PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699245

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699245

Automotive Radar Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

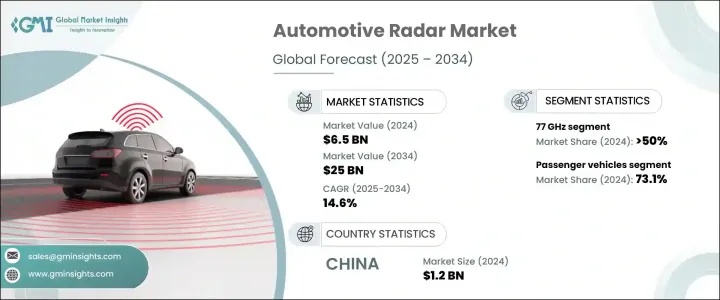

The Global Automotive Radar Market reached a valuation of USD 6.5 billion in 2024 and is projected to expand at a CAGR of 14.6% from 2025 to 2034. This growth is driven by the continuous advancement of radar technology, including innovations such as 4D imaging radar, digital beamforming, and AI-powered radar processing. These enhancements are improving range, resolution, and interference suppression, making radar systems more effective for advanced driver assistance systems (ADAS) and autonomous driving.

Over-the-air (OTA) software updates are allowing vehicles to receive radar capability upgrades, further accelerating adoption. The rise of electric and connected vehicles is also fueling demand, as radar technology plays a crucial role in safety features like blind spot monitoring, adaptive cruise control, and automated parking. With the increasing number of connected vehicles, the industry is transitioning from standalone radar sensors to integrated vehicle networks that facilitate real-time communication with other cars, infrastructure, and cloud-based systems. Strict safety regulations across key regions are further pushing automakers to implement radar-based solutions as standard features in their models.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.5 Billion |

| Forecast Value | $25 Billion |

| CAGR | 14.6% |

By frequency, the market is categorized into 24 GHz, 77 GHz, and 79 GHz radar. The 77 GHz segment held the largest market share of over 50% in 2024. Its widespread adoption is driven by its superior resolution and longer detection range, which are essential for critical safety features like lane-keeping assistance and automated emergency braking. Regulations in Europe and North America have established 77 GHz radar as the new industry standard, and recent policy changes in China mandating high-frequency radar systems in all new cars are accelerating adoption in the Asia Pacific region.

The market is segmented into passenger and commercial vehicles, with passenger cars holding a 73.1% share in 2024. Growing consumer preference for enhanced safety features has led to the widespread integration of radar-based driver assistance systems. Technologies such as blind spot detection and adaptive cruise control are becoming standard in personal vehicles, driven by regulatory frameworks and updated safety rating systems. Governments worldwide are enforcing stricter guidelines, making high-frequency radar a necessity for compliance with crash avoidance and occupant protection standards. Automakers are leveraging radar technology to enhance self-driving capabilities, particularly in Level 2 and Level 3 autonomous vehicles, where features like highway pilot and automated lane changes rely on high-precision radar sensors.

In terms of range, the market is divided into medium-range radar (MRR), short-range radar (SRR), and long-range radar (LRR), with MRR dominating in 2024. Its importance is growing in urban mobility, where self-parking and collision avoidance require 360-degree situational awareness. As cities expand smart transportation systems, ride-hailing fleets, electric vehicles, and last-mile delivery services are increasingly integrating MRR for safe navigation in high-traffic environments. The rise of intelligent transportation systems (ITS) is further driving adoption, as radar sensors play a key role in real-time traffic monitoring, predictive analytics, and accident prevention.

The market is also classified by sales channel into OEMs and aftermarket. In 2024, the OEM segment held the dominant share as automakers continued integrating radar systems directly into new vehicle models. Leading manufacturers are collaborating with radar technology providers to enable large-scale deployment of ADAS features in both luxury and mid-range vehicles. As consumer awareness of vehicle safety grows, automakers are increasingly including radar-based solutions as standard rather than optional features.

The Asia Pacific region leads the global automotive radar market, with China alone accounting for USD 1.2 billion in 2024. Investments in autonomous driving, AI-powered sensors, and vehicle electrification are driving growth, with strong support from government initiatives promoting smart transportation and intelligent highway systems. Favorable policies encouraging radar adoption in new energy vehicles (NEVs) are positioning the region at the forefront of innovation in automotive radar technology.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Chipset providers

- 3.2.2 Radar sensor producers

- 3.2.3 Tier-1 auto suppliers

- 3.2.4 AI & software providers

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Use cases

- 3.7 Price trend

- 3.8 Key news & initiatives

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising demand for ADAS and autonomous vehicles

- 3.10.1.2 Technological advancements in radar systems

- 3.10.1.3 Increasing vehicle electrification and connectivity

- 3.10.1.4 Growing consumer awareness of road safety

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High costs and complex integration

- 3.10.2.2 Interference and standardization issues

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Frequency, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 24 GHz radar

- 5.3 77 GHz radar

- 5.4 79 GHz radar

Chapter 6 Market Estimates & Forecast, By Range, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Short-Range radar(SRR)

- 6.3 Medium-Range radar(MRR)

- 6.4 Long-Range radar(LRR)

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 Light Commercial Vehicles (LCV)

- 7.3.2 Heavy Commercial Vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Adaptive Cruise Control (ACC)

- 9.3 Blind Spot Detection (BSD)

- 9.4 Forward Collision Warning (FCW)

- 9.5 Lane Departure Warning System (LDWS)

- 9.6 Automatic Emergency Braking (AEB)

- 9.7 Parking Assistance (PA)

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Analog Devices

- 11.2 Aptiv

- 11.3 Arbe Robotics

- 11.4 Bosch

- 11.5 Continental

- 11.6 Denso

- 11.7 Echodyne

- 11.8 Fujitsu Ten

- 11.9 Hella

- 11.10 Hitachi Astemo

- 11.11 Infineon Technologies

- 11.12 Mitsubishi Electric

- 11.13 NXP Semiconductors

- 11.14 Oculii

- 11.15 Smart Radar System

- 11.16 Texas Instruments

- 11.17 Uhnder

- 11.18 Valeo

- 11.19 Veoneer

- 11.20 ZF Friedrichshafen