PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928980

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928980

Construction Punch List Software Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

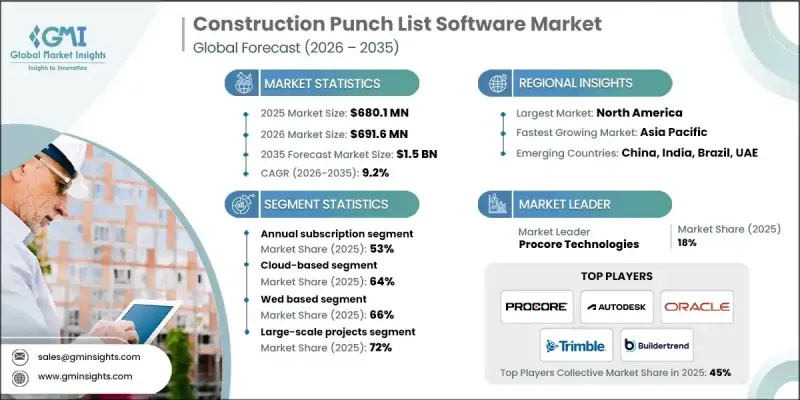

The Global Construction Punch List Software Market was valued at USD 680.1 million in 2025 and is estimated to grow at a CAGR of 9.2% to reach USD 1.5 billion by 2035.

Market growth reflects the increasing reliance of construction teams on digital tools to streamline issue identification, tracking, and resolution during project completion phases. Punch list software supports real-time coordination across stakeholders throughout the construction lifecycle, improving transparency and accountability. Adoption remains strongest in regions with mature construction sectors and high digital readiness. North America continues to lead due to early technology uptake and a well-established software-as-a-service environment, while Europe follows closely, supported by rigorous quality and compliance standards. The industry is evolving rapidly as digital transformation reshapes how quality control and closeout workflows are managed. Artificial intelligence-driven analysis is enhancing accuracy and efficiency by supporting automated identification of project deficiencies, while mobile-first development strategies are improving on-site usability and responsiveness. Cloud-based deployment has become the preferred model, offering scalability, continuous updates, multi-device accessibility, and secure data management without the burden of on-site infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $680.1 Million |

| Forecast Value | $1.5 Billion |

| CAGR | 9.2% |

The annual subscription models segment accounted for 53% share in 2025 and is projected to grow at a CAGR of 8.5% between 2026 and 2035. These plans provide predictable revenue streams for providers and simplify financial planning for construction firms by avoiding large upfront investments. Annual pricing structures are particularly appealing to contractors managing multiple projects simultaneously, as they balance cost efficiency with flexibility.

The cloud-based solutions represented 64% share in 2025 and are expected to grow at a CAGR of 9.7% through 2035. Cloud platforms enable seamless updates, scalable performance, and secure data storage while removing the need for dedicated hardware or internal IT resources. Shared infrastructure models further enhance efficiency while maintaining strong data protection standards.

U.S. Construction Punch List Software Market is forecast to grow at a CAGR of 7.1% from 2026 to 2035. The country maintains a leading global position due to high construction spending levels and widespread adoption of digital project management tools. A strong domestic technology ecosystem continues to provide contractors with early access to advanced software capabilities.

Key companies active in the Global Construction Punch List Software Market include Procore Technologies, Autodesk, Oracle, Trimble (Viewpoint), Buildertrend, Fieldwire, Deltek, Alpha Software, UDA Technologies, and Strata Systems. Companies operating in the Global Construction Punch List Software Market focus on strengthening their market position through product innovation, platform integration, and customer-centric development. Investment in artificial intelligence, automation, and analytics enhances software functionality and user value. Vendors prioritize cloud-native architectures to improve scalability and deployment speed while supporting remote collaboration. Strategic partnerships with construction firms and technology providers expand market reach and solution interoperability. Flexible pricing models and subscription offerings help attract a broader customer base.

Table of Contents

Chapter 1 Methodology

- 1.1 Research approach

- 1.2 Quality commitments

- 1.3 Research trail and confidence scoring

- 1.3.1 Research trail components

- 1.3.2 Scoring components

- 1.4 Data collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.6 Best estimates and calculations

- 1.6.1 Base year calculation for any one approach

- 1.7 Forecast model

- 1.8 Research transparency addendum

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Subscription Model

- 2.2.3 Deployment Model

- 2.2.4 Type

- 2.2.5 Project Size

- 2.2.6 End Use

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Rising digital adoption in construction

- 3.2.1.3 Need for better team collaboration

- 3.2.1.4 Focus on quality and timely completion

- 3.2.1.5 Mobile and cloud-based accessibility

- 3.2.1.6 Growth in large construction projects

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High implementation costs

- 3.2.2.2 Resistance to digital adoption

- 3.2.3 Market opportunities

- 3.2.3.1 Adoption of AI and automation for defect detection

- 3.2.3.2 Expansion in emerging markets with growing construction activities

- 3.2.3.3 Integration with BIM and project management tools

- 3.2.3.4 Demand for mobile-first and cloud-based solutions

- 3.2.3.5 Offering analytics for predictive maintenance and project efficiency

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 US- Building codes, OSHA standards, and digital construction mandates

- 3.4.1.2 Canada - National building code (NBC) and provincial digital construction initiatives

- 3.4.2 Europe

- 3.4.2.1 Germany- EU construction products regulation (CPR)

- 3.4.2.2 UK- BIM Level 2 mandate for public projects

- 3.4.2.3 France- RE2020 building regulation and digital construction compliance

- 3.4.2.4 Italy- National Recovery and Resilience Plan (PNRR)

- 3.4.3 Asia Pacific

- 3.4.3.1 China- Digital construction policies and Smart City initiatives

- 3.4.3.2 India- National BIM adoption guidelines and Smart Cities Mission

- 3.4.3.3 Japan- i-Construction initiative (MLIT)

- 3.4.3.4 Australia- National BIM and digital engineering frameworks

- 3.4.4 LATAM

- 3.4.4.1 Mexico- National BIM and digital engineering frameworks

- 3.4.4.2 Argentina- Building regulations and public infrastructure digitization

- 3.4.5 MEA

- 3.4.5.1 South Africa- National building regulations and digital compliance requirements

- 3.4.5.2 Saudi Arabia- Vision 2030 and national transformation program

- 3.4.1 North America

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Use cases & success stories

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly Initiatives

- 3.10.5 Carbon footprint considerations

- 3.11 Buyer Adoption & Purchasing Behavior

- 3.12 Functional Feature Benchmarking

- 3.13 Integration & Interoperability Landscape

- 3.14 Future outlook and opportunities

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Subscription Model, 2022 - 2035 ($Mn)

- 5.1 Key trends

- 5.2 Monthly

- 5.3 Annual

- 5.4 One-time license

Chapter 6 Market Estimates & Forecast, By Deployment Model, 2022 - 2035 ($Mn)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud-based

Chapter 7 Market Estimates & Forecast, By Type, 2022 - 2035 ($Mn)

- 7.1 Key trends

- 7.2 Web-Based

- 7.3 Mobile apps

Chapter 8 Market Estimates & Forecast, By Project Size, 2022 - 2035 ($Mn)

- 8.1 Key trends

- 8.2 Large-scale projects

- 8.3 Small and medium-sized projects

Chapter 9 Market Estimates & Forecast, By End Use, 2022 - 2035 ($Mn)

- 9.1 Key trends

- 9.2 General contractor

- 9.3 Sub-contractor

- 9.4 Plant engineering contractor

- 9.5 Architects & engineers

- 9.6 Building owners

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 ($Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.3.8 Benelux

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Singapore

- 10.4.7 Thailand

- 10.4.8 Indonesia

- 10.4.9 Vietnam

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Colombia

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Autodesk

- 11.1.2 Citrix Systems

- 11.1.3 Deltek

- 11.1.4 Nemetschek

- 11.1.5 Oracle

- 11.1.6 PlanGrid

- 11.1.7 Procore Technologies

- 11.1.8 Trimble (Viewpoint)

- 11.2 Regional Players

- 11.2.1 Alpha Software

- 11.2.2 Buildertrend

- 11.2.3 eSUB Construction Software

- 11.2.4 Fieldwire

- 11.2.5 FINALCAD

- 11.2.6 Kahua

- 11.2.7 Newforma

- 11.2.8 Novade Solutions

- 11.2.9 SKYSITE

- 11.2.10 UDA Technologies

- 11.3 Emerging Technology Innovators

- 11.3.1 Connecteam

- 11.3.2 Iflexion

- 11.3.3 InEight

- 11.3.4 LetsBuild

- 11.3.5 OnSite Punchlist

- 11.3.6 Raken

- 11.3.7 Strata Systems