PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716687

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716687

Integrated Vehicle Health Management (IVHM) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

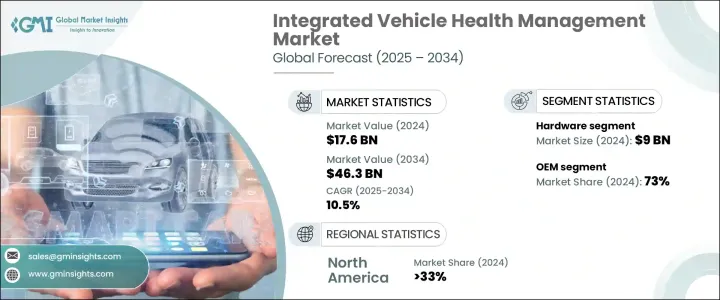

The Global Integrated Vehicle Health Management Market was valued at USD 17.6 billion in 2024 and is expected to grow at a CAGR of 10.5% between 2025 and 2034. This expansion is fueled by the rapid adoption of electric vehicles (EVs), the rise of connected cars, and the increasing need for predictive maintenance in modern automobiles. As automotive technologies become more sophisticated, manufacturers and fleet operators are focusing on real-time vehicle health monitoring to enhance performance, extend lifespan, and reduce downtime. IVHM systems are now a critical component of the automotive ecosystem, offering real-time diagnostics, predictive analytics, and proactive maintenance solutions.

Automakers are integrating advanced IVHM technologies to enhance vehicle efficiency, minimize breakdowns, and improve overall safety. With the automotive industry shifting toward electrification, the demand for battery health monitoring solutions has surged. Electric and hybrid vehicles require continuous tracking of vital components like drivetrains, battery voltage, and charging systems. The growing complexity of automotive electronics, coupled with the rise of autonomous driving technologies, further amplifies the need for sophisticated IVHM solutions. Automakers, fleet managers, and service providers are leveraging AI-powered analytics and cloud-based platforms to ensure proactive maintenance and minimize operational risks.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $17.6 Billion |

| Forecast Value | $46.3 Billion |

| CAGR | 10.5% |

The IVHM market is categorized into hardware, software, and services, with hardware dominating the landscape. In 2024, hardware accounted for a 50% market share, generating USD 9 billion. Sensors play a pivotal role in monitoring key vehicle parameters, including engine temperature, tire pressure, and battery health. These components enable real-time diagnostics, ensuring that critical systems function optimally. As the automotive industry advances, demand for specialized hardware designed for EVs and autonomous vehicles continues to rise.

Market segmentation also includes distribution channels, with original equipment manufacturers (OEMs) holding a significant share. In 2024, OEMs controlled 73% of the market as they integrated IVHM systems into vehicles during manufacturing. This seamless incorporation allows vehicles to benefit from advanced diagnostics, telematics, and continuous monitoring capabilities from the outset. OEMs remain at the forefront of innovation, addressing the evolving needs of electric and connected vehicle owners. With predictive maintenance and battery health management becoming crucial in the EV segment, manufacturers are investing heavily in cutting-edge IVHM solutions.

The U.S. Integrated Vehicle Health Management (IVHM) Market generated USD 3.2 billion in 2024, accounting for a 33% share. The country's strong presence in the automotive and aerospace sectors drives demand for IVHM technologies. Stricter government regulations related to vehicle safety, emissions, and maintenance further accelerate adoption. Additionally, commercial fleet operators and defense agencies are prioritizing predictive maintenance to enhance operational efficiency. The U.S. market is witnessing a rapid shift toward data-driven vehicle health management systems, ensuring optimal performance, compliance, and cost savings across the transportation industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Platform provider

- 3.2.2 Software provider

- 3.2.3 Service provider

- 3.2.4 Distribution channel

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Cost breakdown analysis

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Growing demand for predictive maintenance

- 3.9.1.2 Increase in demand for EVs and connected vehicle

- 3.9.1.3 Increasing vehicle complexity

- 3.9.1.4 Technological advancements in IoT and AI

- 3.9.1.5 Regulatory requirements and safety standards

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Data security and privacy concerns

- 3.9.2.2 Complexity of integration with legacy systems

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Sensors

- 5.2.2 Electronic Control Units (ECUs)

- 5.2.3 Data acquisition systems

- 5.2.4 Communication modules

- 5.2.5 Telematics Control Units (TCUs)

- 5.2.6 On-board diagnostics (OBD) ports

- 5.3 Software

- 5.3.1 Diagnostics software

- 5.3.2 Prognostic software

- 5.3.3 Data management software

- 5.3.4 User Interface (UI) software

- 5.4 Service

- 5.4.1 Installation and integration services

- 5.4.2 Maintenance and repair services

- 5.4.3 Consulting services

Chapter 6 Market Estimates & Forecast, By Channel, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 OEM

- 6.3 Service center

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Diagnostics

- 7.3 Prognostics

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Commercial & defense aviation

- 8.3 Automotive

- 8.4 Marine

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Acellent Technologies

- 10.2 Aptiv

- 10.3 Boeing

- 10.4 Caterpillar

- 10.5 Cummins

- 10.6 General Electric

- 10.7 Honeywell

- 10.8 IBM

- 10.9 Intangles Lab

- 10.10 Iotasmart

- 10.11 Lockheed Martin

- 10.12 Michelin

- 10.13 North Atlantic Industries

- 10.14 OnStar

- 10.15 Robert Bosch GmbH

- 10.16 Rockwell Collins

- 10.17 Rolls Royce

- 10.18 Sibros Technologies Inc

- 10.19 TATA Elxsi

- 10.20 ZF Friedrichshafen