PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699434

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699434

Diesel Fired Telecom Generator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

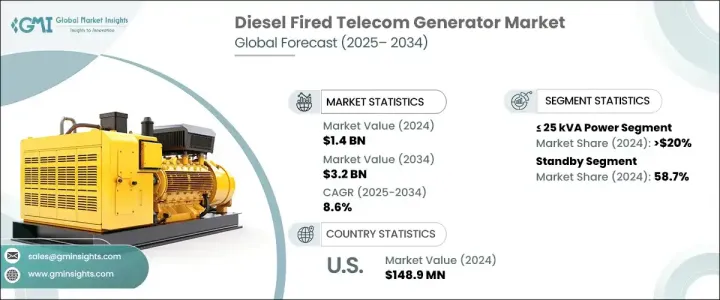

The Global Diesel Fired Telecom Generator Market was valued at USD 1.4 billion in 2024 and is projected to grow significantly at a CAGR of 8.6% between 2025 and 2034. The increasing demand for data services, driven by the rapid adoption of 4G and 5G networks, is fueling the need for reliable power solutions across telecom infrastructure. As the global telecom industry continues to expand, the rising number of telecom towers, coupled with the need for uninterrupted power supply, is pushing telecom operators to invest in diesel-fired generators to maintain seamless service. Furthermore, frequent power outages and the lack of reliable electricity supply in developing regions present significant growth opportunities for telecom operators to deploy backup power solutions, ensuring consistent service availability.

As urbanization accelerates, the need to upgrade aging telecom infrastructure and expand network coverage in underserved regions is becoming a priority. Diesel-fired generators play a critical role in ensuring reliable power for telecom stations in both urban and remote areas, where maintaining seamless connectivity is essential. The growing reliance on backup power systems to support the growing data traffic and automation technologies further highlights the importance of these generators in the telecom sector. Additionally, the push for increased energy efficiency, coupled with the integration of advanced monitoring systems, is enhancing the performance of these generators, making them indispensable in modern telecom operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $3.2 Billion |

| CAGR | 8.6% |

The diesel-fired telecom generator market is segmented by generator capacity and type. Smaller units with a power rating of <= 25 kVA accounted for 20% of the market share in 2024. These compact generators are particularly valuable for powering remote telecom stations in rural and underdeveloped regions where infrastructure development is still ongoing. Their efficiency makes them ideal for smaller-scale operations such as powering base stations and small cells, which are essential for extending network coverage to underserved areas. As telecom networks continue to expand to meet the growing demand for connectivity, the need for smaller, highly efficient generators is expected to rise.

In terms of generator type, standby diesel-fired telecom generators dominated the market, holding 58.7% of the share in 2024. The rising need for uninterrupted network service and minimal downtime is driving the growth of this segment. Telecom operators increasingly depend on these generators to maintain continuous operations, especially as 5G networks, mobile data services, and automation technologies continue to proliferate. These generators provide a reliable backup during power disruptions, ensuring that telecom services remain active without interruption.

The U.S. diesel-fired telecom generator market was valued at USD 148.9 million in 2024, with demand surging due to the growing need for continuous power in edge computing and data center operations. As uninterrupted and efficient power becomes critical for maintaining high-performance networks, the role of diesel-powered backup generators remains vital. Additionally, the push to reduce emissions and integrate advanced monitoring systems into telecom infrastructure is further propelling market growth. As the telecom industry adapts to evolving technological needs, diesel-powered backup generators will continue to play a crucial role in ensuring reliable and efficient service delivery.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's Analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL Analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Power Rating, 2021 – 2034 (Units & USD Million)

- 5.1 Key trends

- 5.2 ≤ 25 kVA

- 5.3 > 25 kVA - 50 kVA

- 5.4 > 50 kVA - 125 kVA

- 5.5 > 125 kVA - 200 kVA

- 5.6 > 200 kVA - 330 kVA

- 5.7 > 330 kVA

Chapter 6 Market Size and Forecast, By Application, 2021 – 2034 (Units & USD Million)

- 6.1 Key trends

- 6.2 Standby

- 6.3 Prime/continuous

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (Units & USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Russia

- 7.3.2 UK

- 7.3.3 Germany

- 7.3.4 France

- 7.3.5 Spain

- 7.3.6 Austria

- 7.3.7 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.4.6 Indonesia

- 7.4.7 Malaysia

- 7.4.8 Thailand

- 7.4.9 Vietnam

- 7.4.10 Philippines

- 7.4.11 Myanmar

- 7.4.12 Bangladesh

- 7.5 Middle East

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Qatar

- 7.5.4 Turkey

- 7.5.5 Iran

- 7.5.6 Oman

- 7.6 Africa

- 7.6.1 Egypt

- 7.6.2 Nigeria

- 7.6.3 Algeria

- 7.6.4 South Africa

- 7.6.5 Angola

- 7.6.6 Kenya

- 7.6.7 Mozambique

- 7.7 Latin America

- 7.7.1 Brazil

- 7.7.2 Mexico

- 7.7.3 Argentina

- 7.7.4 Chile

Chapter 8 Company Profiles

- 8.1 AGG POWER TECHNOLOGY

- 8.2 Aggreko

- 8.3 Atlas Copco

- 8.4 Caterpillar

- 8.5 Cummins

- 8.6 Deere & Company

- 8.7 FG Wilson

- 8.8 Generac Power Systems

- 8.9 HIMOINSA

- 8.10 Kirloskar Electric

- 8.11 Kohler

- 8.12 MAHINDRA POWEROL

- 8.13 Perkins Engines Company

- 8.14 SUPERNOVA GENSET

- 8.15 Tractors and Farm Equipment

- 8.16 Wärtsilä