PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708134

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708134

Mechanical, Electrical, and Plumbing (MEP) Software Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

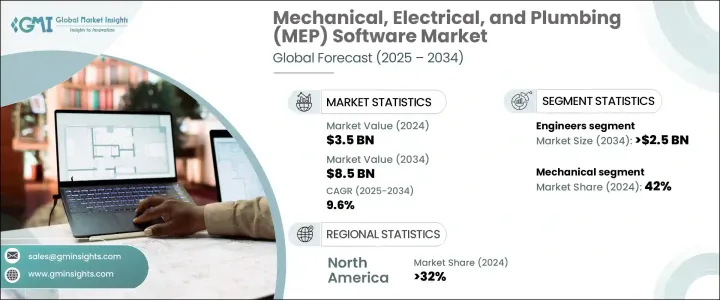

The Global MEP Software Market reached USD 3.5 billion in 2024 and is projected to grow at a CAGR of 9.6% between 2025 and 2034. The market is witnessing significant expansion, driven by the growing adoption of cutting-edge digital solutions in the construction industry. Increasing demand for seamless integration between mechanical, electrical, and plumbing components in modern buildings has made MEP software an essential tool for engineers, contractors, and architects. This software streamlines design, enhances collaboration, and minimizes project risks by identifying potential system conflicts before construction begins.

The rapid integration of Building Information Modeling (BIM) is a key growth driver. BIM facilitates data-rich 3D modeling, enabling multiple stakeholders to collaborate in real time and optimize building design. Engineers and contractors are increasingly leveraging this technology to detect inefficiencies, improve project execution, and reduce operational costs. The shift toward digital construction methodologies, coupled with the rising complexity of infrastructure projects, has fueled the widespread adoption of MEP software across various applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.5 Billion |

| Forecast Value | $8.5 Billion |

| CAGR | 9.6% |

Smart building technologies are further accelerating market growth. The rising incorporation of IoT, AI, and automation into commercial and residential buildings requires efficient MEP systems to support critical functions such as lighting, HVAC, and security. As more buildings transition to intelligent, interconnected systems, the demand for advanced MEP solutions continues to rise, ensuring optimized energy efficiency and sustainability. Governments and regulatory bodies worldwide are also pushing for energy-efficient building designs, creating lucrative opportunities for MEP software providers.

The market is segmented by end users, with engineers holding a 30% share in 2024. Engineers remain the primary adopters of MEP software due to their role in designing and implementing essential building systems. Their expertise in integrating mechanical, electrical, and plumbing components into construction projects continues to drive software demand, making this segment the dominant force in the market.

By application, the mechanical segment accounted for 42% of the market share in 2024, driven by the increasing need for advanced HVAC systems. MEP software is crucial in designing efficient heating, ventilation, and air conditioning solutions, ensuring optimal airflow distribution and indoor comfort. With the growing emphasis on energy-efficient climate control systems, the demand for MEP solutions in mechanical applications remains strong.

North America accounted for 32% of the MEP Software Market in 2024, supported by ongoing expansion in residential, industrial, and commercial construction. The surge in infrastructure projects across the region has intensified the need for innovative MEP solutions, enabling precise design, optimization, and management of critical building systems. The region's increasing focus on smart cities and green buildings further strengthens its position as a major contributor to market growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Software providers

- 3.2.2 Technology providers

- 3.2.3 Consulting and integration service providers

- 3.2.4 End Use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Use cases

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising demand for smart building technologies

- 3.9.1.2 Digitalization of the construction industry

- 3.9.1.3 Increased adoption of BIM (building information modeling)

- 3.9.1.4 Global urbanization and infrastructure development

- 3.9.1.5 Focus on energy efficiency and sustainability

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High initial costs and investment

- 3.9.2.2 Complexity of software integration

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Software, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 BIM-based

- 5.3 CAD-based

Chapter 6 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud-based

- 6.4 Hybrid

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Mechanical

- 7.3 Electrical

- 7.4 Plumbing

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Engineers

- 8.3 Contractors

- 8.4 Architects

- 8.5 Facility managers

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 4MCAD

- 10.2 ACCA Software

- 10.3 Access Technology

- 10.4 Aptus Engineering

- 10.5 Autodesk

- 10.6 Bentley Systems

- 10.7 Cadison

- 10.8 CYPE

- 10.9 Design Master Software

- 10.10 ePROMIS

- 10.11 eVolve MEP

- 10.12 Graphisoft

- 10.13 MagiCAD Group

- 10.14 Nemetschek Group

- 10.15 On Center Software

- 10.16 Procore

- 10.17 ProgeSOFT

- 10.18 Renga Software

- 10.19 SrinSoft

- 10.20 Trimble