PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699324

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699324

Construction Portable Inverter Generator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

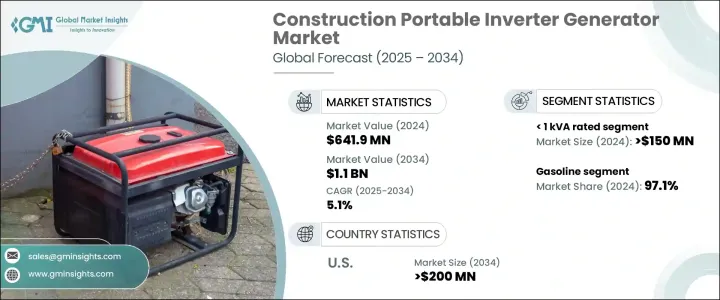

The Global Construction Portable Inverter Generator Market reached USD 641.9 million in 2024 and is projected to grow at a CAGR of 5.1% between 2025 and 2034., driven by increasing demand for efficient and reliable power solutions across construction sites. The surge in construction activities, coupled with the need for portable and versatile power sources, is fueling market expansion. As industries and residential sectors seek enhanced mobility and flexibility in power supply, the adoption of inverter generators continues to accelerate.

These generators offer multiple advantages, including improved fuel efficiency, reduced emissions, and quieter operation. Their compact and lightweight design makes them highly suitable for construction applications, allowing easy transportation and deployment. The rapid pace of urbanization and infrastructure development is further contributing to the rising demand for uninterrupted power supply at job sites. Governments and private developers are investing heavily in large-scale infrastructure projects, increasing the necessity for portable inverter generators. Additionally, advancements in energy-efficient technologies and emission control measures are encouraging the adoption of these generators worldwide. As regulations on carbon emissions tighten, manufacturers are focusing on producing low-carbon, energy-efficient models that comply with environmental standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $641.9 Million |

| Forecast Value | $1.1 Billion |

| CAGR | 5.1% |

Segmented by power rating, the market consists of 1 kVA, > 1 kVA - 2 kVA, > 2 kVA - 3 kVA, > 3 kVA - 4 kVA, and > 4 kVA categories. The demand for smaller, more energy-efficient solutions continues to grow, particularly in home renovations, minor construction work, and interior finishing projects. The 1 kVA segment alone generated USD 150 million in 2024, with increasing preference for generators that offer dependable power with minimal noise. The compact size and enhanced fuel efficiency of these units make them a practical choice for small-scale applications.

By power source, the market includes gasoline, diesel, and other alternatives. Gasoline-powered portable inverter generators dominated the industry with a 97.1% market share in 2024. Their widespread adoption in small to medium-sized construction projects, combined with their ease of portability and ability to power multiple tools, has driven significant demand. Developing regions are seeing an uptick in deployment due to cost-effectiveness and energy efficiency. With ongoing innovations in fuel consumption and emission control, manufacturers are focusing on enhancing the performance of gasoline-powered models to meet evolving industry needs.

The U.S. construction portable inverter generator market was valued at USD 107.6 million in 2024 and is expected to generate USD 200 million by 2034. Factors such as technological advancements, regulatory compliance, and the increasing need for reliable power solutions are accelerating market growth. The rising frequency of natural disasters, including hurricanes and wildfires, is also amplifying demand for these generators, ensuring uninterrupted power supply in emergency situations. As the market continues to evolve, key players are prioritizing product innovation to address the growing need for energy-efficient and cost-effective portable power solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Power Rating, 2021-2034 (USD Million & '000 Units)

- 5.1 Key trends

- 5.2 < 1 kVA

- 5.3 > 1 kVA - 2 kVA

- 5.4 > 2 kVA - 3 kVA

- 5.5 > 3 kVA - 4 kVA

- 5.6 > 4 kVA

Chapter 6 Market Size and Forecast, By Power Source, 2021-2034 (USD Million & '000 Units)

- 6.1 Key trends

- 6.2 Gasoline

- 6.3 Diesel

- 6.4 Others

Chapter 7 Market Size and Forecast, By Region, 2021-2034 (USD Million & '000 Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Russia

- 7.3.2 UK

- 7.3.3 Germany

- 7.3.4 France

- 7.3.5 Spain

- 7.3.6 Austria

- 7.3.7 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.4.6 Indonesia

- 7.4.7 Malaysia

- 7.4.8 Thailand

- 7.4.9 Vietnam

- 7.4.10 Philippines

- 7.4.11 Singapore

- 7.5 Middle East

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Qatar

- 7.5.4 Turkey

- 7.5.5 Iran

- 7.5.6 Oman

- 7.6 Africa

- 7.6.1 Egypt

- 7.6.2 Nigeria

- 7.6.3 Algeria

- 7.6.4 South Africa

- 7.6.5 Mozambique

- 7.7 Latin America

- 7.7.1 Brazil

- 7.7.2 Mexico

- 7.7.3 Argentina

- 7.7.4 Chile

Chapter 8 Company Profiles

- 8.1 A-iPower

- 8.2 Atlas Copco

- 8.3 Briggs & Stratton

- 8.4 Caterpillar

- 8.5 Champion Power Equipment

- 8.6 Cummins

- 8.7 Deere & Company

- 8.8 DuroMax Power Equipment

- 8.9 Generac Power Systems

- 8.10 Ha-Ko Industries

- 8.11 HIMOINSA

- 8.12 Honda Motor

- 8.13 Kirloskar

- 8.14 Kohler

- 8.15 Wacker Neuson SE

- 8.16 WEN Products

- 8.17 Westinghouse Electric Corporation

- 8.18 Yamaha Motor