PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708219

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708219

Tea Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

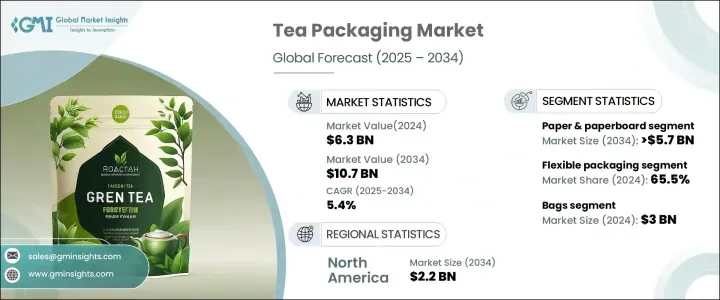

The Global Tea Packaging Market was valued at USD 6.3 billion in 2024 and is projected to grow at a CAGR of 5.4% between 2025 and 2034. This growth is fueled by the rising global consumption of tea, the rapid expansion of ready-to-drink options, and the increasing demand for premium tea products. As tea remains the second most widely consumed beverage globally, packaging manufacturers are under constant pressure to develop innovative and high-quality solutions that preserve freshness and aroma while maintaining cost-effectiveness. Modern tea consumers prioritize sustainability, driving the need for packaging made from biodegradable and recyclable materials. Brands that align with these environmental preferences are gaining a competitive edge by adopting eco-friendly packaging solutions.

Additionally, the growing popularity of organic and specialty teas is accelerating the demand for premium packaging that reflects the high-quality nature of the product. Packaging designs that incorporate resealable options, moisture barriers, and light protection are becoming standard features, ensuring product longevity and enhancing the consumer experience. As global tea consumption trends point toward healthier lifestyles and increased interest in specialty beverages, the need for advanced and sustainable packaging solutions is expected to drive substantial market growth. Moreover, the rise of e-commerce has increased the need for sturdy, attractive, and functional packaging capable of withstanding the rigors of shipping while maintaining product integrity.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.3 Billion |

| Forecast Value | $10.7 Billion |

| CAGR | 5.4% |

The tea packaging market is categorized by materials, including plastic, paper and paperboard, metal, and others. The paper and paperboard segment is expected to generate USD 5.7 billion by 2034, driven by the increasing preference for biodegradable and recyclable packaging. Many tea brands are shifting toward paper-based packaging due to its lightweight, compostable, and recyclable nature. Premium and specialty brands are also embracing crafted paperboard cartons to align with their environmentally friendly brand image and meet consumer expectations for sustainable practices. As consumer awareness around environmental impact grows, brands that offer compostable and reusable packaging options are experiencing higher customer loyalty and market differentiation.

Flexible packaging held a dominant 65.5% market share in 2024 due to its lightweight nature, cost-effectiveness, and superior ability to preserve the freshness of tea. This type of packaging, often made from laminated films, pouches, and resealable bags, provides exceptional protection against moisture, oxygen, and light, ensuring the tea maintains its quality for extended periods. As the demand for convenience and longer shelf life grows, flexible packaging solutions are becoming increasingly popular, especially for ready-to-drink and specialty teas.

The North America Tea Packaging Market is expected to reach USD 2.2 billion by 2034, propelled by the rising popularity of premium and organic tea products and a growing emphasis on sustainable packaging solutions. The U.S. market alone is forecasted to grow to USD 1.9 billion by 2034, driven by increased tea consumption, a shift toward higher-end organic products, and an ongoing preference for eco-conscious packaging. As consumers demand specialty teas that maintain freshness and authenticity, the need for packaging solutions that effectively preserve product quality has never been higher.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising tea consumption

- 3.2.1.2 Growing demand for sustainable packaging

- 3.2.1.3 Premiumization of tea products

- 3.2.1.4 Expansion of e-commerce

- 3.2.1.5 Rising popularity of ready-to-drink (RTD) teas

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Sustainability and environmental concerns

- 3.2.2.2 Fluctuating raw material costs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Material, 2021 – 2034 ($ Mn & Kilo Tons)

- 5.1 Key trends

- 5.2 Plastic

- 5.3 Paper & paperboard

- 5.4 Metal

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Packaging Type, 2021 – 2034 ($ Mn & Kilo Tons)

- 6.1 Key trends

- 6.2 Flexible packaging

- 6.3 Rigid packaging

Chapter 7 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn & Kilo Tons)

- 7.1 Key trends

- 7.2 Bags

- 7.3 Pouches

- 7.4 Stick pack & sachets

- 7.5 Jars & containers

- 7.6 Boxes & cartons

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 ANZ

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Amcor plc

- 9.2 Berry Global Inc.

- 9.3 Constantia Flexibles

- 9.4 Coveris

- 9.5 Duropack Limited

- 9.6 Huhtamaki

- 9.7 Mondi

- 9.8 Printpack

- 9.9 ProAmpac

- 9.10 Sappi

- 9.11 Sonoco Products Company

- 9.12 SPG-Pack

- 9.13 Sprinpak

- 9.14 Swisspac Packaging

- 9.15 Transcontinental Inc.

- 9.16 WestRock Company

- 9.17 Winpak LTD.