PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699373

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699373

Standby Construction Generator Sets Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

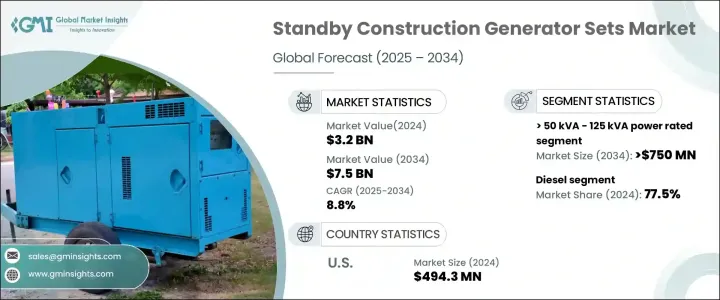

The Global Standby Construction Generator Sets Market was valued at USD 3.2 billion in 2024 and is projected to grow at a CAGR of 8.8% from 2025 to 2034. This rapid expansion is fueled by accelerating infrastructure development, urbanization, and the increasing integration of artificial intelligence (AI) and automation technologies into standby generator systems. As construction projects become more complex and power reliability remains a top priority, demand for advanced generator solutions is rising. The construction industry is experiencing a surge in new developments, particularly in emerging economies, where electrification challenges necessitate dependable backup power sources. The need for generators is further amplified by extreme weather conditions, grid instability, and the rising incidence of power outages in various regions. Furthermore, investments in renewable energy and hybrid power solutions are influencing market trends, pushing manufacturers to innovate with cleaner and more efficient standby generator models.

Tighter environmental regulations aimed at reducing carbon emissions are accelerating the adoption of low-emission generator technologies. Features such as automatic load management and smart fuel optimization are gaining traction, enabling companies to improve fuel efficiency while meeting stringent sustainability standards. With governments worldwide enforcing policies to curb emissions from construction activities, businesses are actively investing in compliant, high-efficiency backup power solutions. Additionally, increasing operational cost concerns are driving the shift toward smarter generator systems that reduce fuel consumption without compromising power output. Innovations in hybrid generator systems, which combine traditional fuel sources with battery storage and renewable energy, are gaining momentum in response to sustainability goals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.2 Billion |

| Forecast Value | $7.5 Billion |

| CAGR | 8.8% |

The <= 50 kVA power rating segment is poised for substantial growth, with a forecasted CAGR of 9% through 2034. This growth is attributed to the rising preference for compact, fuel-efficient generators that cater to small- and medium-scale construction projects. These generators are gaining popularity due to their ability to provide reliable power at a lower operational cost, making them an attractive choice for builders focused on cost-effectiveness and efficiency. Smaller construction projects, remote sites, and emergency backup requirements are fueling demand for these portable and scalable power solutions.

The standby construction generator sets market is segmented by fuel type into diesel, gas, and others, with diesel-powered generators maintaining a dominant position. Diesel generators held a 77.5% market share in 2024, owing to their superior fuel efficiency, durability, and capacity to provide reliable power in large-scale and critical construction environments. Despite the increasing push for greener alternatives, diesel remains the preferred choice for heavy-duty applications where uninterrupted power supply is crucial. Continuous advancements in fuel efficiency and emissions control are further enhancing the appeal of diesel-powered generator sets.

North America standby construction generator sets market is expected to expand at a CAGR of 8% through 2034, driven by ongoing technological advancements, including hybrid power solutions, improved fuel efficiency, and enhanced remote monitoring capabilities. These innovations are helping construction companies maintain uninterrupted operations while optimizing costs, reinforcing the demand for reliable backup power solutions across the region. As urbanization continues and construction projects scale up, investments in next-generation standby generators are expected to remain strong, further propelling market growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2032

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's Analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL Analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Strategic outlook

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Power Rating (USD Million & Units)

- 5.1 Key trends

- 5.2 ≤ 50 kVA

- 5.3 > 50 kVA - 125 kVA

- 5.4 > 125 kVA - 200 kVA

- 5.5 > 200 kVA - 330 kVA

- 5.6 > 330 kVA - 750 kVA

- 5.7 > 750 kVA

Chapter 6 Market Size and Forecast, By Fuel (USD Million & Units)

- 6.1 Key trends

- 6.2 Diesel

- 6.3 Gas

- 6.4 Others

Chapter 7 Market Size and Forecast, By Region (USD Million & Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Russia

- 7.3.2 UK

- 7.3.3 Germany

- 7.3.4 France

- 7.3.5 Spain

- 7.3.6 Austria

- 7.3.7 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.4.6 Indonesia

- 7.4.7 Malaysia

- 7.4.8 Thailand

- 7.4.9 Vietnam

- 7.4.10 Philippines

- 7.4.11 Myanmar

- 7.4.12 Bangladesh

- 7.5 Middle East

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Qatar

- 7.5.4 Turkey

- 7.5.5 Iran

- 7.5.6 Oman

- 7.6 Africa

- 7.6.1 Egypt

- 7.6.2 Nigeria

- 7.6.3 Algeria

- 7.6.4 South Africa

- 7.6.5 Angola

- 7.6.6 Kenya

- 7.6.7 Mozambique

- 7.7 Latin America

- 7.7.1 Brazil

- 7.7.2 Mexico

- 7.7.3 Argentina

- 7.7.4 Chile

Chapter 8 Company Profiles

- 8.1 Aggreko

- 8.2 Ashok Leyland

- 8.3 Atlas Copco AB

- 8.4 Caterpillar

- 8.5 Cummins, Inc.

- 8.6 Deere & Company

- 8.7 Generac Power Systems, Inc.

- 8.8 Greaves Cotton Limited

- 8.9 HIMOINSA

- 8.10 J C Bamford Excavators Ltd.

- 8.11 Kirloskar

- 8.12 Kohler Co.

- 8.13 Mahindra Powerol

- 8.14 Mitsubishi Heavy Industries Ltd.

- 8.15 Powerica Limited

- 8.16 Sterling and Wilson Pvt. Ltd.

- 8.17 Wärtsilä

- 8.18 Yamaha Motor Co., Ltd.