loans Canada

- 6.2.2 HDFC Credila

- 6.2.3 CIBC Bank

- 6.2.4 BMO Bank

- 6.2.5 HSBC Bank

- 6.2.6 ICICI Bank

- 6.2.7 EliteScholars

- 6.2.8 Auxilo

- 6.2.9 Incred

- 6.2.10 Avanse*

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 DISCLAIMER AND ABOUT US