Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408816

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408816

UK Student Loan - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

PUBLISHED:

PAGES: 100 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

The UK education/student loans market is valued at USD 21.10 billion and is expected to register a CAGR of 7% during the forecast period.

Key Highlights

- Student loans are the main method of direct government support for higher education students. Money is loaned to students at a subsidized rate to help with their maintenance costs and to cover the cost of tuition fees. In the year 2021-22, there were 2.86 million students at UK higher education institutions. Over the past decade, the number of entrants to 'other undergraduate' courses has fallen by almost two-thirds. The large majority of these courses are for part-time UK students.

- There were 7,67,000 applications for full-time undergraduate places through the Universities and Colleges Admissions Service (UCAS) in 2022, out of which around 5,60,000 of these applicants were accepted. Currently, GBP 20 billion (USD 27.40 billion) a year is loaned to around 1.5 million students in England each year. The value of outstanding loans at the end of March 2023 reached GBP 206 billion (USD 282.22 billion). The ten most affordable UK cities for students across 21 popular university cities are Cardiff, Cambridge, Southampton, Sheffield, Coventry, York, Durham, Oxford, Bristol, and Birmingham. These cities are known to offer the best value for money when it comes to the cost of living about monthly income.

UK Student Loan Market Trends

High Tuition Fees is Driving the Market

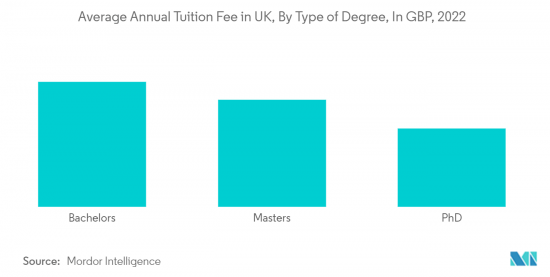

- The United Kingdom is the ultimate study destination for many international students because of the academic excellence and student life it offers. Studying in the UK can be an expensive affair, which is why it regularly features in the list of the top 5 most expensive study abroad destinations. However, if you look at the brighter side, the duration of the majority of courses in the UK is very short, which reduces the overall cost.

- The approximate cost of studying at UK private and public universities varies between GBP 4,180 to GBP 29,259 (USD 5705 to USD 40045) annually. Besides, as an international student, one has to incur several fees while studying in the country. Therefore, it becomes crucial to smartly plan expenditures. The cost of studying in the UK is divided into three parts, i.e., cost of education, living expenses, and other essential expenses.

- The international students in the UK for medical degrees and MBAs are higher compared to tuition fees for humanities and social science degrees. Living expenses are another important part of the total cost of studying in the UK from India or other international cities. They include paying for accommodation, food, transportation, household bills, shopping, other leisure activities, etc. The average monthly cost of living in the UK is around GBP 1100 - GBP 1300 (USD 1507 - USD 1781).

England has the Highest Number of Student Loans Debts

- Loans to students in England are far higher than those in other countries in the UK. Students in Scotland, where tuition is free for residents, have GBP 15,400 (USD 21098) in outstanding loans on average. In contrast, students from Wales owe GBP 35,500 (USD 48395), and those from Northern Ireland owe GBP 24,500 (USD 33545) after graduation. The outstanding student loans in England have surpassed GBP 200 billion (USD 274 billion) for the first time in 20 years, earlier than previous government forecasts, as the number of students at universities continues to outstrip expectations.

- The Student Loans Company (SLC) revealed that the average amount owed by graduating students had risen again and now sits at just under GBP 45,000. England's undergraduate population has swelled more rapidly than expected, while postgraduate students have also been able to take out loans. Currently, GBP 20 billion (USD 27.40 billion) a year is loaned to around 1.5 million students in England each year. The value of outstanding loans at the end of March 2023 reached GBP 206 billion (USD 282 billion). The Government forecasts the value of outstanding loans to be around GBP 460 billion (USD 629 billion) (202122 prices) by the mid-2040s.

UK Student Loan Industry Overview

The UK Education/Student Loans Market is relatively fragmented. There are various providers including government-backed loans, private banks, and alternative lenders offering different types of loans for education. Some of the major players in the market are Lendwise, Prodigy Finance Student Loan, HSBC Student Loan, CUJ Loans, and The Global Student Loan.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50001407

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Higher Education is Driving the Market

- 4.2.2 Government Support is Driving the Market

- 4.3 Market Restraints

- 4.3.1 Economic Uncertainty is Restricting the Market

- 4.4 Market Opportunities

- 4.4.1 Leveraging Technology and Fintech

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights on Current Trends and Innovations in the Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Federal/Government Loan

- 5.1.2 Private Loan

- 5.2 By Repayment Plan

- 5.2.1 Standard Repayment Plan

- 5.2.2 Graduated Repayment Plan

- 5.2.3 Revised Pay As You Earn (REPAYE)

- 5.2.4 Income-based

- 5.2.5 Other Repayment Plans

- 5.3 By Age Group

- 5.3.1 24 or Younger

- 5.3.2 25 to 34

- 5.3.3 Above 35

- 5.4 By End-User

- 5.4.1 Graduate Students

- 5.4.2 High School Student

- 5.4.3 Other End-Users

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Lendwise

- 6.2.2 Prodigy Finance Student Loan

- 6.2.3 HSBC Student Loan

- 6.2.4 CUJ Loans

- 6.2.5 The Global Student Loan

- 6.2.6 HDFC Bank

- 6.2.7 Canara Bank

- 6.2.8 Punjab National Bank

- 6.2.9 Bank of Baroda

- 6.2.10 State Bank of India*

7 FUTURE OF THE MARKET

8 DISCLAIMER AND ABOUT US

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.