PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699239

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699239

Vehicle Health Monitoring Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

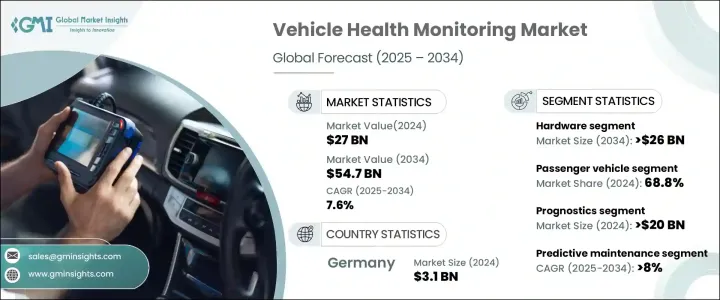

The Global Vehicle Health Monitoring Market was valued at USD 27 billion in 2024 and is projected to expand at a CAGR of 7.6% from 2025 to 2034. Increasing adoption of real-time diagnostic tools, advancements in IoT sensors, telematics, and AI-driven analytics are driving market growth. These technologies enhance vehicle monitoring, improve predictive maintenance, and reduce unexpected failures. Vehicle health monitoring systems continuously assess key components such as the engine, transmission, brakes, and battery, ensuring optimal performance and preventing malfunctions.

Cloud computing and edge processing enable real-time data feedback for drivers, fleet operators, and service providers, enhancing vehicle reliability and minimizing breakdowns. The increasing deployment of connected and autonomous vehicles further boosts demand for advanced diagnostics. Automakers and tech firms are integrating AI-powered predictive analytics, remote diagnostics, and OTA (over-the-air) updates to optimize vehicle maintenance. Monitoring battery charge levels in real time enhances energy efficiency and extends battery life. Government policies mandating real-time On-Board Diagnostics (OBD) and emissions monitoring further fuel demand for vehicle health monitoring solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $27 Billion |

| Forecast Value | $54.7 Billion |

| CAGR | 7.6% |

Real-time diagnostics play a crucial role in predictive maintenance, minimizing fleet downtime and improving route management. The integration of these technologies into commercial fleet operations is transforming the telematics industry. Insurance companies are also leveraging vehicle health data for usage-based insurance (UBI), adjusting premiums based on driving behavior and vehicle condition. The evolution of AI and 5G networks is expected to enhance vehicle safety, efficiency, and operational cost savings.

The vehicle health monitoring market is segmented into hardware, software solutions, and services. The hardware segment captured over 50% of the market share and is projected to exceed USD 26 billion by 2034. This segment includes sensors, GPS, and OBD ports, which capture vehicle data to optimize performance. Sensors monitor engine temperature, tire pressure, fuel consumption, and emissions, while GPS enhances fleet tracking and OBD ports enable remote diagnostics. The increasing automation and connectivity of vehicles are driving demand for advanced hardware solutions. Government regulations mandating emission monitoring through OBD further encourage automakers to equip vehicles with high-precision sensors and diagnostic systems.

The market is also categorized by vehicle type, including passenger and commercial vehicles. Passenger vehicles held a 68.8% market share in 2024, while commercial vehicles are seeing significant growth due to rising demand for tailored maintenance services.

Based on health management, the market is divided into diagnostics and prognostics. The prognostics segment led with over USD 20 billion in 2024. Automakers and fleet operators are increasingly adopting prognostic solutions, which use real-time data analytics to predict malfunctions in advance. Modern vehicles are equipped with cloud-based analytics, IoT-enabled sensors, and digital twin technology for monitoring critical systems. The integration of 5G with edge computing is further refining diagnostic accuracy and efficiency. Unlike traditional maintenance inspections, prognostic systems analyze real-time sensor data and AI models to detect early signs of component degradation, enabling timely maintenance actions.

The market is segmented by application into predictive maintenance, roadside assistance, real-time vehicle diagnostics, emission monitoring, fleet management, and vehicle safety and security. Predictive maintenance is expected to register the highest CAGR of over 8% during the forecast period. AI, IoT, and real-time data computing are advancing predictive maintenance solutions, allowing sensors to continuously track essential vehicle components. By analyzing real-time data and maintenance history, predictive maintenance solutions reduce downtime and repair costs. The adoption of edge computing and cloud-based analytics further enhances the efficiency of these systems. Automakers and fleet operators are increasingly using predictive maintenance to improve vehicle performance and durability while minimizing operational expenses.

Germany led the European vehicle health monitoring market in 2024, generating around USD 3.1 billion in revenue. The country is at the forefront of IoT-enabled prognostics, AI-based diagnostics, and smart vehicle health monitoring systems. With strong R&D investments and rapid adoption of intelligent vehicle technologies, Germany remains a key player in shaping the future of connected car diagnostics.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Component suppliers

- 3.1.1.2 Technology providers

- 3.1.1.3 System integrators

- 3.1.1.4 End use landscape

- 3.1.1.5 Distribution channel analysis

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Regulatory landscape

- 3.5 Cost breakdown analysis

- 3.6 Case study

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Shifting trends towards adoption of electric vehicles across the globe

- 3.7.1.2 Increase in the demand for commercial vehicles in North America and Europe

- 3.7.1.3 Growing internet penetration and smart phone connectivity in Asia Pacific

- 3.7.1.4 High demand for passenger cars in Latin America

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Cyber security threats related to vehicle health monitoring systems

- 3.7.2.2 Lack of connected infrastructure

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Sensors

- 5.2.2 GPS systems

- 5.2.3 OBD port

- 5.2.4 Others

- 5.3 Software

- 5.4 Services

- 5.4.1 Maintenance & repair services

- 5.4.2 Consulting & integration services

Chapter 6 Market Estimates & Forecast, By Health Management, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Prognostics

- 6.3 Diagnostics

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 Light commercial vehicles (LCV)

- 7.3.2 Heavy commercial vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Predictive maintenance

- 8.3 Real-time vehicle diagnostics

- 8.4 Roadside assistance

- 8.5 Emission monitoring

- 8.6 Fleet management

- 8.7 Vehicle safety & security

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Bosch

- 10.2 Car Media Lab

- 10.3 Continental

- 10.4 Delphi

- 10.5 Denso

- 10.6 Garrett Advancing Motion

- 10.7 Harman International

- 10.8 Intangles Lab

- 10.9 Intellicar

- 10.10 iotaSmart Labs

- 10.11 KPIT Technologies

- 10.12 Luxoft

- 10.13 Octo Group

- 10.14 Onstar

- 10.15 Taabi

- 10.16 TATA Elxsi

- 10.17 Vector Informatik

- 10.18 Visteon

- 10.19 ZF Friedrichshafen

- 10.20 Zubie