PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699345

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699345

Hypodermic Syringes and Needles Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

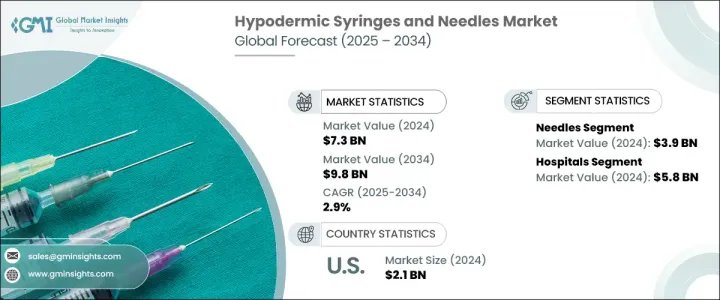

The Global Hypodermic Syringes And Needles Market was valued at USD 7.3 billion in 2024 and is set to grow at a CAGR of 2.9% from 2025 to 2034. This growth is fueled by multiple factors, including the rising prevalence of chronic diseases, an increasing number of surgical procedures, and the expanding utilization of syringes and needles for blood collection. As healthcare advancements continue to shape modern medical treatments, the demand for efficient and precise injection devices is expected to surge over the next decade. Additionally, technological advancements in drug administration, the push for safety-engineered syringes, and the rising geriatric population requiring routine injections are further strengthening market expansion.

The growing burden of chronic illnesses is a significant driver behind the increasing demand for hypodermic syringes and needles. Millions of people worldwide require frequent injectable medications for conditions such as diabetes, arthritis, and cardiovascular diseases, amplifying the need for reliable and accurate needle systems. The increasing focus on preventive care, coupled with rising awareness of vaccination programs, is also expected to propel market growth. Government initiatives promoting immunization and the increasing preference for home healthcare solutions are further driving adoption rates.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.3 Billion |

| Forecast Value | $9.8 Billion |

| CAGR | 2.9% |

The market is divided into two key segments: syringes and needles. The needle segment is poised to be the primary contributor to overall market expansion, with a projected CAGR of 3.1%, reaching USD 5.4 billion by 2034. The growing necessity for chronic care treatments, particularly for patients who require regular injections, is fueling the demand for advanced needle technologies. With the steady increase in the number of self-administered injections and the growing emphasis on infection prevention, manufacturers are focusing on innovative needle designs that enhance patient comfort and safety.

In terms of application, the hypodermic syringes and needles market spans various categories, including blood collection, drug delivery, vaccinations, insulin administration, and more. The drug delivery segment is projected to experience notable growth, reaching USD 4.8 billion by 2034 at a CAGR of 2.8%. As the number of individuals managing chronic diseases rises, there is a greater need for effective medication administration solutions. The industry is witnessing advancements in needle-free injection systems, smart syringes, and prefilled syringe technology, all of which are playing a crucial role in enhancing drug delivery efficiency and patient compliance.

The U.S. Hypodermic Syringes and Needles Market was valued at USD 2.13 billion in 2024 and is set to grow at a rate of 1.8% between 2025 and 2034. The country's well-established healthcare infrastructure, combined with a high prevalence of chronic diseases, continues to drive demand for these devices. With a significant portion of the population requiring injectable treatments, the need for precise and high-quality syringes and needles remains strong. Moreover, increasing investments in healthcare innovation and stringent regulatory policies ensuring product safety and efficiency are further shaping the market dynamics in the United States. As the demand for injectable solutions grows, manufacturers are focusing on sustainable and user-friendly syringe and needle technologies to cater to evolving healthcare needs.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of chronic disorders

- 3.2.1.2 Increase in the number of surgeries

- 3.2.1.3 Technological advancements and product innovation

- 3.2.1.4 Surged adoption of syringes and needles for blood collection

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Risk of needlestick injuries and infection

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Emerging alternatives

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Syringes

- 5.3 Needles

Chapter 6 Market Estimates and Forecast, By Usability, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Disposable

- 6.3 Reusable

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Blood collection

- 7.3 Drug delivery

- 7.4 Vaccination

- 7.5 Insulin administration

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ambulatory surgical centers

- 8.4 Diagnostic centers

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott

- 10.2 B. Braun

- 10.3 BD (Becton, Dickinson and Company)

- 10.4 Cardinal Health

- 10.5 Catalent

- 10.6 Connecticut Hypodermics

- 10.7 DeRoyal

- 10.8 EXEl

- 10.9 HI-TECH MEDICS

- 10.10 ICU medical

- 10.11 Lifelong MEDITECH

- 10.12 McKESSON

- 10.13 Medline

- 10.14 NIPRO

- 10.15 RETRACTABLE TECHNOLOGIES

- 10.16 TERUMO

- 10.17 VITA NEEDLE

- 10.18 VMG